A payment gateway is a service used by businesses to authorise payments for card transactions, typically online. If your business wants to accept credit or debit card payments from your customers online, you’ll need to use one.

In this post, we’ll take you through a detailed guide to payment gateways, how they work and what you should bear in mind when choosing one for your business.

What is a payment gateway?

A payment gateway is the online equivalent of a point-of-sale (POS) terminal – the first step to making a card transaction.

It’s a technical layer which enables you to verify your customer’s credit or debit card details when they make a purchase online, and check that they have enough money available.

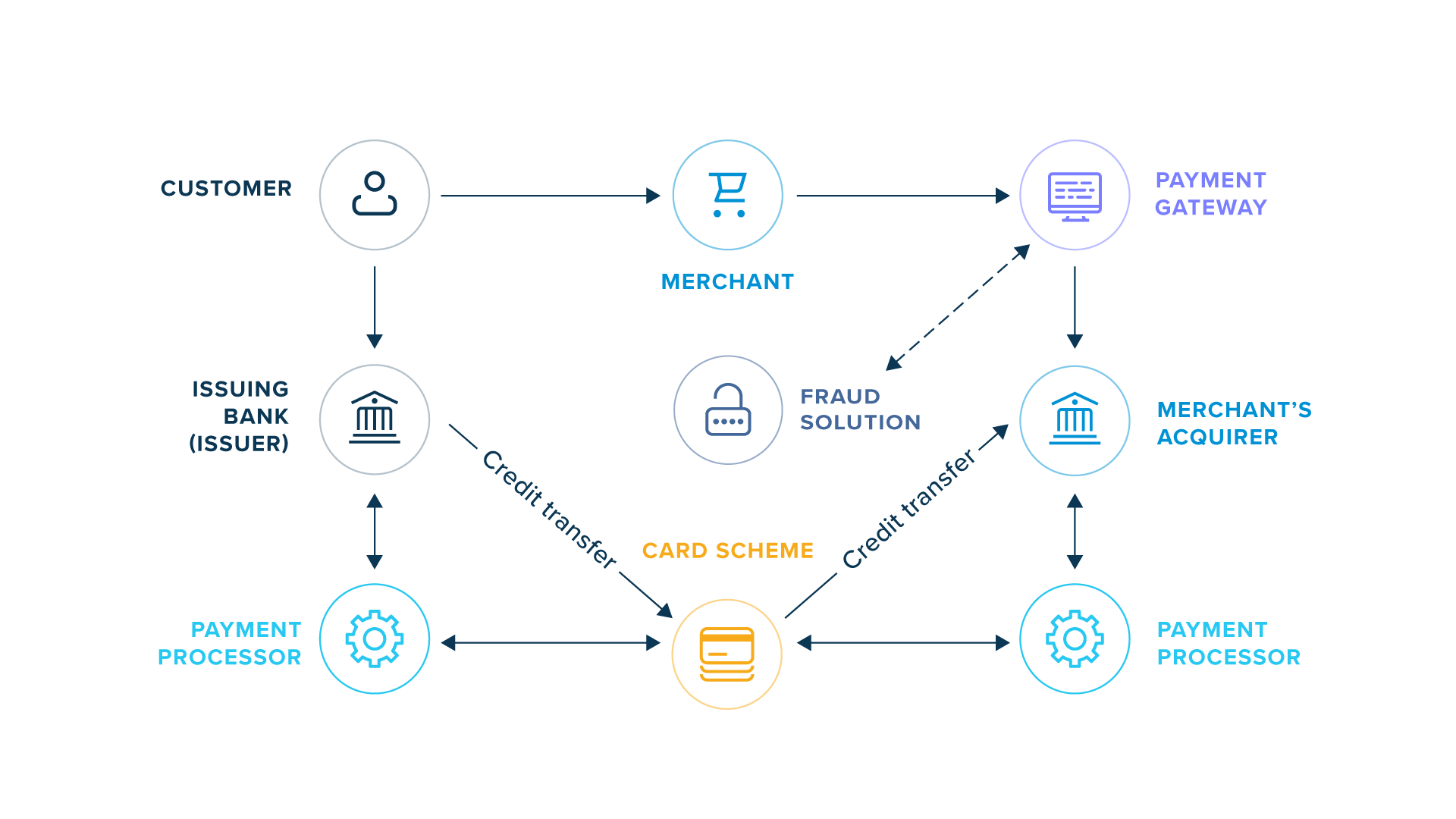

It connects you to your acquirer (the provider of your merchant account), which then routes the transaction to the issuer (for debit card payments, this is the customer’s bank) via card schemes like Visa or Mastercard. The issuer that will approve or refuse the transaction and pass this information back to you and the customer, via the payment gateway.

How do payment gateways work?

At checkout, a customer enters their credit or debit card details onto a payment page. The payment page is either hosted by the payment gateway in its entirety or the entry fields are encrypted and information is securely passed onto the payment gateway.

The payment gateway encrypts the card details, carries out fraud checks and then transfers the cardholder’s information and transaction details to the merchant’s acquirer.

The acquirer relays the information to the card scheme (eg Visa, Mastercard) and onwards to the issuing bank. Further fraud checks are carried out and the payment is either authorised or declined.

The verdict of the authorisation makes the same way back to the payment gateway where both customer and merchant are informed as to whether the payment has been approved or declined.

