PSD2, which set open banking in motion, came into force in January 2018. And ever since, open banking has been the subject of countless op-eds in both industry and national press.

Depending on who you ask, it’s either the biggest revolution in finance for decades, or — if you ask Starling Bank CEO Anne Boden — a failure. So who’s right? As a business that's harnessing open banking technology to help our customers, we at TrueLayer believe it's a generational change for the way consumers will pay for things and manage their finances.

But press attention alone doesn’t guarantee success. For payment methods, consumer adoption will always be the defining metric. So, are consumers adopting open banking payments? And will it continue to take payment market share from traditional methods like cards?

In this article we chart the rise of consumer adoption in open banking across the UK and Europe, analyse what led to this growth and consider what previously held it back. We also look to the future of open banking and how commonplace it might become.

The open banking story so far

However you measure it, open banking has been growing at a rapid rate since PSD2 came into force.

In May 2022, the UK reached the milestone of 6 million open banking users, or 11% of the UK’s digitally-enabled consumers. For comparison, less than two years ago, there were only 2 million users.

There were also 6.5 million successful open banking payments in August 2022, up from 2.4 million the year before. That represents a 267% increase.

While the UK continues to lead the way in open banking adoption, there are now 58 countries rolling out open banking technology based on PSD2 or similar legislation.

Germany, France and Italy are all on track to pass 1 billion open banking application programming interface (API) calls per month by the end of 2022. API calls are messages sent to a server asking an API to provide information or perform an action, showing that the demand for open banking services — including payments — are growing in these countries.

What’s causing open banking payments to grow so rapidly?

There are key trends which support the adoption of open banking payments, including demand for new and alternative payment methods from businesses and consumers alike.

The European ecommerce market, for example, was estimated at $465 billion in 2021, 30% more than before COVID-19 struck. In the UK, over 25% of all retail sales take place online, up from less than 19% pre-pandemic.

Despite consumers increasingly shifting to online payments, incumbent payment methods, like cards, aren’t inherently suited to online payments. Cards represent around 41% of ecommerce payments in Europe. But they also face problems with fraud, user experience and payment failures. For example:

Card-not-present fraud in ecommerce is the single-largest category of card fraud in the UK, accounting for 78% of all card fraud losses in 2021.

Up to 14% of all card payments fail because of user error, expired cards or technical issues.

As many as 14% of browser-based card transactions, and a quarter of app-based ones, are discouraged by strong customer authentication (SCA).

Two thirds of shoppers have refrained from buying something due to worries about online security.

While cards will remain the dominant payment method online in the UK and European markets like France and Spain for the next few years, the constant chipping away of customer trust and satisfaction will see card usage drop to 33% of European transactions by 2026. There's a big opportunity for the right alternative payment methods to win the remaining two thirds.

So why hasn’t open banking grown more quickly?

Some early predictions suggested we’d see 60% of the UK’s population using open banking by September 2023. While we haven’t reached quite that breakneck rate of growth, you only need to look to other alternative payment methods and see that it takes many years — even decades — to become truly mainstream.

Contactless payments, for example, were introduced in 2007 and by 2016 only accounted for 7% of all UK payments. By 2020, that figure had reached 27%. Change happens (relatively) slowly at first, but open banking has built a solid foundation for continued growth.

While we know any major shift in consumer behaviour will happen gradually, we can also see several roadblocks that have slowed the growth of open banking payments:

Missing use cases

Open banking has, until recently, been a payment method for one off and ad-hoc transactions. But the introduction of variable recurring payments (VRP) in the UK is opening up open banking payments to recurring use cases like subscriptions and memberships. This means a whole new set of businesses will begin to explore open banking, leading to further consumer adoption.

