What are the biggest limitations of card payments for ecommerce?

In the UK and much of Europe, debit and credit cards have long been the default - and sometimes only - payment method available to ecommerce customers. In 2017, debit card payments surpassed cash as the most common payment method across all purchases in the UK, with 15.8 billion debit card payments in the UK in 2020 alone.

But in November 2021, Amazon announced that it would stop accepting Visa credit card payments. While Amazon will still accept Visa debit card payments - and card payments from other providers - it’s the first time a retailer of Amazon’s scale has made such a move.

Why has Amazon made this decision now, especially when cards are so readily used by consumers? The issue is ageing card infrastructure, which was built for the physical world, is causing ecommerce brands all manner of headaches. Amazon cited high fees as its primary motivator, but other issues like card-not-present fraud, purchase abandonment and chargeback issues also cause problems.

This article looks at the biggest issues with card payments, and how alternative payment methods could tackle many of these problems. Will more online retailers follow Amazon's lead in reducing their reliance on cards?

The findings and data in this article are from our recent future of ecommerce payments report. TrueLayer commissioned an independent research consultancy with extensive experience in payments, to better understand why open banking payments are particularly suited to challenge the dominance of cards.

Get your copy of the full report

High costs and fees

For card payments, merchant service charges (MSCs) average 1.9% for UK merchants with turnover less than £380,000, and ~1% for those with turnover between £380,000 and £1 million. And while the MSC is the most significant fee, it’s far from the only one. Other card fees include:

authorisation fees (1-3p per transaction)

card terminal hire fees (£14-24 per month)

PCI compliance costs (£2.50-5.50 per month)

chargeback fees (£15-25 per chargeback request)

In addition to the direct costs of card processing fees, other card scheme rules lead to higher costs in other ways.

For example, since 2018, UK and EU merchants have not been allowed to add a surcharge at checkout to reflect the increased cost of processing different forms of payment. So they must either limit customer payment options (usually to just card payments), raise prices for everyone or absorb the incremental cost if costlier payment methods are used.

Card-not-present fraud

Ecommerce purchases are associated with higher decline and fraud rates, both of which can considerably dent a merchant’s margins. One of the biggest types of fraud affecting ecommerce businesses is card-not-present fraud. Card-not-present fraud occurs when a person attempts to make a card purchase when they do not possess the physical card.

Card-not-present fraud in ecommerce is now the single-largest category of card fraud in the UK, accounting for 79% of all card fraud losses in 2020.

Strong customer authentication (SCA)

SCA has been a hot topic in ecommerce for some time, with successive delays taking the UK deadline back to March 2022.

But even those that have been able to add it to their card payment journeys still face losing out on sales. While SCA significantly reduces fraud risk, somewhat offsetting the problem of card-not-present fraud, it also introduces significant additional friction for consumers. This leads them to abandon purchases they would otherwise have made.

As many as 14% of browser-based card transactions, and a quarter of app-based ones, were discouraged by SCA. And a recent study looking at EU markets found that a mix of friction and lack of preparedness from banks could lead to up to €108 billion in lost online sales over 2021.

