With every credit or debit card transaction, a company pays an interchange fee. The sum of this fee varies according to various factors, including the card scheme used (like Mastercard or Visa), if it’s a domestic or international transaction, as well as whether or not the payment is made face-to-face or online.

In this post, we’ll take you through exactly what interchange fees involve, how much it can cost you, as well as how alternative payment methods can help you reduce payment-related fees and costs.

What are interchange fees?

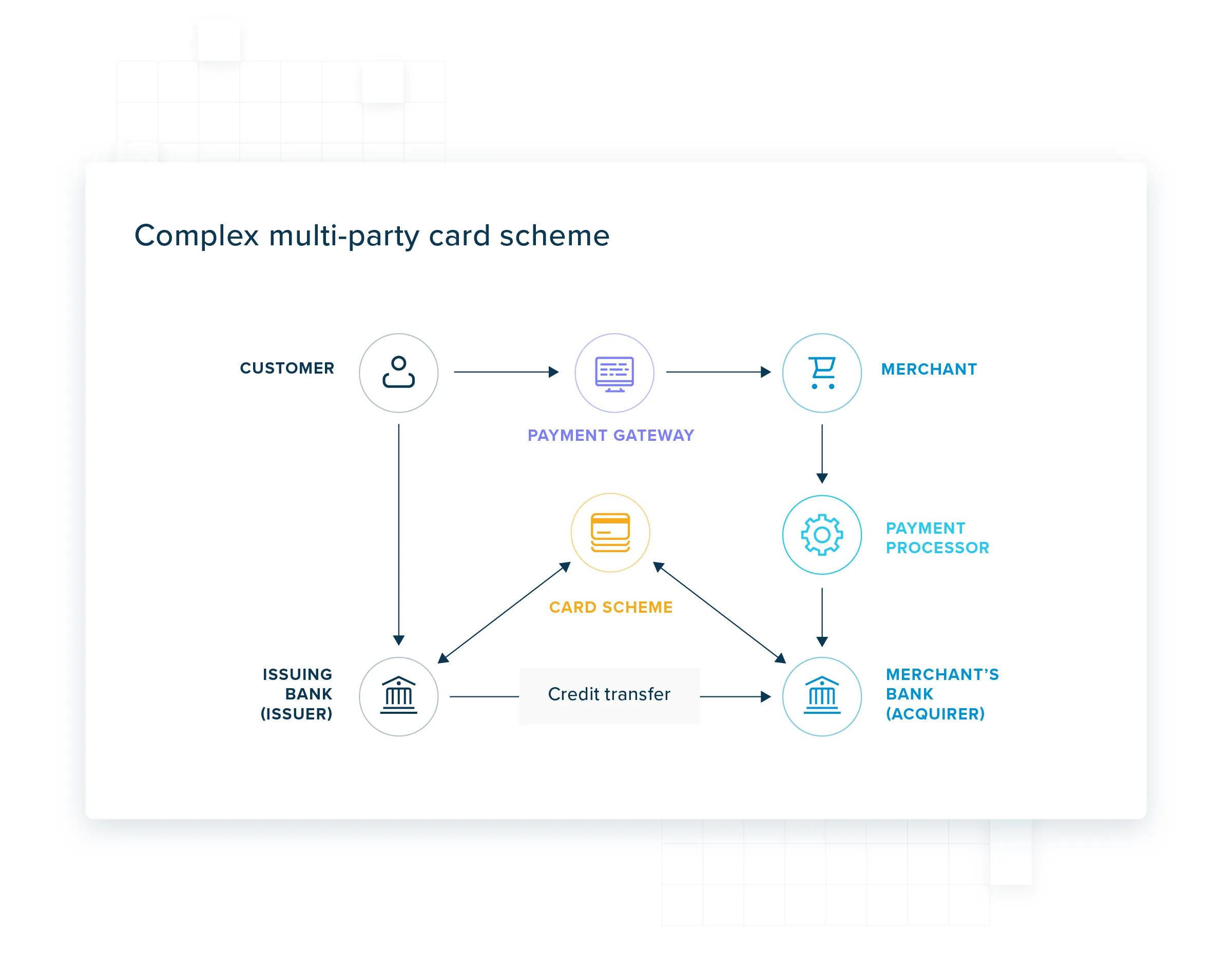

Every time a card transaction is made, the merchant pays an interchange fee to their card acquirer, who then passes this on to the card schemes, who in turn pass it on to the card issuer.

Accurate updates for interchange fees can be found on a card scheme’s website (Visa, Mastercard), but the average fee is approximately 0.2% for debit cards and 0.3% credit cards for each domestic transaction in the UK, as well as all domestic transactions and intra-regional transactions within European Economic Area (EEA) Countries.

