For decades, increasingly higher card acceptance fees have created headaches for retailers. Credit and debit cards were designed for an analogue age: as the economy has increasingly moved online the challenges associated with them have only accelerated, with merchants and consumers both losing out as a result.

Alongside fees, the higher rates of fraud and chargebacks which accompany credit and debit cards also hit merchants’ revenue. At the same time, the slow, clunky nature of card payments, exacerbated by poor implementation of strong customer authentication (SCA) rules, mean that all too often customers end up abandoning before they’ve completed a purchase, leading to lower conversion rates.

Regulators know this and have — understandably — had retailers venting their frustration on the unfairness of the current system. Mastercard's European president recently defended the fees they charge merchants, but the entire payment model is currently in the crosshairs of the Payments Systems Regulator (PSR).

Fees have continued to grow over the past few years, and they increased sharply in the wake of Brexit. In February, the PSR announced that it will be formally reviewing the market to identify ways of promoting more effective competition. As part of this work, it has indicated that open banking is one way of creating competitive constraints and giving retailers and consumers more choice. This is a welcome step.

Who makes money in card payments?

Every time a card transaction is made, the merchant pays an interchange fee to their card acquirer, who then passes this on to the card schemes, who in turn pass it on to the bank who issued the card.

Interchange fees are intended to cover the various costs linked to accepting, processing and verifying card transactions. The fees effectively create a revenue stream for issuing banks, allowing them to provide secure and innovative card products to consumers whilst also ensuring merchants can receive payments from anywhere in the world.

Interchange fees are capped through regulations in the UK and Europe. However, interchange is not the only card acceptance cost. There are also fees paid to the card acquirer, the scheme, authorisation fees, PCI compliance fees and chargeback fees (as we explain in our future of ecommerce report).

Although the intention of Interchange fee regulation was to reduce costs for merchants, the combination of fees means merchants are still paying a high price for card acceptance. The alternative to further interchange caps is to introduce more competition, through alternatives like open banking payments.

Do banks lose out with open banking payments?

The original competition remedy basis for open banking prohibited banks from charging third party providers, like TrueLayer, for initiating payments. This ‘free access’ has been a huge boost for competition, reducing barriers to entry for fintechs, resulting in many new products and services being developed for consumers and businesses.

However, there is acknowledgement, for example in the recent Joint Regulatory Oversight Committee (JROC) report, that a new economically sustainable phase of open banking is needed to allow the ecosystem to scale. In practice, this means the development of commercial APIs, which banks would charge for, creating a similar revenue stream to interchange.

Open banking + interchange = win win?

One advantage of open banking under the current regulatory framework has been its low cost. This can be explained partly by the fact that there are no fees currently paid to the bank.

But it is also because open banking uses technology to cut out a number of other layers in the payment chain, such as acquirers and card schemes.

Open banking payments avoid specific card fees such authorisation fees, chargeback fees and fees for compliance.

The inherent security of open banking also reduces instances of fraud, which generally add to the cost of card payments.

The efficiency of open banking payments means that even where banks are remunerated for their part in the initiation of payments, there can still be cost savings for merchants versus card payments. A win-win for banks and merchants.

A new kind of payments network

By working closely with banks on commercial models for open banking, TrueLayer is pioneering the sustainable economic model proposed by JROC.

Our work on a commercial model for variable recurring payments (VRPs) is a first step in this direction. Through continued engagement and partnership, we believe we can deliver real value for banks, retailers and consumers.

As open banking networks like ours develop further, they’ll exist alongside cards — the aim being to provide businesses and consumers with greater choice about how they pay.

Software engineering in the age of AI: run the mile you're in

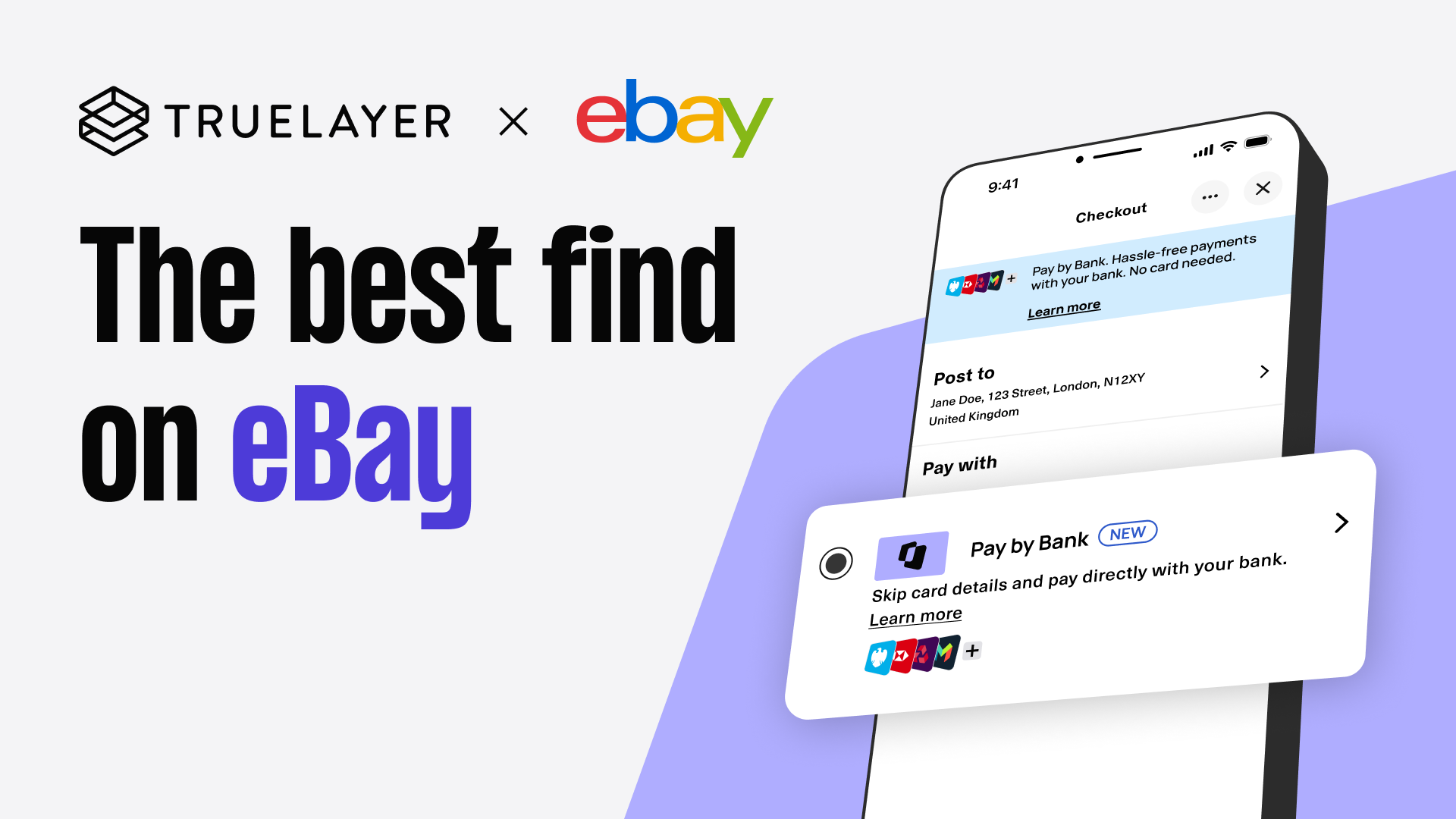

eBay partners with TrueLayer to offer Pay by Bank at checkout

)

)

)

)

)

)

)