Limited integration routes

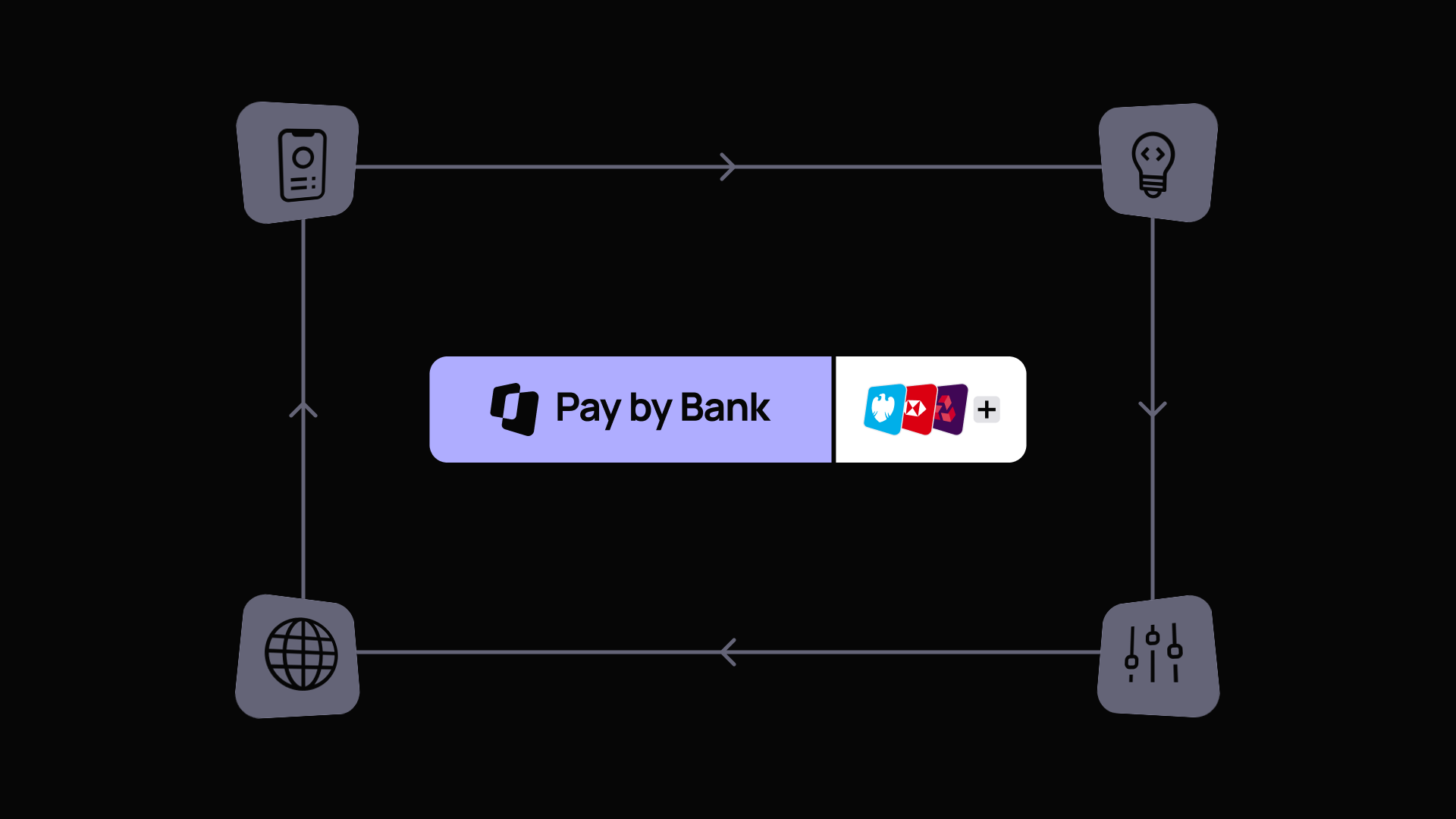

For the first few years of open banking’s existence, the only viable way to integrate it into your checkout or payment page was via a direct integration. While that gave businesses a lot of flexibility, it was also resource intensive, requiring in-house developers to carry out the technical work. This meant it was largely the preserve of enterprise businesses.

With the introduction of integration tools like mobile software development kits (SDKs) and hosted payment pages (HPP), it’s now possible for businesses of all sizes to launch their own open banking payment experiences faster and at scale.

