The way we pay online has changed. Shoppers want — or demand — their checkout experience to be a seamless part of the overall shopping experience. It needs to be instant, simple and secure. Fail to meet those expectations, and your customers are willing to shop elsewhere.

Yet compare that to the default payment method we’re so used to seeing at checkout. Card payments. While efforts have been made to optimise their experience at checkout, they are — at heart — an offline payment method retrofitted to the world of ecommerce.

Lengthy online checkout processes, such as the need to input lots of payment details, as well as over-zealous SCA, are conversion killers. And card-not-present fraud is rife. On the merchant side of the equation, card payments mean high card fees, while slow settlement times can affect your cash flow.

But card payments are everywhere. What can you use instead of, or in addition to, cards?

Hello Pay by bank

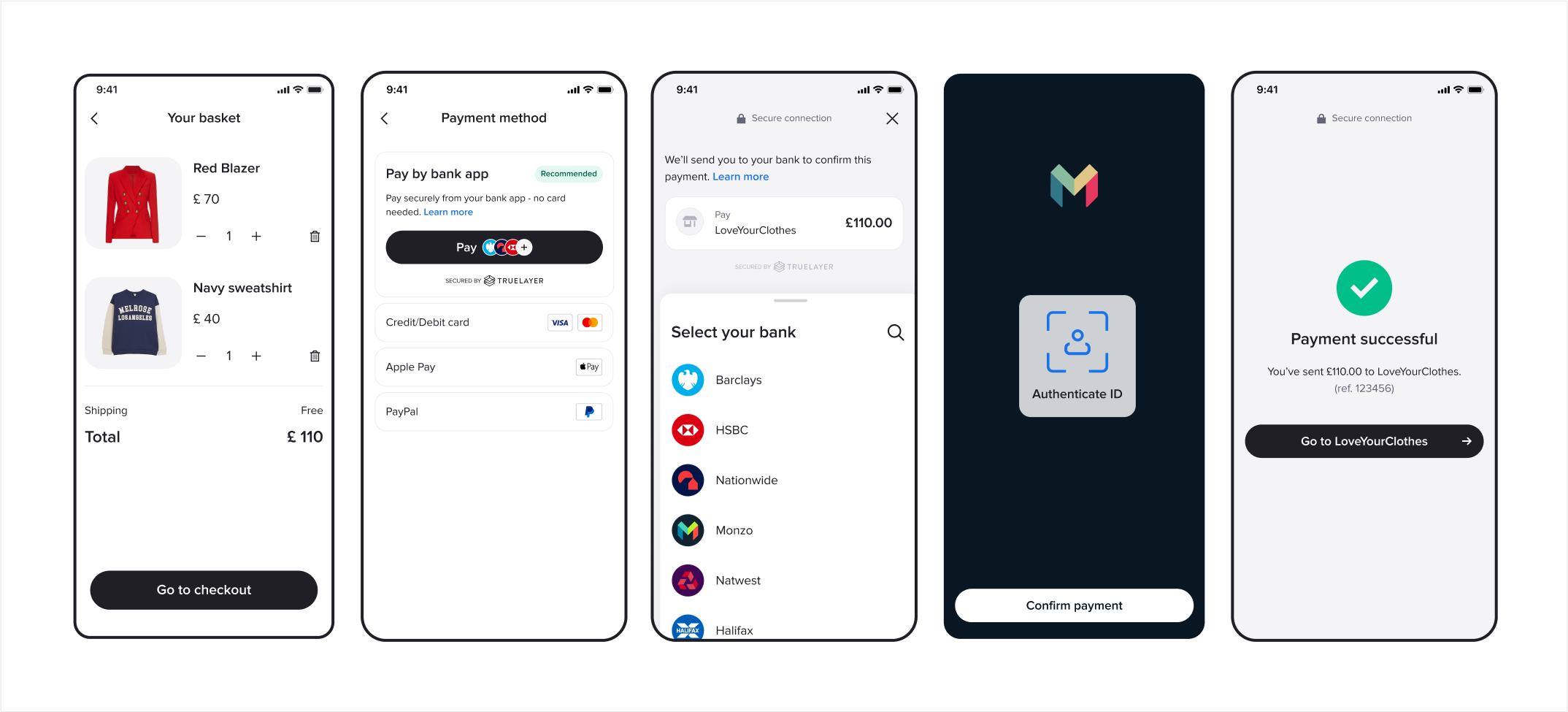

Pay by bank — also known as instant bank payments — is a payment method that’s powered by open banking. Pay by bank lets retailers accept and send money online directly from one account to another, quickly, simply and securely, completely free of card payment rails.

Open banking payments, the technology powering Pay by bank, is increasingly popular among UK consumers, with 18 million successful payments taking place in June.

But to make the most of Pay by bank, you need a provider — one who can help you design and integrate a high–converting payment experience at checkout. That’s where TrueLayer comes in…

5 reasons forward-thinking brands are partnering with TrueLayer to add pay by bank to their checkout

Some of the UK and Europe’s leading brands, including those in online retail, are already using TrueLayer to collect via Pay by bank. Topps Tiles, cashback app JamDoughnut, Citizen Ticket, Revolut, William Hill, Watches of Mayfair and many more brands already work with TrueLayer to optimise their checkouts and payment operations.

TrueLayer customer stories

But precisely how and why did these brands choose TrueLayer?

1. Increase sales at checkout by reducing friction

87% of consumers are frustrated with their checkout experiences, while 73% say that slow or frustrating payments will make them abandon their purchase. Shoppers won’t put up with friction when trying to pay, and friction can come in many guises, whether it’s a poor 3DS implementation on card payments or unexpected payment failures.

