In 2025, a quiet revolution is reshaping the way we pay online, and it’s happening at the checkout. Forget the traditional card payment dance; a faster, safer, smarter contender is staking its claim: Pay by Bank. And TrueLayer’s newly released Pay by Bank update 2025 has everything you need to know about the future of the checkout. From the latest policy news and Pay by Bank trends to exclusive brand stories from the likes of Papa Johns and lastminute.com, get all the insights into the payment method set to dominate ecommerce. Here’s what you can expect.

The numbers speak for themselves

Let’s start with momentum. Pay by Bank is already clocking in at 27 million transactions a month in the UK alone. Nearly nine million Brits are using it every month, and that number grows by one million new users each month.

Another figure sure to make ecommerce leaders take notice is that 80% of merchants with more than £1 million in annual revenue have Pay by Bank on their roadmap already, with 90% of them planning to implement it within 12 months. It’s clear Pay by Bank is a strategic play for merchants, and the Pay by Bank update 2025 details why.

What’s behind the shift?

As CEO and Co-founder of TrueLayer, Francesco Simoneschi, writes in the report’s foreword:

“In the long term, we believe in a future where Pay by Bank powers roughly half of all ecommerce transactions… And yes, to some payment industry observers, the battle might be a spectacle to watch.

Francesco notes, adoption of Pay by Bank also brings long-overdue price competition to the payments ecosystem, which will slash transaction fees and reduce the cost burden on merchants. And when merchants reinvest their savings in customer incentives that will drive customer adoption of Pay by Bank, they help to break the longstanding habits of card usage.

So, what’s fuelling the confidence in Pay by Bank? For merchants and consumers alike, it’s a no-brainer:

