Offering a broader range of payment methods online and letting customers choose how to pay is likely to increase conversion.

The three main types of alternative payments are: bank transfers, digital wallets and buy now pay later (BNPL) / instalment payments.

Payments based on card rails have good global coverage and are popular with consumers in parts of Europe, but they often perform poorly when it comes to cost, security and speed of settlement.

Letting customers choose how they want to pay – and offering the right alternatives to cards – drives sales. Research shows that if the right payment options are available online, shoppers are more likely to buy from a retailer and less likely to abandon their basket. It also typically speeds up the purchase process, especially on mobile.

What’s an alternative payment method?

APMs are alternatives to global card payments such as Visa, Mastercard and Amex. We can categorise alternative payment methods in three areas: bank transfers, digital wallets and buy now pay later/instalment payments.

How can TrueLayer help?

TrueLayer is a global open banking platform that enables your customers to pay with their bank app in a few clicks. No cards, no registration, no hassles. TrueLayer powers some of Europe’s most innovative brands. Whether investing through Freetrade, banking with Revolut, or buying a car on Cazoo, millions of consumers and businesses use TrueLayer to pay for goods and services.

Find out more about choosing a trusted partner for open banking payments

Guide to card alternatives

Bank transfers

Bank transfers make up 17% of ecommerce payments in Europe, but this share is expected to grow by 10% in the next four years.

Bank transfer payment methods have historically been limited to domestic schemes in Europe. The rollout of open banking APIs from 2018 has changed this, allowing customers with any bank to pay merchants across the EU.

Instant bank payment infrastructure across Europe and the UK is key to driving adoption of open banking payments as an attractive option for merchants and consumers.

Overview

Bank transfers can be initiated by the payer (push) or the payee (pull). More recently with the introduction of open banking, push payments can also be initiated by authorised third party providers (TPPs) acting on behalf of the payer.

Manual bank transfers

These are account-to-account (A2A) transfers that are initiated by the payer directly through their banking provider. To make a manual bank transfer, the payer logs on to their online banking app or site and enters the sort code and account number of the payee, the amount to be sent and usually a payment reference.

Paying with a domestic scheme (eg iDEAL, Swish)

Payment schemes owned and operated by domestic banks (such as iDEAL in the Netherlands and Swish in Sweden) allow customers to pay using their banking app by scanning a QR code or pressing a payment link provided by a merchant. In this model the payer and the payee (ie merchant) are each served by a bank that is a participant in the scheme. The payer’s bank facilitates a bank transfer to the merchant’s bank at a lower cost than using card schemes.

Open banking payments

Open banking payments allow third party providers (TPPs) to initiate a bank transfer on behalf of, and with the permission of the payer. The payment is authenticated by the payer’s bank via redirection to the payer’s banking app, where credentials (such as biometrics) can be submitted. Open banking payments work because banks have been required (by the Payment Services Directive or PSD2) to allow access to payment functionality to third parties via secure APIs.

Open banking payments can be used for ecommerce purchases:

The TPP has a contract with the merchant to allow it to accept open banking payments.

At the checkout the payer chooses the bank transfer option, and is redirected to their bank to authorise the payment.

The TPP populates the payee details, ensuring that payments cannot be misdirected (as can happen with manual bank transfers).

The payer is taken automatically back to the website or app where they were shopping.

Providers such as TrueLayer have built API connections to hundreds of banks, creating a new open banking payment network.

Developments

Bank transfers represent 17% of ecommerce payments across Europe and the UK but this share is expected to increase by 10% to 2026.

Over the last decade, markets across the world have made significant investments to upgrade their inter-bank legacy payment infrastructure to faster or instant payments:

Faster Payments Service (FPS) in the UK is a net-settlement system that takes only a few seconds. Funds are credited to the recipient’s bank account almost immediately.

With pan-European instant payment systems such as SEPA INST, payments take less than ten seconds to reach the recipient. TARGET Instant Payment Settlement (TIPS) and RT1 (operated by EBA Clearing) are two payment systems underpinning instant payments in the EU.

