In April 2019, the regulator for pharmacies in England, Scotland, and Wales — the General Pharmaceutical Council (GPhC) — published new guidance, stating that pharmacies providing medication online must verify customers’ identities.

However, pharmacies using a third-party provider to meet this guidance will be well aware that it adds friction to the checkout experience. Customers have to manually upload identity documents such as a passport or driving licence and wait for verification approval. The verification process can take minutes or hours, leading to high drop-off during checkout, meaning you miss out on customers you’ve worked hard to win.

Fortunately, there is an alternative solution, which can help you convert more customers by streamlining verification with a single payment. That alternative is open banking, or to be more precise, a tailored solution powered by open banking.

Wait, what is open banking?

Open banking is a secure way for businesses to easily accept online payments from customers, accelerate identity verification and to provide other value-added services.

What are the challenges pharmacies face with existing online identity verification options?

In addition to satisfying GPhC guidance, identity verification is also fundamental for maintaining public trust and safety, ensuring the correct dispensing of medication, and preventing misuse or illegal distribution of medicines. But as important as verification is, existing methods can cause pharmacies several unexpected problems:

High drop-off at checkout

The explosion of online retail, specifically purchases on smartphones, means that customers are used to making purchases quickly and easily. At any time. We’ve all become accustomed to buying products wherever we are, with a few taps and without having to upload any documents.

If purchasing a prescription is complex or prone to error, customers may shop with a competitor or abandon their purchase altogether. 30% of online shoppers have abandoned the checkout due to either a complicated checkout or website errors.

Each additional step in the verification process lengthens checkout and adds friction. It takes time for the customer to manually input information, upload their identity, and take a picture of themselves. Aside from the time and effort required, the extra steps may even prevent less tech-savvy customers from being able to complete the process.

Some customers might not have an acceptable identity document (typically a driving licence or passport) to hand — do you have yours with you at all times? Some customers won’t have a valid ID at all.

Loss of brand loyalty

Modern pharmaceutical brands spend time and resources carefully crafting a brand that customers can trust. Pharmacies can’t control user interfaces of verification services, which may be poorly designed or confusing. They also might not be suitable for mobile — a significant problem given that many customers like to order prescriptions via mobile. This poor user experience can lead to customers losing trust in a brand.

High cost

Identity verification checks make an already resource-intensive checkout process even more difficult and costly.

Alongside the usual complexities and expenses associated with handling different payment providers and payment methods, pharmacies are classed as ‘high risk’ by card networks. This means pharmacies are required to pay extra yearly fees.

Complex and lengthy integrations with PSPs and other payment providers

Identity verification checks, in general, tend to be resource intensive. In addition to the cost of verification services, pharmacies must invest time in setting up and maintaining the verification process. The investment in identity checks adds yet another layer of expense to the already extensive list of costs that pharmacies must bear.