Reduce cart abandonment and increase conversion

TrueLayer’s Pay by bank removes manual data entry and uses seamless biometric or face ID authentication. Unlike card-based SCA, which may also use similar authentication, open-banking powered Pay by bank has had SCA baked in since inception, which means a journey of ~5-7 screens, rather than 10+ which is typical for card payments. TrueLayer payments have, on average, a 13% higher payment acceptance rate than cards.

Cashback app Jam Doughnut allows customers to earn cashback or reward points with thousands of UK businesses. JamDoughnut has large payment volumes, handling one transaction every single second, so needs a consistently reliable payment method. Using TrueLayer, Jam Doughnut has achieved a 90% end-to-end payment conversion rate, with over 90% of all Jam Doughnut shoppers using Pay by bank at checkout.

Don’t leave a penny on the table

As well as operating as a standalone payment method at checkout, Truelayer's Pay by bank can also be used as a method for recovering online card payments, where the consumer dropped out of the authentication journey or the payment was falsely declined by 3D Secure.

This can be done by simply offering the customer the option to retry the payment using Pay by bank, or recovering checkout abandonment by using TrueLayer's payment links feature.

2. Stand out from the crowd with instant refunds

Quick refunds have become table stakes for shoppers. 81% of consumers expect refunds in one week or less, while 2 in 3 customers choose to shop with a brand based partially on refund times. Refunds can also help build long-term loyalty.

Add instant refunds to your shopping experience

In addition to collecting instant payments, TrueLayer can help you offer instant refunds to your customers. Your shopper simply selects the item they want refunded, checks their pre-linked account details on a confirmation screen, and TrueLayer can instantly send them the money. Plus, streamline the manual operations of refunds, which otherwise add additional costs and further frustrate your customers.

3. Lower operating costs and payment fees

Card payments have upwards of seven intermediaries for each transaction, with each taking their cut from a payment, it can be costly to rely solely on cards. You will likely need to pay merchant service charges (MSC), interchange fees, card-not-present transaction fees, gateway fees, authorisation fees and more.

These payment costs are compounded by the operational costs associated with managing the integration of these payment methods, as well as the internal manual workload necessary for managing features related to card payments, including chargebacks and refunds.

Fewer intermediaries, lower operational costs, fewer fees

On the other hand, Pay by bank only involves the customer’s bank (issuing bank), the open banking provider (TrueLayer), and the merchant bank (acquirer). This means the total fees of operating Pay by bank using TrueLayer will typically be lower. Plus, by reducing the likelihood of payment fraud and chargeback requests, you can reduce operational costs as well.

No more chargeback challenges

With card payments, chargebacks are a huge challenge facing merchants. According to the JUSTT 2023 report on chargebacks, 77% of UK shoppers filed at least one chargeback in 2023. Worryingly, 28% said they filed six or more.

Pay by bank is a true alternative to card payments, eliminating the chargeback process completely. Customers still benefit from relevant consumer rights and protections to make sure their purchases are safe and secure.

Since launching TrueLayer’s Pay by bank, Citizen Ticket has seen a saving of 40% in merchant banking fees, while decreasing its rate of chargebacks by 96%.

“Progressive open banking APIs have changed the game with the payments industry. Fees have gotten cheaper because it’s bank to bank. There are fewer people taking a small percentage of that fee.

Harry Boisseau, CEO, Citizen Ticket

“Progressive open banking APIs have changed the game with the payments industry. Fees have gotten cheaper because it’s bank to bank. There are fewer people taking a small percentage of that fee.” — Harry Boisseau, CEO, Citizen Ticket

4. Reduce card scheme dependency

While card payments are still popular, forward-thinking merchants are starting to diversify their checkout, by offering more payment methods to shoppers. And that’s a critical step for online retailers, especially when we’ve just witnessed the Crowdstrike outage that inadvertently brought down the ability for many brands to take card payments.

Build resilience with a best-in-class checkout

Diversity means resilience; resilience that you’ll still be able to collect payments if something changes unexpectedly, whether that’s an IT outage taking an entire payment method offline or card networks increasing their fees.

TrueLayer can act as part of a best-in-class checkout that caters to individual payment preference, while offering security that you’ll have some form of working payment method even when a crisis strikes.

Europe-wide coverage

A true alternative to cards needs to be widely available to your entire customer base. TrueLayer is live across 21 European markets and 30% of all open banking traffic in UK, Ireland, France, and Spain is handled by TrueLayer.

5. Flexible integration options to suit every brand

As powerful as Pay by bank can be, without the right partner or provider, you won’t be able to fully realise the benefits of open banking-powered payments. TrueLayer has integration options to suit whatever balance of resources you have and flexibility you need. Integrating with TrueLayer can look like:

Direct API: whitelabel TrueLayer’s API to give total control and a fully customisable checkout experience.

Ecommerce plugins: seamless integrations for some of the world’s most popular ecommerce platforms — including Magento, Shopify and woocommerce, means merchants can start accepting payments using TrueLayer in a matter of minutes.

Hosted payment pages: adding Pay by bank easily with prebuilt UIs that speed up the integration process.

Mobile SDKs and embedded payment pages: start collecting payments using prebuilt UIs, which are embedded directly into your checkout page.

Want to find out more about integrating with TrueLayer, and which option is right for you? Book a demo and speak to one of the team.

Book a demo and find out how TrueLayer can help you add Pay by bank to your checkout

Whether you want to maximise conversion, eliminate unnecessary costs, build loyalty and customer LTV or simply offer another payment option to your customers, TrueLayer can help. Book a demo with one of our payment experts.

TrueLayer completes acquisition of Zimpler

Why your iGaming payment stack needs to work as one

)

)

)

)

)

)

)