The SEPA Instant problem

Progress in the EU has been slower than the UK, partly because of SEPA Instant coverage. SEPA Instant is a bank transfer scheme introduced in 2017 at the request of the EU, which was meant to enable easy and instant cross-border payments across 36 countries. But a mixture of low coverage, high fees and IBAN discrimination has held back its usage.

It is growing slowly, increasing from 5% of all SEPA credit transfers in 2019 to 10% in 2021, but legislators have much loftier ambitions. In October 2022, the European commission announced a new proposal to make it compulsory for banks in the EU to offer SEPA Instant Payments, and cap fees at the same price as regular credit transfers. As we’ve seen in the UK, where there is coverage, adoption soon follows.

Inconsistent bank UX

Another issue in Europe has been the inconsistency with which banks implement open banking user journeys. In June 2020, the European Banking Authority (EBA) stepped in. The EBA made it clear there must be parity between the online banking experience that banks provide directly to their customers and the service they provide through PSD2 APIs.

From this we saw real improvements. For example, Spanish banks have now enabled app2app biometric authentication, bringing the user experience in line with countries like the UK. This led to conversion rates — the percentage of consumers successfully completing payment journeys — jumping by 10%.

Will open banking continue to grow?

With consistent growth and demand for alternative payment options, we’ve seen open banking payments go from a niche payment option, to a bonafide alternative payment method in industries like financial services, iGaming and online retail.

But has it hit its peak? Do all the people who want to pay by open banking now have access to it?

The short answer is no. On its current growth trajectory, the UK will surpass 8 million monthly open banking payments by the end of 2022 and reach 10 million in the first half of 2023. The number of open banking users worldwide is expected to grow at an average annual rate of nearly 50% between 2020 and 2024. In terms of value, Juniper Research estimates the global value of open banking payments will exceed $116 billion by 2026, up from $4 billion in 2021.

But beyond simply looking at the rate of growth, how can we be so sure consumers will continue to use open banking payments?

Mobile banking adoption is at an all-time high

One vital step in consumer adoption is a high mobile bank app usage. During the COVID-19 pandemic, between March 2020 and April 2020, 6 million people in the UK downloaded their bank app for the first time.

And as of March 2021, the top six European neobanks have a combined 40 million downloads. With this shift in behaviour, a seamless open banking payment experience is available to so many more consumers.

Consumers are comfortable paying by open banking

Consumers will pay by open banking where it’s offered. eight in ten investors are happy to pay by open banking, while seven in ten players in the UK, Germany and the Nordics use it to pay into a gaming service.