Instant payment infrastructure is helping to drive adoption of open banking payments as an attractive option for both merchants and consumers. Consumers have the convenience of paying using their banking app, and funds settle with the merchant much faster than with card payments.

Open banking payments can work on a pan-European basis because they are based on all EU banks having APIs available. This contrasts with schemes such as iDEAL and Swish that only work domestically.

Since the introduction of PSD2, open banking payment providers (also known as payment initiation service providers or PISPs) have entered the market with services that make it quick and easy to make a bank transfer to a merchant at checkout. Because the banks have provided APIs to enable PISP services, customers can make payments securely without sharing any credentials or sensitive payments data with anyone other than their bank.

Benefits for merchants

Thanks to advances in technology, including the emergence of open banking, offering bank transfers to customers makes a lot of sense from an operational and commercial perspective.

Immediate funds

Merchants receive funds immediately where instant payment systems are involved. In contrast, card payments typically take two to five days to clear in the merchant’s account (merchants may receive a payment guarantee once the card transaction is authorised, though this doesn't help with a merchant’s cash flow).

Lower costs

Merchants are likely to pay lower fees for accepting bank transfers compared to credit and debit cards, despite moves from regulators to drive down card interchange fees and merchant service charges. A recent study found that on average European merchants were paying more to accept each card transaction than they had before the regulation.

No chargebacks

Unlike card payments, payments by bank transfer don't pose a risk of chargeback for merchants. For some merchants the losses stemming from chargebacks can be significant and can damage profitability. While better risk management techniques and strong regulatory initiatives have reduced the incidence of online criminal fraud, there is mounting evidence that ‘friendly fraud’ is on the rise. This involves buyers denying having received goods they ordered or claiming falsely that goods were damaged in transit. Such losses are inordinately borne by merchants.

Rich data via open banking

When bank transfers are combined with open banking, the end-to-end payments experience can be enhanced. For example, through open banking, a merchant can easily verify the name and address of the person paying with what’s on file at the bank, or understand if a recurring payment will fail because of insufficient funds by looking at a customer’s previous balance history (with their consent).

Drawbacks for merchants

Acceptance footprint

Unlike card payments using global card brands, bank payment networks have historically tended to be domestic. Even payment brands that leverage online banking such as iDEAL in the Netherlands or Pay-by-link in Poland are restricted to consumers in their countries only.

This is changing with the development of open banking payments: PSD2 required all payment account providers in the EU to enable open banking payments. However, while the UK has developed a common open banking standard and the payment experience is good, differences in implementation by banks across the EU has meant that the quality of payment experience is not yet consistent everywhere. The European Banking Authority has recently acted on this by calling on local regulators to take supervisory action against banks that impose obstacles to open banking.

Speed and cost of international bank transfers

Sending a small international payment can be a slow process. While larger corporate payments may be processed relatively quickly, smaller retail payments may take a long time depending upon the transfer corridor and are also likely to be expensive. Foreign exchange conversion fees will also apply.

Benefits for consumers

Convenience

Traditional online bank payments may require customers to leave the website or app they were in, open up their online banking and manually key in a payee name, bank account details and payment reference. With the advent of open banking payments, modern bank payments are much more convenient and secure: customers no longer need to manually input any payment or payee details and the payment flow starts and finishes in the shopping website or app they start in.

Low cost and fast domestic payments

In many markets, bank payments are free or very inexpensive for consumers, as banks charge fees on other products but not on domestic payments (though in some EU member states, payments made through the SEPA Instant scheme are still expensive). Where real-time or faster payment systems exist, these bank payments enable the merchant to ship the order immediately on receiving the order.

Drawbacks for consumers

Chargebacks

Consumers have the same protections under law (PSD2) when using bank transfers, as when using cards. In some markets, card schemes have introduced additional voluntary measures where they take on liability for the delivery of goods and services. This takes place in the form of ‘chargebacks’, where card issuers refund consumers in the event of purchase disputes, and charge the costs back to the merchant. Merchants are also penalised by the card schemes for chargeback claims.

