Customer churn is the rate at which your customers stop buying your services or your subscribers cancel their subscription. It’s a key metric for SaaS, ecommerce and financial services brands that rely on recurring revenue, and high churn can slow down or entirely wipe out growth, even when you’re consistently acquiring new customers.

There are several reasons for customer churn. Most of these are caused by customer dissatisfaction. But involuntary churn is too often overlooked, and it results in the loss of customers who are actually satisfied with your brand. They are simply unable to make payments to your business.

This article defines involuntary churn, explains how it differs from other kinds of churn, and offers practical solutions for reducing your involuntary churn rate.

What exactly is involuntary churn?

Involuntary churn happens when your customer or subscriber loses access to your services, but they didn’t choose to end the relationship with your brand. They lose access because they were unable to make a payment to keep their service active. This type of churn can lead to happy customers — even advocates of your brand — no longer being customers, so it’s potentially a very costly problem.

And while those customers might have been perfectly happy with your product or service, there’s no guarantee they will return to your brand after their subscription lapses. While there are tactics to win customers and subscribers back who have churned involuntarily, it’s best to stop it happening altogether.

Involuntary churn accounts for about 20% to 40% of all churn, so it’s a major problem if left unchecked.

What’s the difference between voluntary and involuntary churn?

Voluntary churn is where your customer chooses to end their relationship with your business, be it by cancelling their subscription or simply by choosing not to buy from you anymore.

There are many reasons for voluntary churn, but they all boil down to some kind of dissatisfaction with your service. Indicators that a customer may churn voluntarily include low NPS scores, complaints to customer service, and poor online reviews.

Involuntary churn, on the other hand, doesn’t necessarily mean the customer is dissatisfied. They could leave good reviews and NPS scores, but when their payment fails, their access to your service is soon revoked — sometimes immediately.

What causes involuntary churn?

At the core of involuntary churn are failed payments. Payments fail for various reasons, so it’s important to look at why a payment failed and the customer churned:

Lost, stolen and expired card payment details

Approximately 10-14% of card payments fail globally, and expired card details are a common reason for that.

If a card is lost or stolen, and the owner cancels the card, those details will no longer work. And cards typically expire after three years, so if you’re collecting recurring payments from a repeat purchaser or subscriber, the card details they have supplied will eventually stop working.

Lack of funds

Sometimes, a lack of funds is unavoidable due to a customer’s circumstances, but other times it’s simply a matter of timing. The average person in the UK has 2.8 bank accounts, and people regularly use different accounts for different reasons.

If you try to collect a payment near the end of the month, for example, your customer may not have moved money across from the account they collect their monthly salary, and the payment will fail.

Strong customer authentication issues

Strong customer authentication (SCA) is an important fraud prevention process designed to ensure a customer is the rightful owner of a card and/or bank account. While SCA helps reduce card-not-present fraud, it can sometimes cause legitimate payments to fail.

For card payments, 3D Secure 2 (or 3DS2) was built to improve the SCA experience, but as many as 21% of payments aren’t completed when using 3DS2.

How do you calculate involuntary churn?

Involuntary churn is calculated in the same way as overall churn rates. Take the number of customers that involuntarily churned in a specific time period (we’ll use a month in this example), and the total number of customers at the beginning of that period:

(Number of customers who involuntarily churned in a given month / total customers at the start of the month) x 100 = customer churn rate

So if your subscription service has 1,000 customers at the beginning of August and 20 customers churn due to payment failure throughout August, the calculation looks like this:

(20 / 1,000) x 100 = 2%

If the company lost 50 subscribers to all types of churn, the overall churn rate would be 5%. You, therefore, also know that 2 out of 5 — or 40% — of all your churn is involuntary.

How do you benchmark involuntary churn?

Both voluntary and involuntary churn rates will vary depending on a variety of factors, including your industry, business type, geography, pricing and more. However, there are a few ways to evaluate whether your business is suffering from abnormally high churn.

Generally, an average churn rate sits at about 4.1%, consisting of 3% voluntary churn and 1% involuntary churn. Again, averages will vary depending on your market. For example, retailers can expect an even 1% involuntary churn rate, while travel and hospitality providers should expect an average of 1.4%.

Ways to reduce involuntary churn and increase customer retention

There are two ways to reduce involuntary churn. One way is to prevent payments from failing before churn happens. The other is to rectify a failed payment and reinstate your customer’s access to your service. Specific ways to reduce the likelihood of involuntary churn include:

Which payment methods are best for reducing involuntary churn?

When it comes to involuntary churn, not all payment methods are created equal. Here’s a comparison between a few major options:

Cards: while cards are well known and widely used, they’re often unreliable for managing churn, failing up to 14% of the time for a variety of reasons.

Direct debit: a popular alternative for subscription payments, direct debits are less likely to fail than cards. However, they take up to five days to settle, and setting up a direct debit mandate can be cumbersome for customers.

Manual bank transfer: benefitting from instant settlement and strong security features, manual bank transfers require users to manually enter data, increasing the risk of human error, payment failure and churn. This also requires extensive reconciliation processes for merchants, increasing operational costs.

Pay by bank: powered by open banking, Pay by bank represents an ideal payment method for cutting involuntary churn. It has low failure rates, baked- in SCA and seamless UX.

Use card account updaters

As card expiration is one of the most common reasons for failed payments, some card issuers offer account updaters. These programs automatically update the customer’s card details when one card expires and they are issued a new one.

