The most common online payment method — in the UK at least — are card payments, which make up 51% of all ecommerce payments. But a common and growing alternative, which most customers will have used before, are account to account (A2A) payments. In this article, we’ll look at how A2A payments work, as well as the benefits of A2A payments for both merchants and consumers.

What is an account to account payment?

An account to account (A2A) payment, otherwise known as a bank to bank payment, direct account payment or even just online banking payment, is a payment used to directly transfer money from one bank account to another bank account without the need for any additional payment intermediaries.

A2A payments make up 17% of all ecommerce payments in Europe (as of 2021). In some European countries, such as the Netherlands (64%) and Germany (31%), bank payments are particularly popular thanks to domestic payment systems.

How do account to account payments work?

A2A payments can be initiated in two ways, either as a push payment — initiated by the party making the payment — or as a pull payment — initiated by the party collecting the payment. A2A payments come in several forms, each with their own benefits. Types of A2A include:

Manual bank transfers

These are A2A payments initiated by the payer using their online banking provider. The payer must log in to their online banking, enter the sort code and account number of the payee — typically along with a payment reference — and then send the money as a bank transfer.

Domestic payment schemes

In many countries there are payment schemes owned or operated by domestic banks, such as iDEAL in the Netherlands and Swish in Sweden. These schemes differ from country to country, but are generally offered to make A2A payments simple, quick and cheap.

Open banking payments

Open banking payments enable third party providers (TPPs) to initiate A2A payments on behalf of the payer (with their permission). The payment is authenticated by the payer’s bank via redirection to the payer’s banking app, where the necessary credential —such as biometrics — are submitted.

What can account to account payments be used for?

Some of the most common use cases for A2A payments include:

Peer-to-peer (P2P) payments: A2A payments are regularly used to pay another individual, such as when paying them back for money borrowed or to split the cost of something paid for by one individual.

Me-to-me payments (AKA sweeping): A2A payments can also be used to send money from one bank account to another, where both accounts belong to the same person. This is used frequently in smart budgeting and saving apps.

One-off bill payments: Manual bank transfers have long been a common way to pay for one-off services, such as car repairs or for paying a tradesperson.

Business payments: A2A payments are commonly used for paying business invoices.

Deposits and withdrawals: A2A payments can be used to add or withdraw money from services like wealth management apps and iGaming providers.