Because card schemes are not involved in open banking payments, chargebacks are not currently a feature of this type of payment.

However, it is early days for open banking payments, and open banking payment providers may develop voluntary protections to cover certain types of purchases, if it's required by merchants and sought after by consumers.

Lack of credit facility

Open banking payments involve transferring funds that a consumer has in their bank account. That means, unlike when paying with a credit or debit card with an overdraft facility, consumers are not able to borrow money as part of a transaction.

Digital wallets

Digital wallets represent 27% of ecommerce payments in Europe and are expected to grow market share by 2026.

Container or mobile wallets like Apple Pay and Google Pay offer a slick user experience, as payment details are tokenised. But since they are typically based on card rails, they suffer from some of the same issues as cards.

Wallets are increasingly used in sectors such as online gaming as well as online marketplaces.

Wallet providers manage both ends of the payment equation and facilitate transactions relating to services provided through the wallet for their partners. This allows them, with the customer’s approval, to access and analyse customer data.

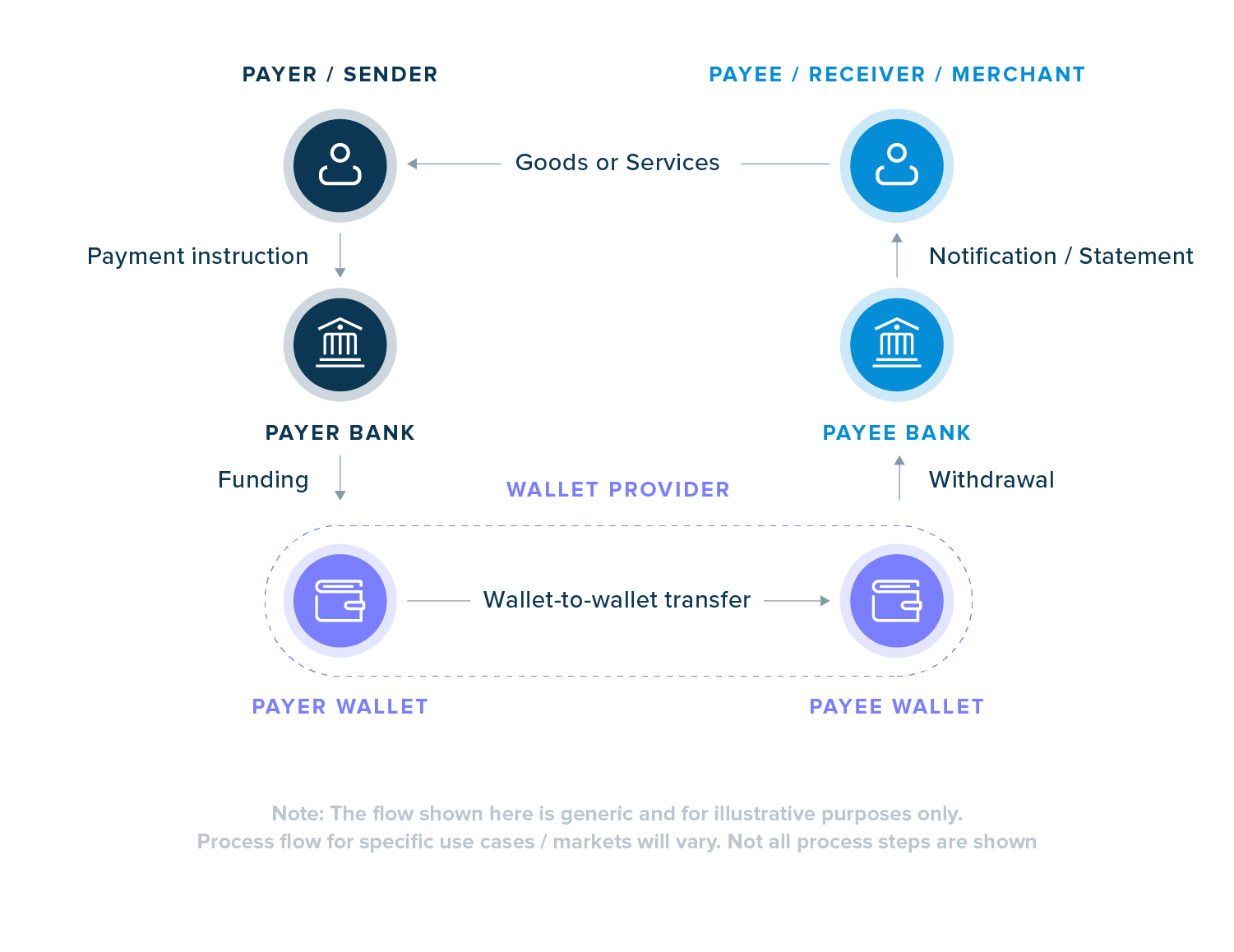

Overview

Not all digital wallets are the same. They vary by the functionality they offer. Some digital wallets are similar to bank accounts in the sense they store funds from which payments can be made, but these are primarily if not always offered by non-bank entities (eg e-money institutions in the UK and EU).

A consumer can deposit or withdraw funds to their wallet account via a bank transfer or by using a payment card.

Other digital wallets (such as Google Pay and Apple Pay) are simply virtual representations of physical wallets, allowing customers to access virtual versions of their physical cards.

Stored value wallet

These represent traditional wallets which store funds that customers use to make payments. Like a bank account, you need to have the account “funded” before any payments can be made. Funds can also be withdrawn to a linked bank account. PayPal and other providers such as Paysafe offer stored value wallets.

Staged wallet

Staged wallets do not store funds but are connected to a funding source such as a bank account or payment card. A payment made with the wallet is directly charged to the customer’s bank account or payment card. The wallet acts as a conduit or an intermediate mechanism for accessing the source payment instrument. There are usually two transactions that take place back to back – a payment made by the consumer is matched by a funding transaction from the source payment instrument, ensuring that the wallet does not carry a balance. PayPal offers this feature for its wallets.