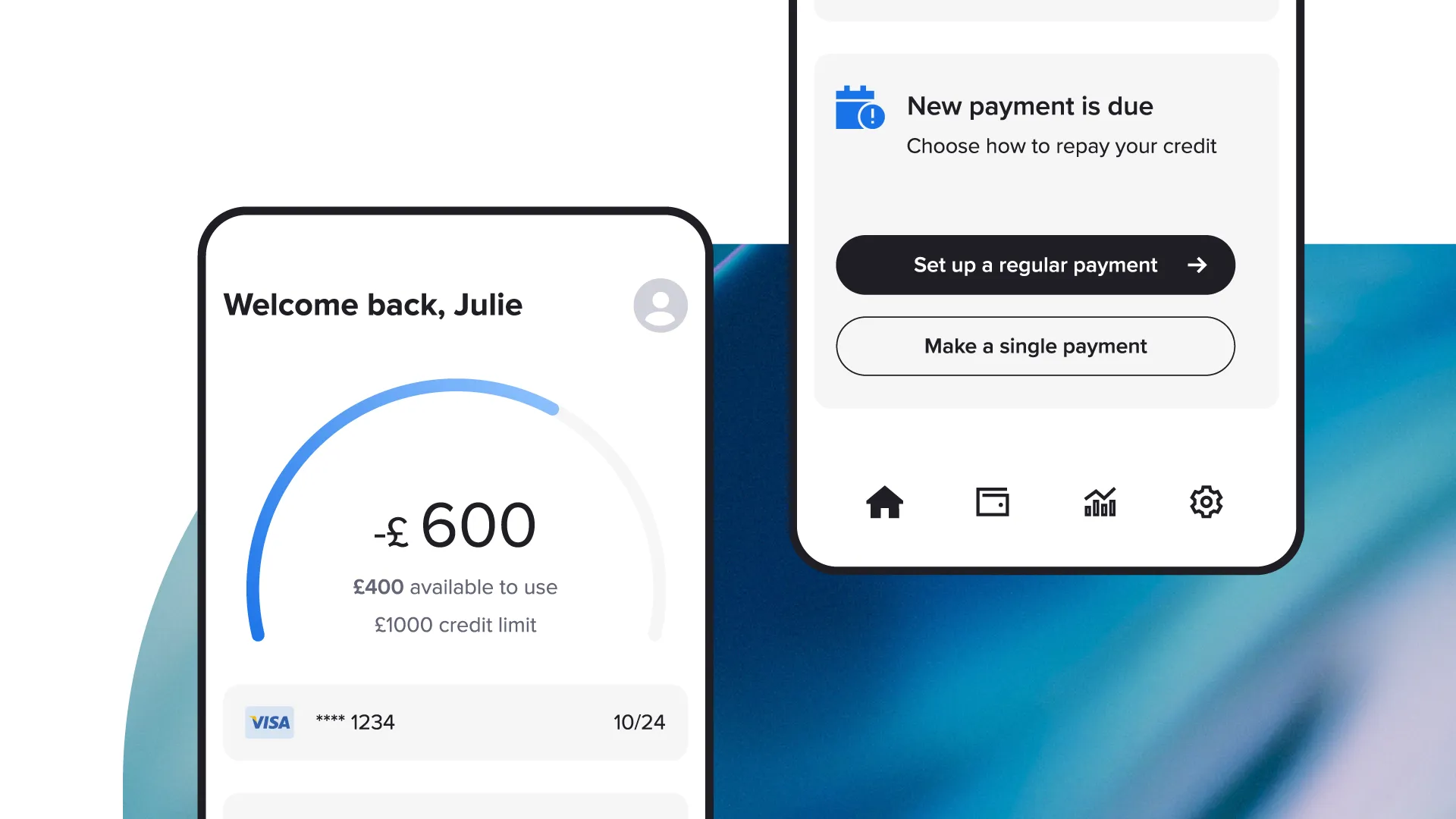

Send in-app or email reminders

If your customer needs to update expired or incorrect details, and you have not been able to update them using card account updaters, then it’s time to reach out to them directly. If your service or subscription is delivered via an app, in-app messages are a good way to reach out to that customer. Alternatively, a friendly reminder email could work.

Retry the payment

If a payment fails due to lack of funds or over-zealous fraud protection, the solution can be as straightforward as retrying the payment a few days after the initial attempt. Payment service providers (PSPs) like Stripe have ‘smart retry’ functionality, which uses machine learning to retry the payment at the optimal time.

Remember, even if a payment does fail, don’t remove your customer’s access to their service or subscription immediately. Doing so could accelerate the involuntary churn, as it could prompt them to search for an alternative from one of your competitors.

Can Pay by bank help prevent involuntary churn?

In short: yes. Using open banking technology, Pay by bank from TrueLayer facilitates one-time payments directly from customers’ bank accounts. With no card details to share and authentication seamlessly integrated, they reduce payment failures and churn alike.

TrueLayer can also help prevent involuntary churn through recurring payments. With variable recurring payments (VRPs), customers can set up regular payments to merchants directly from their own bank accounts. Initially limited to moving money between two accounts belonging to the same person, VRPs can also be used for commercial purposes, allowing businesses to take recurring payments for utility bills, subscriptions and more.

Along with providing real-time settlement, lower transaction costs than cards and the elimination of chargebacks, VRPs also reduce churn. VRPs don’t require re-authentication or re-authorisation, and since payment consent is tied to a bank account, they don’t expire until they’re revoked by you or the user.

Read our guide to VRPs to learn more about how they can help your business reduce involuntary churn.

Software engineering in the age of AI: run the mile you're in

eBay partners with TrueLayer to offer Pay by Bank at checkout

)

)

)

)

)