Who is this guide for?

This guide is for anyone keen to understand more about ecommerce payments. Heads of ecommerce and heads of payments at online retail businesses, travel brands, events and ticketing operators and food/grocery delivery brands will find this particularly relevant.

Where are you on the product adoption curve?

Do you think of yourself or your brand as an innovator, early adopter, mainstream, or laggard? I’d wager it’s one of the first two. And I’m very confident it’s not the last. These “categories” come from the product adoption curve, a framework that shows how different sets of buyers interact with a new technology, product or innovation.

While a select few of us will be innovators (roughly 2.5% of people/businesses), I think this audience will most likely fall into the early adopters category. Does the following definition sound like your brand — or more importantly — how you want the world to think about your brand?

Early adopters represent 13.5% of the market. They’re solving a real problem that they’re keenly aware of. They’re often thought leaders in their space and look for disruptive innovation. They are highly demanding in product features and performance.

There is, of course, nothing wrong with being in the majority. But by the time an innovation reaches the majority, any first-mover advantages will have been lost. Early adopters are best-placed to influence advancements in any new innovation, compared to the majority that will get the “mass-produced” version.

So why am I telling you about the product adoption curve?

Because you’ve got to decide on the right time to adopt open banking payments. Without a pressing need, you’re unlikely to invest in a new payment method.

For ecommerce businesses, there are six key scenarios we’ve identified, where putting open banking payments on your roadmap isn’t just an interesting idea, but a call to action:

1. You’ve been waiting for customers to adopt and trust instant bank payments

There’s a reason this one comes first. All other benefits of instant bank payments are undermined if your customers don’t understand or won’t use the payment method. Helpfully, instant bank payments are growing in popularity. As of November 2023, 11% of the UK population are active users of open banking (as are 17% of small businesses). While there is still some way to go before the majority of the population become active users, that growth needs to be compounded by merchants offering it in the first place.