Container wallet

Container wallets store payment credentials and are in many ways digital representations of physical wallets. These are more prevalent on mobile devices operating in the physical environment leveraging NFC or QR code technologies. Well-known examples are Apple Pay and Google Pay. As such these are not alternative instruments of payment as the payment is charged directly to the card.

Wallet channels

Wallets can also be defined by channel or device over which the buyer interacts with the seller. A consumer’s device for completing an online transaction could be a computer, tablet or mobile device. Some wallets are only available on mobile devices.

Developments

Wallets are increasingly being used as the underlying payment mechanism for digital marketplaces. The marketplace wallet is used by both buyers and sellers to make and receive payments. The buyer is able to fund the wallet from various types of payment instruments and the seller is able to withdraw funds received to a bank account. In markets in Asia and Latin America “super apps” such as Line and Rappi issue their own wallets to make it easier for customers to pay for the several services they offer.

As cryptocurrencies gain popularity, crypto exchanges and specialist providers are offering crypto wallets where customers can store their digital assets. The market will see more and more providers offering both “fiat” or real money and crypto wallets side by side.

Benefits for merchants

Wallets are widely used as the underlying payment method by online merchants, fintechs, online marketplaces and others.

Versatile – beyond payments

Some wallets, especially in Asia Pacific and Latin America have evolved to become “super apps,” going beyond ecommerce to offer services such as ride-hailing, food delivery, chat platforms, games, education and trading. A digital wallet provider may not provide these additional services directly but partner with the right players sharing revenues or generating commission fees. The common thread across all these services is the digital wallets. Users are able to pay with their wallets and can also earn rewards, which foster customer loyalty. The wallet can be funded through a variety of payment instruments. Digital wallets often operate with a closed loop infrastructure offering a variety of services to maximise profitability. Prominent examples of supers-apps are Gojek and Grab in Asia-Pacific and Rappi in Latin America.