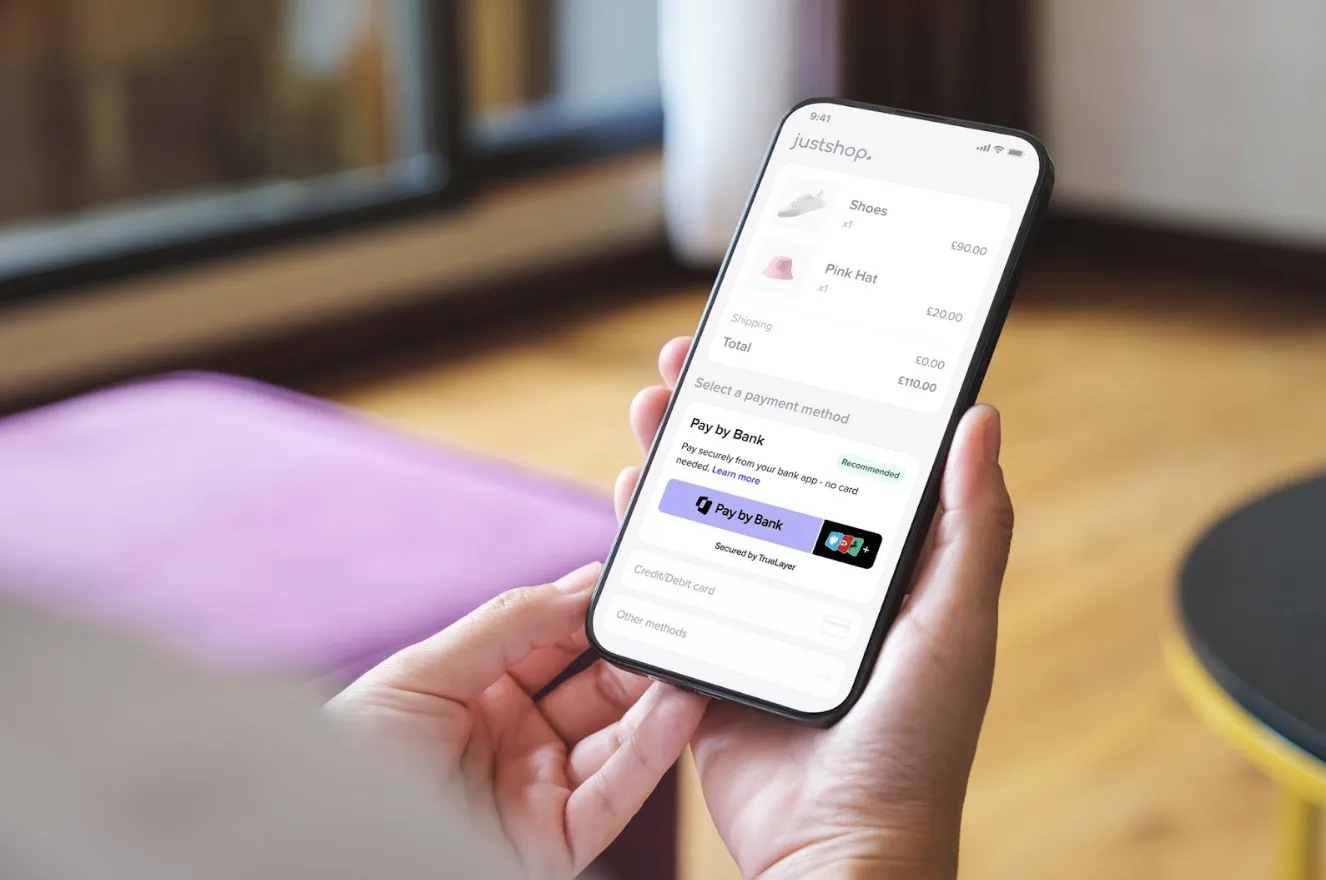

And in online retail, 63% of shoppers are comfortable to pay by ‘instant bank transfer’ (a common consumer-facing way of describing open banking payments). It’s particularly high for motor vehicles (84%), flight tickets (76%), electronics (75%), and tickets to events (72%). Interestingly, 66% of shoppers would happily pay for groceries using open banking.

More and more businesses plan to implement it

Consumer willingness to pay via open banking is undoubtedly part of the reason more businesses are turning to it as a new payment method at checkout. 74% of UK retailers include open banking in their long-term strategy, not only to meet consumer demand but also to take advantage of reduced fraud, instant settlement and lack of chargebacks.

When customers are given the option, share of checkout regularly reaches 25%

And what about when customers are actually given the option to use open banking, even if card payments are available? Online car retailer Cazoo now sees around a quarter of car purchases carried out via open banking. Citizen Ticket, an online ticket seller, sees similar share of checkout for open banking.

This uptake shows that not only are consumers willing to try it, but many will choose it over other payment methods and return to it for future purchases.

Understand more about how open banking can help your business

Are you one of the 74% of businesses with open banking in your long-term strategy? One of the biggest challenges is finding the right provider for your exact requirements, such as how you need to integrate your payment experience and what features you need it to have.

The growth of open banking has seen the technology constantly changing and evolving, and that presents a challenge and an opportunity. Your business needs a trusted partner to make the most of what is available.

Our buyer’s guide to open banking payments is designed to help. We walk through every stage of the buying process, plus all the questions you should ask your potential open banking payments provider.

How does your business stack up on the Pay by bank value flywheel?

Payment incentives: the secret sauce in your Pay by Bank recipe

)

)

)

)

)

)

)

)

)

)