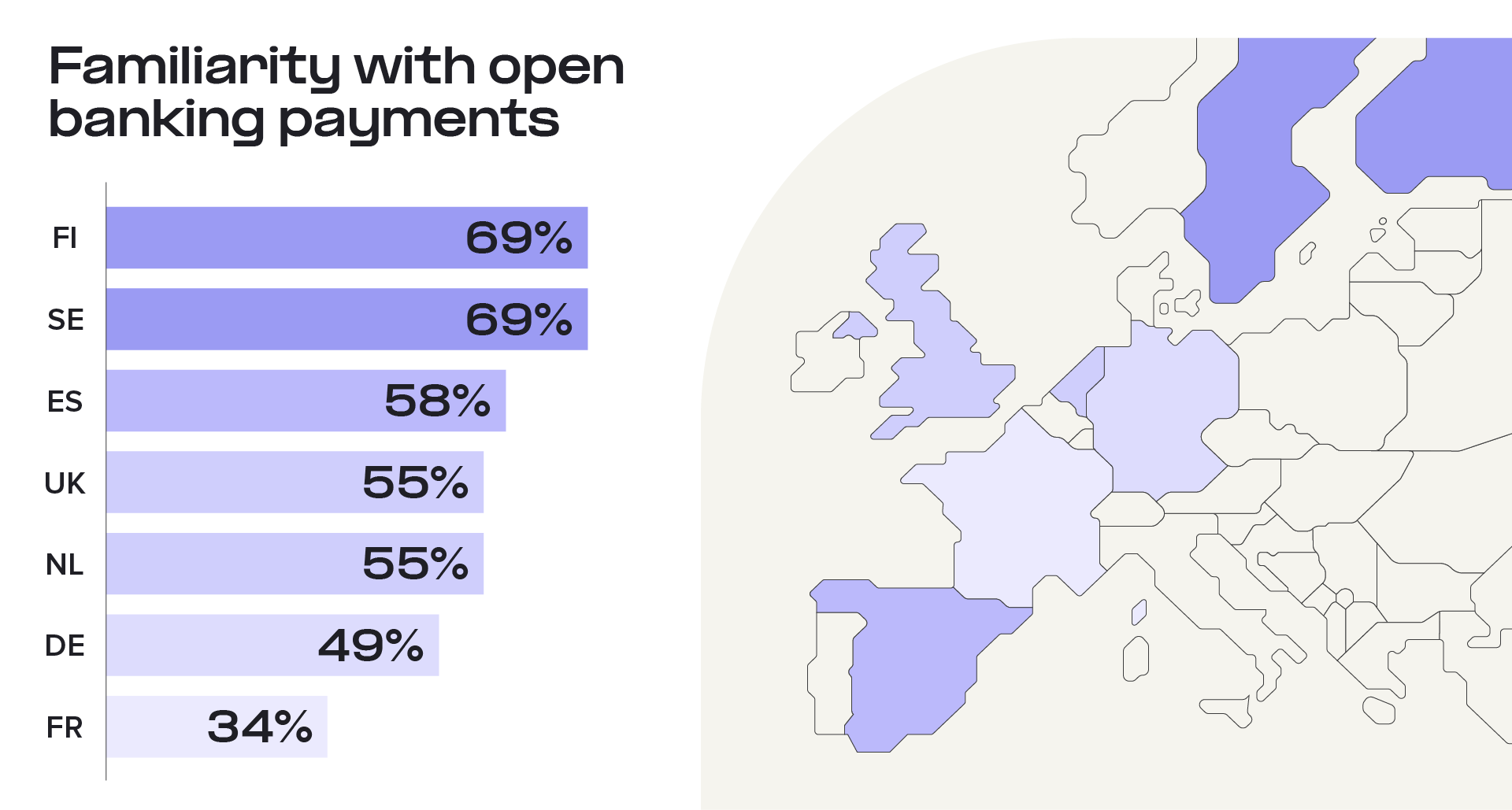

From research conducted by TrueLayer in late 2022, 55% of UK consumers are familiar with open banking as a payment method, and 61% say ‘instant bank payments’ — a common customer-facing name — sound trustworthy. The picture across Europe is similar, with several major markets seeing significant familiarity with open banking payments.

When should you act?

A lot of ecommerce brands have already begun to act, with 3 in 4 ecommerce merchants saying open banking is part of their long-term strategy. It’s difficult to pinpoint the exact moment for you to consider open banking payments, but with over 12 million payments taking place every month in the UK, consumers are becoming increasingly willing to try this new payment method, especially if positioned and explained well at checkout.

2. Your customers need to enter too many details at checkout

While we’re seeing a constant rise in online shopping, consumers also increasingly expect payment experiences that reduce the amount of manual input they need to worry about at checkout, while also feeling the payment method is secure. Typing in card payment details, including the 16-digit card number, expiry date and CVV code — along with any authentication measures — are a prime example of where your customers could get frustrated.