Designed for purpose

Some wallets like PayPal are accepted at most online merchants and marketplaces while others are more tailored for specific purposes. Wallets are used for emerging areas such as online gaming and esports or digital downloads, making it easier for the digital provider of content to process the payment. Wallets are also specifically suited for online marketplaces which are growing in popularity where buyers and sellers are offered digital wallets to settle their obligations instantly on the marketplace platform.

Rich data

As mentioned above, digital wallet providers manage both ends of the payment equation. Additionally they facilitate transactions relating to services provided through the wallet for their partners. This allows them, with the customer’s approval, to access and analyse customer data which helps in understanding customer spending behaviour and providing more customised services to clients.

Drawbacks for merchants

High costs

Though there are exceptions, wallets tend to be more expensive than cards for merchants in Europe. This is because interchange fees that impact merchant pricing for cards have been regulated downwards in Europe. Wallets tend to be proprietary resulting in pricing variations based on usage and also merchant payment volumes. Wallets issued by merchants can be cheaper but may have technology costs associated with their design, implementation and operation.

Integration

Merchants usually need to make specific technology investments to accept a specific wallet and ensure that payments are automated and integrated with ordering and checkout processes. Merchant may also need to follow rules and processes when working with external wallet providers, which can generate more acceptance and administrative costs.

Benefits for consumers

All-on-one

Wallets can be used to store non-payment credentials such as store rewards, loyalty cards, special-purpose or discount coupons, and now even crypto assets. The superapps mentioned before are examples of the all-in-one services which customers can access in a single app such as insurance and stock trading.

Security

Consumers who are concerned about online fraud on credit cards, or do not want to use their bank account to make online payments, often perceive stored value wallets to be secure because a staged wallet does not have a balance. In the case of a stored value wallet, the balance can be kept to a minimum in order to reduce exposure to potential fraud.

Budget control

Where a wallet is used for a specific purpose, the user can control their spending by deciding on their funding and spending caps. A specific allowance can be set aside, say, for downloading or playing online games or for making in-app purchases.

Drawbacks for consumers

Monitoring

Stored value wallets carry a monetary balance and users need to monitor it to make sure they have enough funds to pay. If the funding process isn't quick and easy, this can sour the user experience. Customers don't typically like to carry a large balance because wallet providers don't or aren't allowed to offer interest on wallet balances. This isn't an issue for staged or container wallets.

Costs

There are fees associated with certain types of wallets that are popular in specific online segments, such as wallets provided by crypto companies or by online gaming entities.

Coverage

Payment card brands such as Visa, Mastercard and American Express have global coverage. Many wallets enjoy only limited coverage usually in specific industry segments or countries/regions. A consumer may have to use several wallets when making payments online, which can be cumbersome.

Buy now pay later

Buy now pay later (BNPL) payment options represent 8% of European digital payments and are expected to grow market share significantly by 2026.

Instalment loans and point-of-sale financing have been around for some time but newer BNPL options offer a better customer experience.

Merchants may accept higher fees from BNPL providers so they can make their products more affordable and increasing sales.

BNPL typically sits on top of other payment rails. Providers may offer consumers different repayment options, including card-on-file payments and direct debit.

As with all forms of credit, the affordability of purchases on BNPL terms can lead to credit problems for consumers, and may create financial risk for BNPL providers.

Overview

BNPL has been described as ‘on-demand financing’ and customers increasingly prefer it over traditional revolving credit card borrowing which is expensive, complicated and often lacking in transparency.

BNPL is not new. Instalment loans and point-of-sale financing have been around for some time and provide a similar service. The key advantage with newer BNPL payment options is a superior consumer experience. However, consumers can struggle to keep up with instalments, which can create financial risk for BNPL providers.

When a consumer selects a BNPL option at checkout, they usually choose between a range of repayment options such as 3, 6 or 12 monthly payments. The service might be free of interest or other fees, or where it carries interest, costs are often clearly indicated.