In addition to interchange fees, card payments involve several other card processing fees:

Acquirer markup: fees charged by the acquirer — the merchant’s bank — for carrying out the service of acquiring funds from consumers. This is also known as the merchant service charge (MSC) or merchant discount rate (MDR).

Card scheme fees: fees charged by a card scheme (Mastercard, Visa, etc.) for using the card network.

Merchants may also face setup fees, online payment gateway fees for hosted checkout pages, chargeback fees and many more.

Why do merchants have to pay interchange fees?

Interchange fees are intended to cover the various costs linked to accepting, processing and verifying card transactions. Interchange fees effectively create a revenue stream for issuers, allowing them to provide secure and innovative card products to consumers whilst also ensuring merchants can receive payments from anywhere in the world. Interchange fees also cover some of the cost of fraud protection on the issuer’s side, as well as providing a smooth buying experience for customers.

Card schemes argue that interchange fees are also necessary to avoid banks passing on the cost of processing card payments to customers, as well as contributing towards future innovation and development of card payments.

Can merchants pass on interchange fees to customers?

No. UK companies used to be able to pass on the cost of card payment processing to their customers, but the rules changed in 2018. It’s now illegal for businesses to offset processing fees with surcharges added at the checkout stage.

How are interchange fees calculated?

The way Interchange fees are calculated is largely based on where a merchant is located and where the issuing bank is.

Interchange fees in Europe have been strictly regulated by the EU since 2015 to be 0.2% for consumer debit and 0.3% for consumer credit cards for domestic transactions in the UK and in the EEA, as well as for transactions that happen between two EEA merchants, otherwise known as Intra-regional. The EEA includes all countries in the EU, as well as Iceland, Liechtenstein and Norway. Notably, Switzerland isn’t part of the EEA

Transactions that happen between the rest of the world (including the UK, post-Brexit) and the EEA are called interregional transactions. Transactions between two non-EEA countries are also considered interregional and are typically the most expensive for merchants.

Importantly, as long as the EEA is one party to the transaction, the interchange fee is capped at 1.15% for debit cards and 1.5% for credit cards. In some non-European markets interchange is even higher if the transaction is non-secure, if there is no 3D Secure (3DS) technology used, for example, or if there is no CVV (the three-digit number found on the back of most cards).

Business and corporate cards are also charged at a higher rate than consumer cards, even within the UK.

Usually, interchange fees are charged as a percentage of the sales price but sometimes there is also an additional flat fee. Exact fees can be found on the relevant card scheme’s websites. Mastercard domestic interchange fees, for instance, range from 0.7-1.9% with each commercial card transaction.

Interchange fees are updated regularly. Visa and Mastercard both update their rates in April and October of every year.

What can affect interchange fees?

As mentioned above, interchange fees will vary depending on where the card issuing bank and the merchant are located in relation to a transaction, whether a debit card or credit card is used and if it’s a consumer or commercial card that is used to make the payment.

Another thing to bear in mind when it comes to interchange fees is that they are different for international card-present (CP) transactions and card-not-present (CNP) transactions. CNP transactions are those that take place online, over the phone or by post. For instance, with Visa Consumer Credit, fees increase from 0.3% with CP transactions, to a much higher 1.5% with CNP transactions if the merchant was in the EEA but the card used was issued outside the EEA.

There will also be a difference between commercial card and consumer interchange fees. Typically, commercial cards will come with higher fees than consumer cards. With Mastercard, for example, a contactless consumer credit payment incurs a fee of 0.3% of the transaction value, whereas a commercial contactless payment will incur a 1.5% fee.

How can merchants reduce interchange fees?

Interchange fees, as well as other card processing fees, occur only when accepting payments by credit or debit card. The complex network of parties involved in every card transaction results in at least seven different service providers all taking their cut of every transaction. Interchange fees are non-negotiable by merchants.

One way to reduce interchange fees is to look at adding more payment options to your checkout, which don’t incur interchange fees. They will, of course, still incur fees, but can be much more cost effective than card payments.

One alternative to card payments are open banking payments, often referred to as instant bank transfers at checkout. With open banking, the payment process is streamlined. As funds are directly moved from the customer’s bank into the merchant account, there is no third party network involved — effectively eliminating interchange fees.

With open banking, businesses also eliminate chargebacks entirely. And with instant settlement, payments are faster and easier than they would be with cards. Strong customer authentication (SCA) is also baked into the payment experience, reducing the likelihood of fraud dramatically.

Open banking recently reached the milestone of 6 million users in the UK, with over 7 million payments made every single month. Read our guide to open banking to find out more about how it can help you build a more cost-effective payment experience.

3 tipping points for change within ecommerce payment experiences

How to reduce ecommerce cart abandonment

)

)

)

)

)

)