A new way to speed up identity verification checks

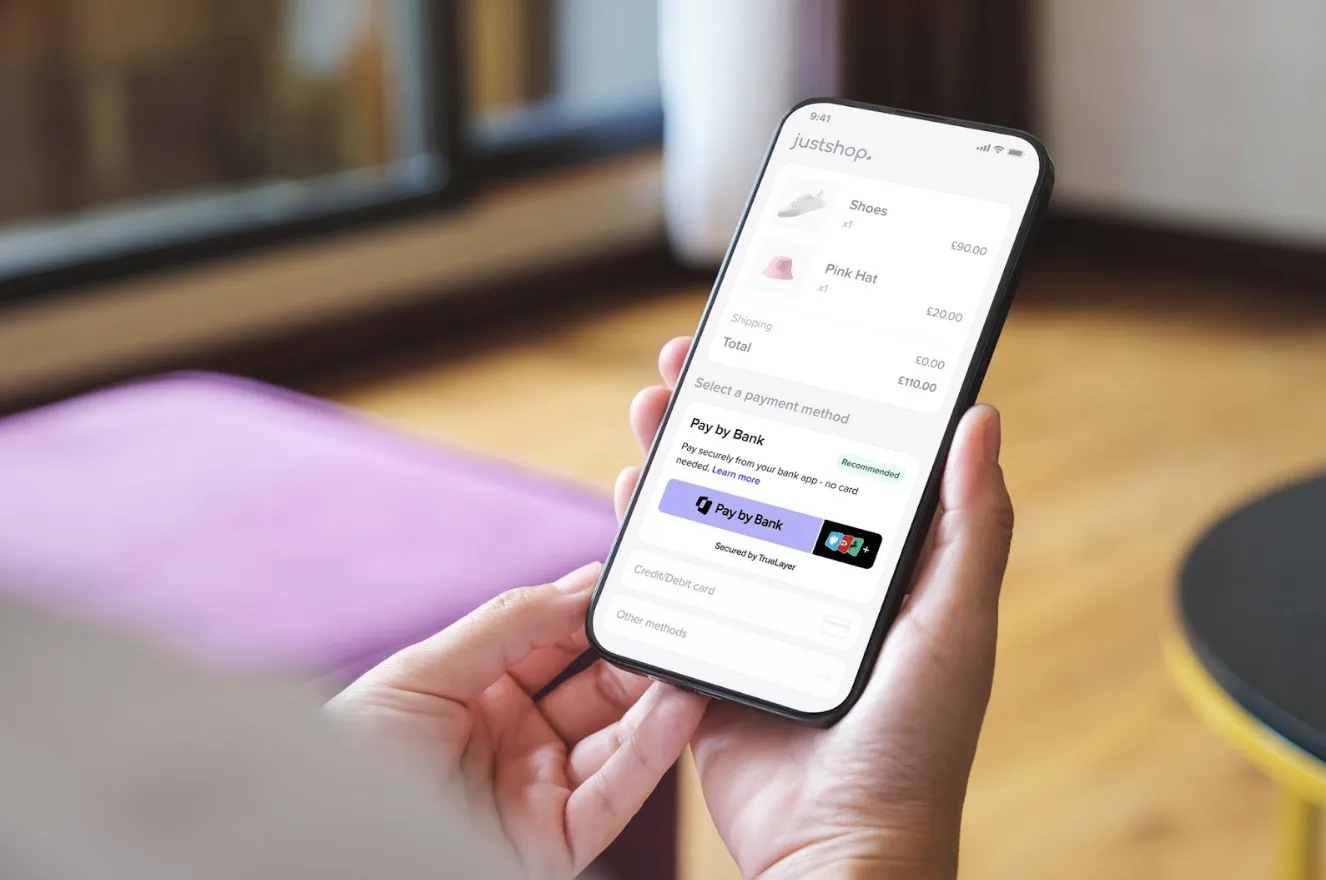

Signup+ is an open banking-powered payment solution, which combines identity verification with making a payment. It speeds up checkout so that customers can purchase prescriptions without friction. Signup+ uses bank-sourced identity data to verify a customer’s name, address, and date of birth to speed up verification checks and customer onboarding.

There are no documents to scan and no waiting minutes or hours for verification checks. Customers simply make an open banking payment at checkout, and they are securely verified simultaneously through open banking technology in the background.

How else can Signup+ help pharmacies?

Convert more customers with fast and frictionless checkout

Reduce drop-off at checkout by streamlining verification through a single, instant open banking payment. No need to manually create an account or upload documents — good news if customers don’t have their ID with them. Faster checkout means better conversion rates.

Plus, Signup+ has been built with mobile checkout experiences in mind, so customers paying on their smartphone won’t be confronted with a clunky or broken user journey.

Stay compliant and allow customers to checkout securely

Our research found that 64% of people trust a bank's verification process more than uploading documents to a third party. Signup+ uses open banking technology to check customer data as they make a payment by interacting with their bank directly. This system means customers don’t have to share sensitive data with an unfamiliar third party. Their data remains protected within the trusted security environment of their banking institution.

By connecting directly to the customer's bank, Signup+ also ensures that pharmacies stay compliant with SCA and PSD2 regulations.

Consolidate suppliers and cut costs

With Signup+, gone are lengthy checkout processes and ‘high-risk’ additional fees from card networks. The adoption of Signup+ means pharmacies can save on costs associated with managing many third-party providers, as it combines payment processing and identity verification in one. The consolidation reduces the need for multiple service agreements, simplifying management and reducing costs associated with using several vendors.

Signup+: the fastest way for customers to purchase prescriptions

By streamlining identity verification with a single payment, Signup+ transforms the dreaded checkout ordeal into a quick, effortless experience. Pharmacies can be confident that they’re complying with legal obligations, and customers can order their prescriptions without the hassle. Increase conversions by simplifying identity verification into a single, swift payment step with Signup+.

How does your business stack up on the Pay by bank value flywheel?

Payment incentives: the secret sauce in your Pay by Bank recipe

)

)

)

)

)