This is in contrast with borrowing on credit cards. Offering cardholders revolving or open-ended credit after making a small minimum payment every month can exacerbate debt problems for consumers.

Most of the time it's difficult to understand what accumulated credit card debt relates to. Regulators have put the brakes on revolving credit in many countries because of the problem of low income consumers who use revolving credit facilities and find themselves unable to pay back.

BNPL services don't guarantee that consumers will not go into debt. Buying too many things on BNPL will generate similar issues and require an individual to exercise judgement. The lender must also accept responsibility in clearly communicating to the individual all charges and potential penalties associated with the BNPL transaction.

BNPL options typically sit on top of other payment rails. Providers may offer consumers different repayment options, including card-on-file payments and direct debit.

Developments

As the BNPL space becomes more competitive, it’s likely that BNPL providers will focus on niche market sectors where they'll develop more precise products to determine a customer’s credit worthiness and identify higher risk verticals.

BNPL leaders are also likely in the future to expand from being payment and credit providers to helping their partners engage prospective ecommerce customers and even developing e-stores in conjunction with partners.

Benefits for merchants

Revenue generation

By making their products more affordable to buyers, merchants can increase sales. For this reason they're often willing to pay higher fees to the BNPL providers. Many brands such as Klarna, Clearpay and Laybuy charge no interest to buyers but may charge other fees.

No collection costs

Where merchants work with BNPL companies, they don't carry BNPL receivables on their books. This frees up capital for the balance sheet and means there are no risks of collection costs and receivable write-offs.

Drawbacks for merchants

Accounting reconciliation

Where the merchant is providing the BNPL or instalment service, it might require a considerable back office support on reconciliation, depending on the quality and behaviour of BNPL customers. Merchants need to assess returned items for amounts already collected and outstanding, so they can refund customers appropriately and make ledger reversal entries.

Credit checks and write-offs

BNPL, like any form of credit, requires that the buyer is checked for creditworthiness at the point of purchase. Some BNPL providers undertake ‘soft’ credit checks – possible in some markets – which don't adversely impact the customer’s credit score. But there is always the risk of extending credit to a buyer who may default. A consumer may pass all the checks, but still encounter financial difficulties later, forcing the merchant to begin costly collection efforts.

Benefits for consumers

Affordable

Most, though not all, BNPL providers, don't charge fees to buyers. Instead, they charge merchants who are eager to sell and often willing to pay a fee. As with any other type of loan, there are penalty charges if the buyer fails to make their repayments.

Clear line of sight

BNPL can give clarity to the consumer on their finances since payments are linked to a specific purchase. This is unlike borrowings on credit cards, which go into a pot of accumulated debt, making it hard to identify the purchases it's made up of.

Greater flexibility

Compared to credit cards, BNPL payments offer contractual terms that are more flexible and easier to understand. Buyers can choose the number of repayments and the time period involved.

BNPL schemes are similar to lending on instalment payments that are commonplace in many markets, but a key difference is the technology. BNPL user interfaces are designed to be simple, straightforward and more responsive to customer questions. This often means that customers perceive a payment as affordable, rather than as a debt with interest payment commitments.

Drawbacks for consumers

Credit burden

For some consumers, the affordability of purchases on BNPL terms can lead to serious credit problems. Customers viewing each transaction on its own may overlook their total exposure to debt if they use the service regularly. This can result in customers paying their outstanding instalments by getting credit from another provider or on a different payment instrument. In the United States, Capital One said it would bar customers from using credit cards to settle debts from not paying upfront for items. The US credit card provider warned these were 'risky' transactions.

Not entirely free

Even where the BNPL provider doesn't charge interest on outstanding credit, there are usually other fees. Late payments can attract hefty penalties and there could also be service fees on some types of transactions/contracts. Citizens Advice recently noted that in the United Kingdom, shoppers were charged £39 million in 2020 for late payments.

)

)

)

)

)

)

)