Based on the issuing bank’s verdict, the payment page will either display payment confirmation, or ask the customer to try another payment method if it has been declined.

Despite there being a number of steps involved, the payment process occurs virtually instantaneously. But, since there can be seven or more parties involved in a card transaction, the likelihood that a payment will fail is higher than it is with other more direct payment methods (like open banking payments).

Payment gateway vs acquirer

Payment gateways and acquirers are both needed for taking card payments online, but they're not the same thing. An acquirer is the provider of your merchant account. They relay information between parties (eg you – the merchant, the card schemes, and the payment gateway). If you have physical shops, the acquirer also provides you with credit card machines for accepting card payments in-person.

A payment gateway, meanwhile, is a service that securely transmits card and payment data to the acquirer for online transactions. Put simply, a payment gateway is like a point-of-sale (POS) terminal in a shop, except it carries out its job without a card or customer being physically present.

The key difference is that an acquirer (mostly) works in the background to authorise a transaction, while a payment gateway is a tool that communicates and displays that authorisation to the customer.

Another difference is that payment gateways are mainly used to take payments in card-not-present (CNP) transactions – for example when a customer has to fill in their card details online. An acquirer is used in both CNP and in-store transactions – whether the customer pays using a card machine, or by filling in their details.

Most acquirers, such as WorldPay or Adyen, offer their own in-house gateway services – and at the same time partner with independent gateways.

Examples of acquirer-independent payment gateways include Cybersource, Mastercard Payment Gateway Services (MPGS) and Computop.

How much does it cost to use a payment gateway?

Payment gateways can charge you in different ways, depending on what services you use. For example, they may charge you:

a per transaction fee

a fraud management fee (this could be per transaction)

a fee for tokenising card details (to enable subscriptions or one-click type payments)

monthly account fees

set-up fees

fees for strong customer authentication (SCA) / 3DS2

The price of these services will vary depending on the provider you choose.

If the payment gateway is independent (like the ones listed previously), these fees will be separate from the fees you pay your acquirer for card processing. This could be anything from a few pence per transaction for large merchants with high transaction volumes, up to 30p per transaction for smaller merchants with low volumes.

If your payment gateway is also your acquirer, you might also pay them a percentage fee for debit and credit card processing. Again fees vary greatly between small and enterprise businesses and depend on their business mix.

What should I consider when looking for a payment gateway?

It’s important that you choose the right payment gateway for your business model. Below we’ll take you through some factors you should consider when making your decision.

Hosted or non-hosted payment page options

Payment gateways can offer either hosted or non-hosted payment pages. In the case of hosted, the customer is redirected to the payment gateway’s hosted payment pages (HPPs) in order to fill in their card information. While this method is typically easier and quicker to integrate into your website, it gives you less control over the payment experience that your customer receives.

In the case of non-hosted, the customer can complete the transaction without leaving the merchant’s website – by entering their card details into secure and encrypted payment fields.

Both options have the advantage of not storing sensitive information on a merchant’s servers. But HPPs have the disadvantage of adding an extra step to the payment process, which some customers find off-putting, and which may lead to lower conversion.

Non-hosted payment pages can help you provide a consistent payment experience for your customers, in line with your brand’s look and feel.

Security and fraud tools

Security is paramount when taking payments online as it involves handling highly sensitive financial information. All payment gateways have to be PCI compliant. On top of that, payment gateways may offer additional screening tools to help protect against fraud. Make sure that the payment gateway you opt for offers enough security to satisfy your business and customer needs.

Support for alternative payment methods

In some markets, such as Germany, the Nordics and the Netherlands, consumers prefer to pay with alternative payment methods like instant bank payments, so offering these is important for driving conversion at checkout. Some payment gateways struggle to cater for alternative payments options, so be sure to check your chosen gateway can support the payment methods that matter to your customers.

Multi-currency support

If you accept payments from customers internationally, you need to opt for a payment gateway that can deal with payments in different currencies and across borders. You’ll also need to take into account any additional costs involved when taking payments in foreign currencies.

Mobile and tablet payment support

Many customers shop online using their phones or tablets, so it’s important you pick a gateway that can support payments on these devices.

To ensure the best payment experience for your customers, choose a gateway that recognises where a consumer is shopping and automatically renders the checkout page according to screen size.

Cost

Payment gateways can charge different payment fees: monthly fees, fees per transaction, and set-up fees. To figure out which will be the most cost-effective gateway for you, you'll need to take into account both the volume and the value of transactions you typically process. If your business typically deals with high-value transactions, it’s advisable to opt for a set monthly fee, or look for cost-effective alternatives like open banking payments.

How open banking provides a faster and cheaper payment option on your ecommerce site

As we covered earlier in this guide, a good way to reduce card processing fees and increase payment acceptance and success rates is to look into offering alternative payment methods.

Instant bank transfers, powered by open banking can help you reduce your business' reliance on card payments. There are fewer parties involved in the transaction, reducing payment failures and cost.

Plus, with accounts authenticated directly with the bank, fraud and chargebacks are dramatically reduced or eliminated, which cuts operational overheads and costs.

Find out how to get started with open banking and instant bank transfers.

TrueLayer completes acquisition of Zimpler

Why your iGaming payment stack needs to work as one

)

)

)

)

)

)

)