Scanning the regulatory horizon

Navigating regulation in any industry requires research, application, implementation and finally, internal governance. We absolutely see it as our mission in Compliance Operations to lead the way with PSD2 (the Second Payment Services Directive). We’re committed to empowering our clients to grow the open banking economy, and guiding them through its correct implementation and application in the UK and throughout Europe.

Charting the journey so far

PSD2 and its implementation into the UK under the Payment Services Regulations 2017 (PSR) since 13 January 2018 is changing the landscape of financial services; it provides opportunities for competition and for the innovation of products and services in ways we have not seen before. And what has gone hand in hand with this, is the manner in which each competent authority across Europe is implementing PSD2, based on guidance from a plethora of European institutions — the Central Bank (ECB), and the Banking Authority (EBA) amongst others, and here in the UK, the Financial Conduct Authority (FCA).

Suffice to say, the mood is as though we’re all about to set sail, rather than having completed the crossing.

Navigating the regulatory seas

Most of us are now aware of why PSD2 was introduced across Europe. In parallel, the Competition and Markets Authority (CMA) in the UK introduced the CMA Order to mandate nine of the UK’s largest banks to adopt the proposals for Open Banking. This, with a strict timetable to boot.

With the deadline moving ever closer and with requirements under the EBA’s Regulatory Technical Standards (RTS) in the process of being finalised, currently, there are many changes in regulation that all players in the market need to be aware of.

It’s a moveable feast; there are still some elements within regulation and the market that need formalising. Now that we are 9 months into PSD2 being implemented in the UK, elements of how PSD2 and the RTS are to be further implemented are already being pushed out to consultation so that each of the players — banks, third party applications and consumers alike can provide their views on how this will ultimately work — with the sole aim of consumer protection. And we concur with this process.

With this in mind the FCA is focusing on these players:

Banks and the requirements on them under the RTS;

Third-Party Applications that need to be regulated under PSD2;

Consumers so that they receive adequate information on who is doing what with their information.

Circumnavigation

PSD2 implementation across Europe is steadily advancing. The introduction of Open Banking Europe together with the Berlin Group hopes to provide the same level of technical support and standardisation as the Open Banking Implementation Entity (OBIE) in the UK. With our expansion into Germany and France, we’ve shared our experience of open banking in the UK, with some of Europe’s regulators and participants alike. The overall consensus is that Open Banking is a positive step for consumers, and all participants should foster a culture of collaboration to ensure it works for their markets.

Beyond that, we are starting to see open banking being implemented in Australia, Asia, Japan and Canada. We have participated in consultations that have been released by Australian Treasury, and have had positive discussions with regulators in Singapore and Hong Kong.

Here in the UK, we submitted our response to the Global Financial Innovation Network (GFIN), an initiative which the FCA, along with other global regulators and standard setters, have pulled together to introduce the concept of cross-border trials. We’ve learned a lot on our voyage so far and are keen to share this so that the market continues to innovate and regulation remains relevant.

Voyaging into the unknown

Brexit looms and we are preparing to be ready by implementing solutions to support our operations within and outside of the European Union. As so much of the next few months are unchartered territory, we, along with our technology contemporaries in the market, have contingency plans for a second jurisdiction.

It’s an incredibly exciting time for us at the moment. We’re ambitious as pioneers ought to be, but are cognisant as ever, of the changing regulatory currents.

Keep an eye out for updates relating to our open banking Data API Beta launch and our Payments API coming soon.

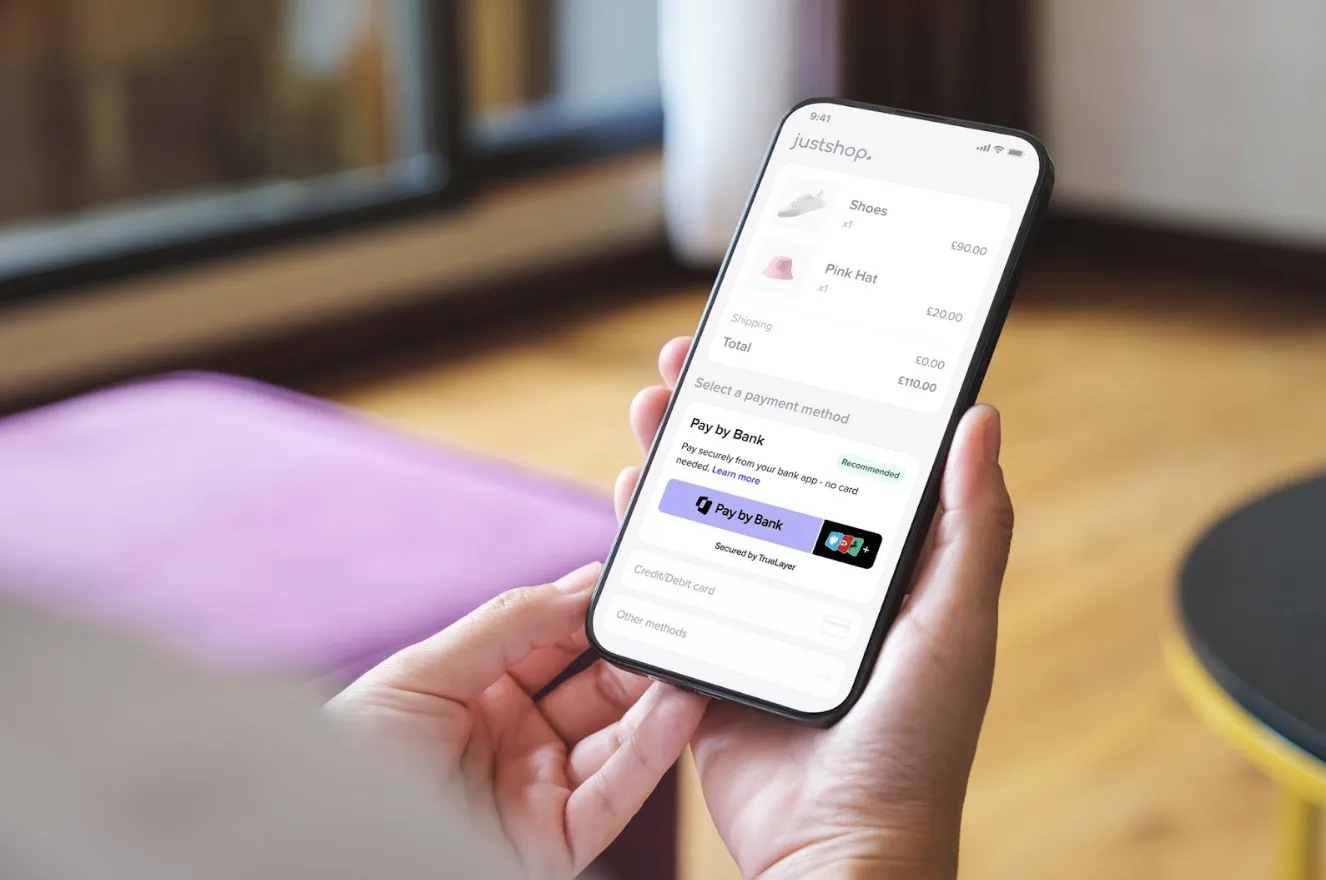

How does your business stack up on the Pay by bank value flywheel?

Payment incentives: the secret sauce in your Pay by Bank recipe

)

)

)

)

)