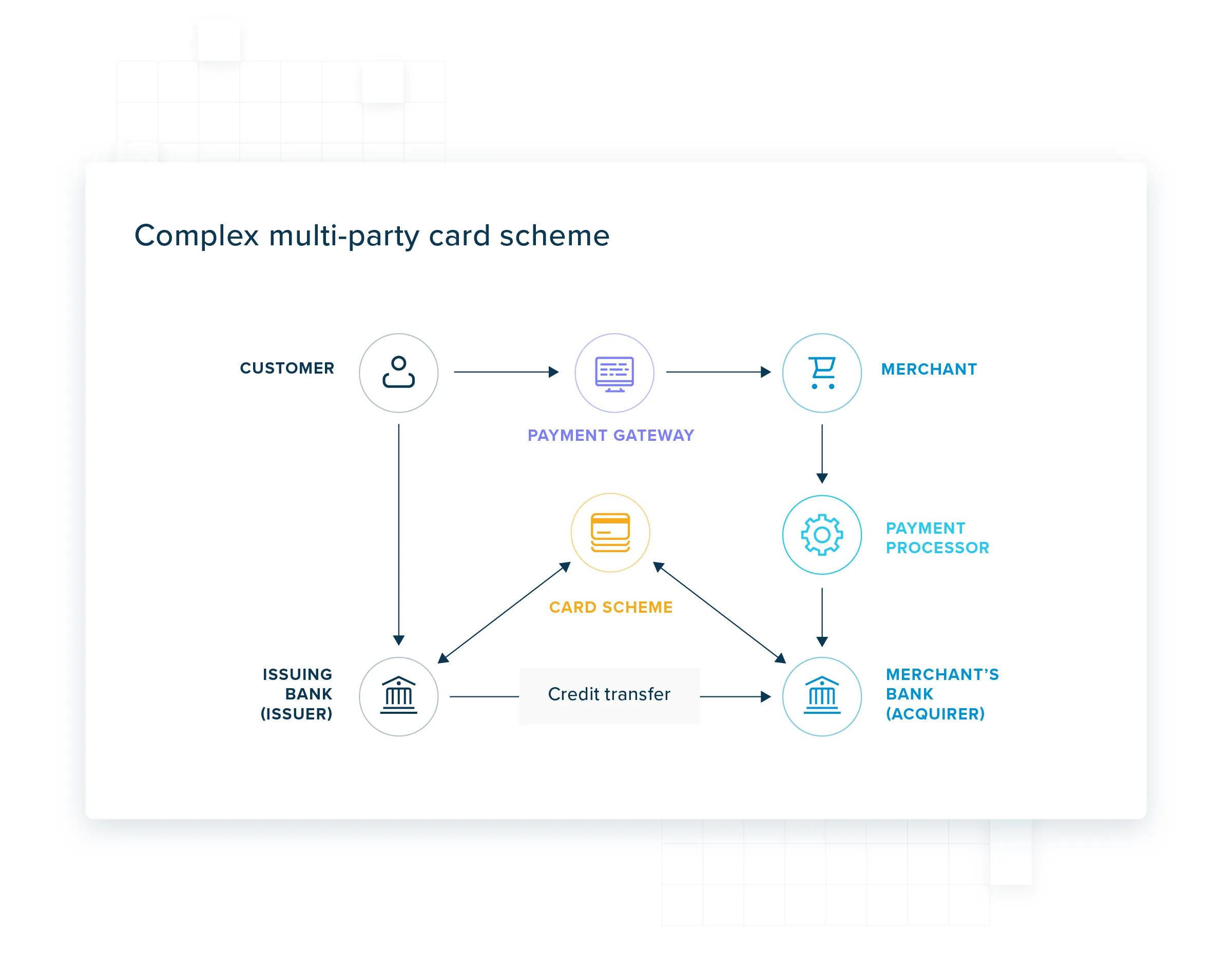

Complex multi-party card schemes

At the very centre of many of the issues surrounding card payments is the complex makeup of different parties involved in completing card payments. There are seven parties involved in every single card transaction, including the customer, the payment gateway, the card scheme, the payment processor, the merchant’s bank (acquirer), the merchant itself, and the customer’s bank (issuer).

There are potentially others on top of that, including fraud and dispute management. This complicated web of businesses adds costs and resources to processing card payments, much of which inevitably impacts merchants the most.

Chargebacks

One of the most pressing concerns for ecommerce businesses right now is chargebacks.

Chargeback rules within card schemes were introduced as a means of fixing onboarding incentives and dispute resolution between participants in complex multi-party schemes. They were designed to promote card usage when cards were a new payment method, by reassuring consumers that they were safe to use, incentivising acquirers to onboard reputable merchants and encouraging merchants to provide refunds where appropriate.

However, in practice, chargebacks have several drawbacks. For starters, schemes charge steep fees for processing chargebacks, often £15-25 but sometimes as high as £150. And because card issuers hold back the disputed transaction amount while a dispute is being resolved - a process that can take up to 120 days - even chargebacks resolved in the merchant’s favour can increase the cost of doing business.

Merchants that become frequent targets of chargebacks face additional problems. Businesses with high rates of chargebacks face having card-acquiring contracts cancelled, even if those claims are illegitimate or fraudulent. This problem has become so bad, many acquirers have started bundling chargeback protection insurance into their overall fees.

Is now the right time to look for alternative payment methods?

While it’s clear that card payments have several limitations, they continue to be the most common payment method. Why should we think now is the time for other payment methods to challenge card dominance?