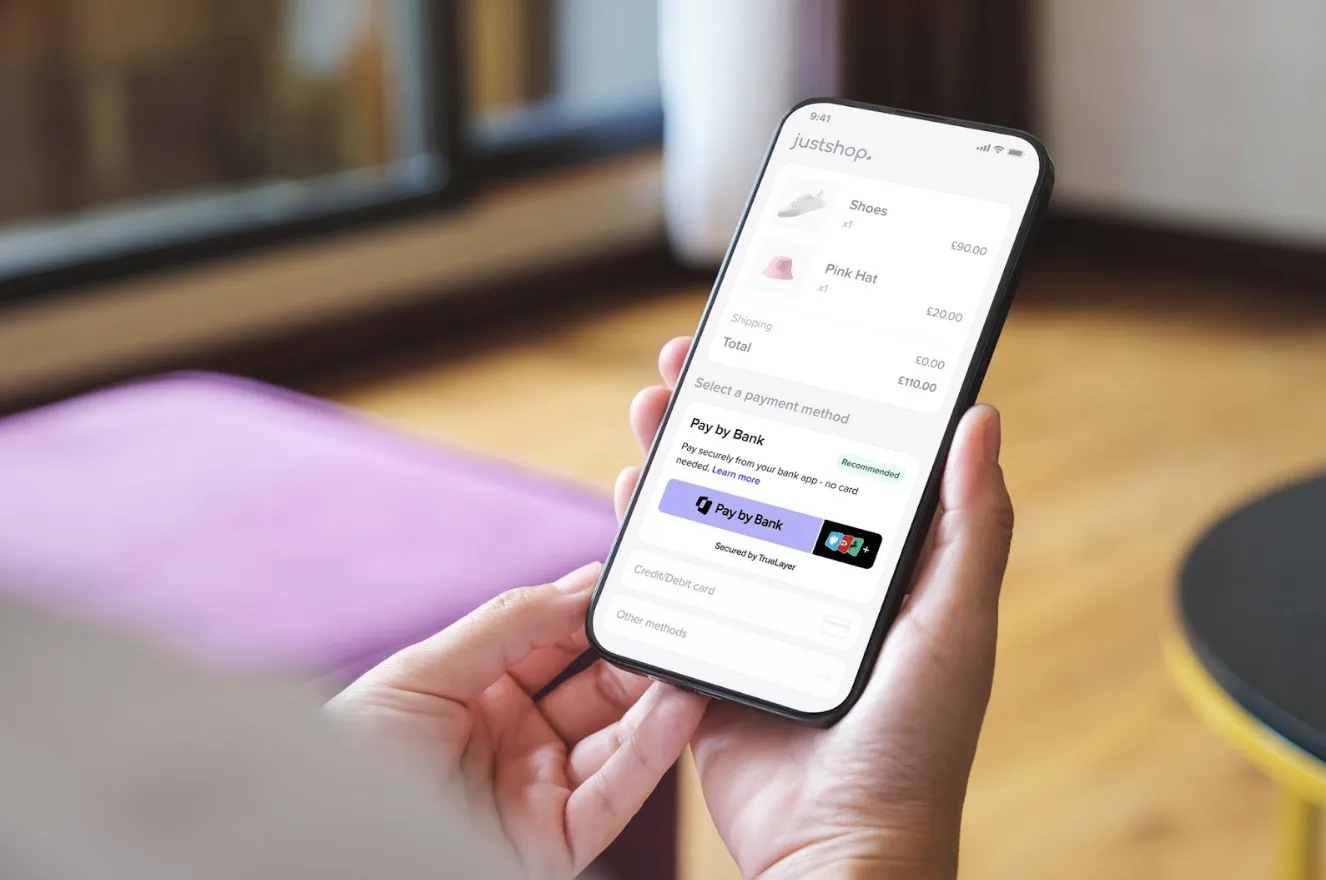

Ecommerce payments: While card payments are more commonly used for ecommerce payments, instant bank transfers (powered by open banking) are increasingly appearing as part of the online checkout process, as a lower-cost alternative.

What are the benefits of account to account payments for merchants?

Better coverage

A2A payments are available to anyone with a bank account, so coverage is generally high. In any given country, the proportion of people with a bank account is known as the ‘banked population’. In the UK, the banked population — classed as the percentage of people aged 15+ with account ownership at a financial institution or mobile-money service provider — is 99.8%. It is similarly high in France (99.2%), Germany (99.9%) and Spain (98.3%).

Reduced costs

Card payments include merchant service charges (MSCs), which average 1.9% for UK merchants with a turnover less than £380,000, and ~1% for those with a turnover between £380,000 and £1 million. Other fees include authorisation fees, card terminal hire, PCI compliance costs and chargeback costs.

While each form of A2A payment will come with associated fees and operating costs, they will typically cost less than the equivalent card payments.

Instant settlement (in the UK)

Most UK A2A payments, including manual bank transfers and instant bank transfers, will arrive near instantaneously. In the UK, the Faster Payment Service (FPS), which most banks are direct participants of, allows for A2A payments to be transferred instantly. The situation across Europe is more complex, but a new proposal from the EU Commission aims to make instant payments the norm across the continent.

Improved security

Most A2A payments now have multi-factor authentication as part of the online banking journey, which helps protect consumers from payment fraud and unintended mistakes. Additionally, the lack of card payment rails means A2A payments effectively eliminate card-not-present (CNP) fraud. CNP fraud is a particular problem for UK businesses, who lost £199.4 million to CNP fraud in just the first six months of 2022.

Open banking and account-to-account payments

Open banking payments (often called instant bank transfers at the payment page or checkout) are an increasingly popular way for consumers and businesses to make seamless, instant and safe A2A payments for several different kinds of transactions. Open banking payments are possible due to payment initiation services (PIS) where TPPs make payments on behalf of their customers with their consent.

There are several reasons to use open banking payments over other types of A2A payments:

Improve UX and reduce friction: customers can pay with a fingerprint or face ID, with no need to enter lengthy card details

Lower fees and costs: open banking payments lack many of the transaction fees (including interchange fees) and operational costs of other methods

No chargebacks: as there’s no card network involved, there is no chargeback process to deal with, which can be very costly and time consuming for businesses to deal with

Minimise fraud: with no card rails, there’s no CNP fraud to worry about, while pre-populated payment details helps reduce the likelihood of authorised push payment (APP fraud)

To find out more about open banking payments, read our comprehensive guide to open banking.

How traditional onboarding methods are holding iGaming operators back

Why iGaming operators are turning to TrueLayer for player onboarding

)

)

)

)

)