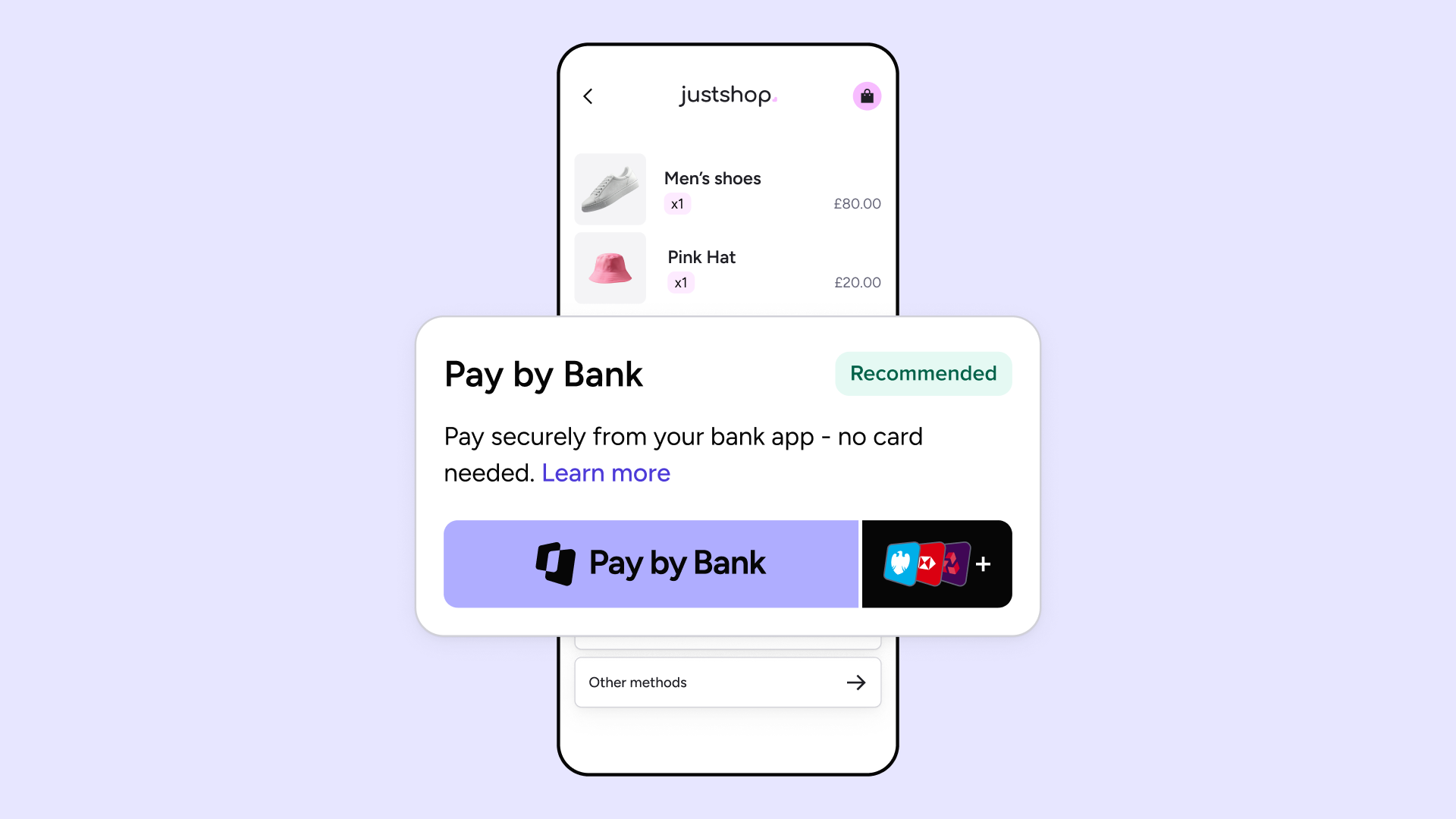

A frictionless checkout: no card numbers to enter, no redirects. Just a seamless flow from purchase to confirmation via your banking app.

Security by design: biometric logins, strong customer authentication, and zero sensitive data shared with merchants.

Instant refunds: what used to take days now takes seconds, and more than half of shoppers would switch to Pay by Bank if it means speedier refunds.

Pizza, planes and Pay by Bank

Some of the most promising success stories come from brands showing how they’re already reaping the rewards from Pay by Bank.

Take Papa Johns, who saw a chance to futureproof their payments and rescue lost revenue. Senior Product Manager Eamon Lindsell reflects on the revenue opportunities:

“If you can recover 20% of failed payments by offering Pay by Bank as an alternative, we can rescue over £1 million in revenue each year.

Similarly, lastminute.com, saw their switch to Pay by Bank help to increase their average order value by 20%. When global card systems went down during the Crowdstrike outage in 2024, there was a payment method that saw no disruption: “We saw a massive spike that day,” says Nicola Bettari, Fintech & Payments Director. “It justified Pay by Bank’s role in our resiliency strategy.”

The return of VRP: Bank on file is coming in 2025

One of the most exciting developments in the report is the comeback of Variable Recurring Payments (VRP), or as it’s also called, Bank on file.

Reshaping how we think about repeat payments altogether, Bank on file allows merchants — think subscriptions, bills, or streaming services — to collect recurring payments directly from your bank account, without needing a card on file. The FCA has signaled its support, and 2025 is expected to see the first major wave of implementation.

Megan Coulson, UK Policy Lead at TrueLayer, details the FCA milestones in the report, and provides a Bank on file cheatsheet with example use cases merchants can check against.

Debunking the consumer protections myth

We also cover one of the biggest hot-button issues: consumer protection. While consumer protection is critical, it’s time to be frank about chargebacks. There seems to be a whole class of payment leaders who believe chargebacks are a fundamental driver of consumer preference. It’s important to challenge this perception this year and beyond.In a world where consumers are already well protected by merchants themselves, it’s essential to ask whether replicating the same chargeback system of cards (and all of their downsides/costs) is a sensible approach.

TrueLayer’s CEO, Francesco, argues, this is actually more myth than reality:

“Chargebacks have become an enabler for fraud rather than an antidote... With Pay by Bank, customers are already protected—and they’re also more satisfied.

Find out Francesco’s three key reasons that challenge the notion that Pay by Bank needs the same chargeback mechanism to continue growing.

The missing pieces: collaboration

While the growth in Pay by Bank is impressive, the report calls for stronger collaboration between banks, fintechs, and regulators. An independent central operator is already being developed to support recurring payments, guided by scheme rules that incentivise performance, ensure interoperability, and boost innovation.

As TrueLayer’s VP of Policy & Research, Jack Wilson, puts it:

“Pay by Bank was built to bring competition and innovation to a stale ecosystem. Now, it needs a governance model that can match its ambition.

The report details how a decentralised approach has been holding Pay by Bank back, with plans for a scheme being part of the solution.

Ready to dive in?

The TrueLayer Pay by Bank Update 2025 is more than a report, it’s a realistic glimpse into the future of payments. Whether you're a merchant, a fintech strategist, or just someone who’s tired of typing in card numbers, this is essential reading.

The battle for the checkout has begun. And Pay by Bank isn’t just competing—it’s positioning itself for the win. Download the full report here

We don’t need another Wero: building on Pay by Bank

Software engineering in the age of AI: run the mile you're in

)

)

)

)

)

)

)