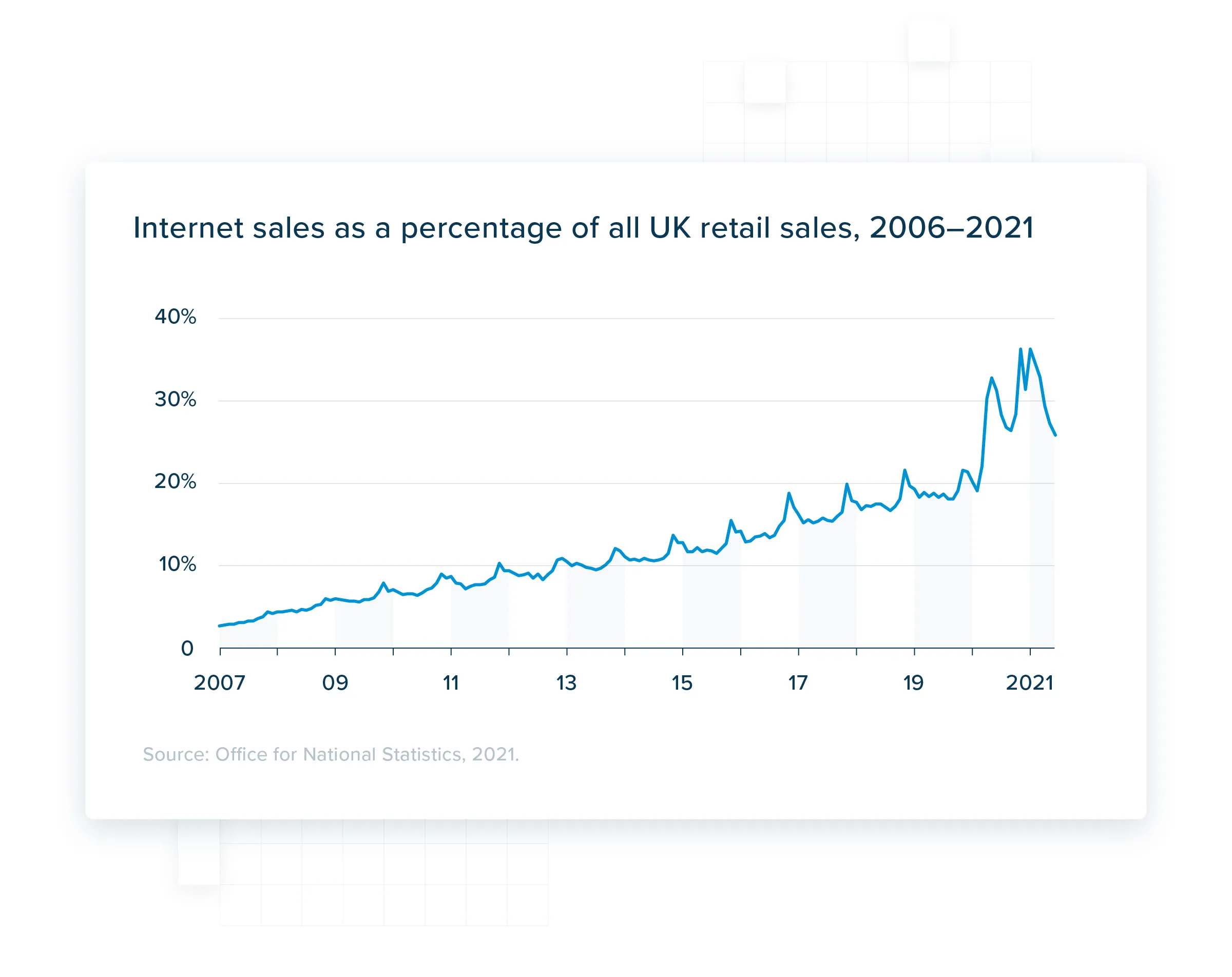

One reason is the continued growth of online retails sales. Internet sales as a percentage of total retail sales have steadily increased since 2006, and they accelerated significantly with the onset of the COVID-19 pandemic. In 2006, internet sales as a share of total UK retail sales stood at 2.8%, rising to 36.5% at the height of the pandemic.

This continued shift away from physical retail and into online retail is good news for ecommerce brands, but the added volume puts more and more strain on the legacy card infrastructure. All the issues listed above only compound as the demand grows.

Open banking is the alternative ecommerce brands have been waiting for

If it’s time to lessen the reliance on card payments, what can ecommerce brands offer instead? Some have turned to mobile wallets, like Google Pay and Apple Pay. They paper over some of the cracks, improving the customer experience, but they also add even more cost and complexity for the merchants.

Another option is open banking. Open banking payments have surged in the last 12 months in the UK, rising from 280,000 in July 2020, to 1.83 million in June 2021, an increase of over 550%. There are already over 3 million open banking users in the UK, which equates to 5% of the population. On its current growth trajectory, around 60% of the population will be open banking users by as soon as September 2023.

What makes open banking payments better than card payments?

Open banking payments have lower merchant fees for accepting electronic payments.

There is a reduced risk of unauthorised payments and fraud, thanks to embedded strong customer authentication (SCA) and pre-populated payment details. Existing open banking SCA journeys are significantly shorter and more convenient than the SCA journeys for some card payments.

Open banking provides payments for a digital age. It reduces the number of parties to transactions, increasing efficiency and speed, which will translate into customer satisfaction.

Some ecommerce merchants are already making the most of open banking in their payment journeys. For example, online car retailer Cazoo uses TrueLayer’s PayDirect solution to offer instant payments and refunds, resulting in a fast and frictionless ecommerce experience. As open banking payments continue to gain traction, many more brands will follow suit.

3 tipping points for change within ecommerce payment experiences

How to reduce ecommerce cart abandonment

)

)

)

)

)

)

)

)

)

)