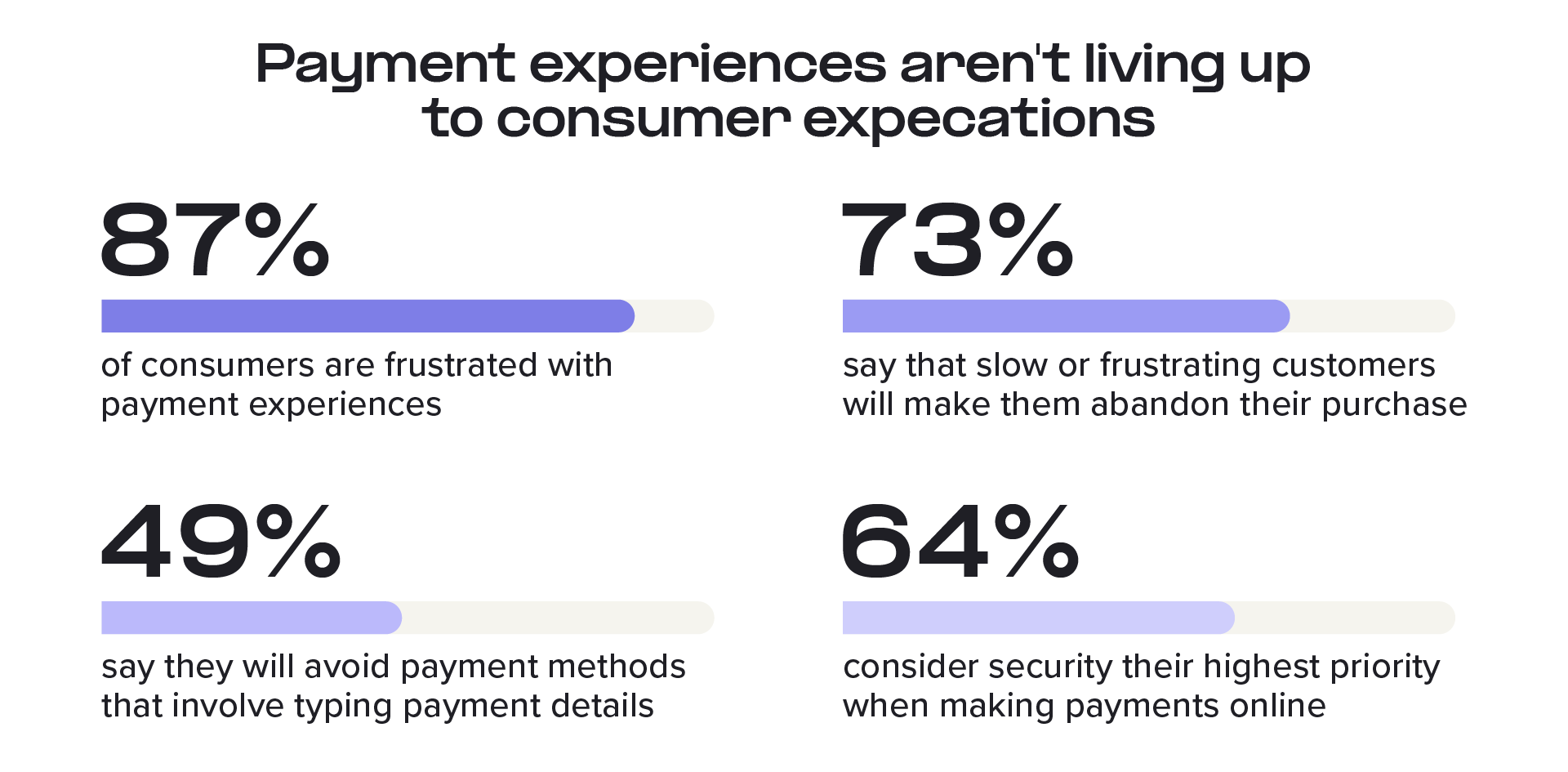

They’re not afraid to take their business elsewhere if your payment experience doesn’t measure up. In a survey of more than 4,000 consumers we found that payment experiences aren't living up to consumer expectations.

In short, a fast, smooth and secure payment experience is the key to winning customers, fostering loyalty and — ultimately — growing your business. Unfortunately, most brands don’t measure up to consumer expectations. Do you know how your consumers view your payment journey? And how many are dropping off before they ever make a payment?

When should you act?

The most straightforward ways to find out if your payment experience is falling short of consumer demands is to:

Ask your customers about their experiences

Analyse your conversion rate over time

For example, 56% of merchants have seen a decrease in conversion rates because of strong customer authentication (SCA), which — when implemented for card payments — can add significant friction to the payment journey. If your only payment option is a card payment, you’re likely losing legitimate transactions.

Open banking payments strike the balance of security and convenience. They’re inherently secure and the user flows have been refined to make it easy for customers to pay this way. They typically involve 5-7 steps to make a payment compared with 10+ on card.

3. You’re having trouble with rising chargebacks

Chargebacks — the reversal of a debit or credit card payment — is a growing concern for online commerce brands. Unlike normal refunds, where the customer is the party requesting a refund, chargebacks result in the customer’s bank taking the money on the customer’s behalf.

According to the JUSTT 2023 report on chargebacks, 77% of UK shoppers filed at least one chargeback in 2023. Worryingly, 28% said they filed six or more. Estimates from Equifax show that the costs a business incurs from a chargeback requires them to make that sale eight times over to recoup those costs.

And this is before we even get to chargeback fraud (or friendly fraud) where a shopper claims a chargeback without proper reason to do so. A staggering 86% of chargebacks are probable cases of friendly fraud.

When should you act?

The UK’s chargeback rate is 0.52%, meaning approximately 1 in every 200 payments will result in a chargeback. Is your business’ chargeback rate higher than that average? Even with chargeback protection — for example, using Stripe — merchants have an annual limit of £20,000. Merchants processing high volumes of payments can quickly reach that limit. Merchants with high average order value (£500+) spend an average of £235,000 each year on chargebacks.

In short, if your chargeback rates are higher than the average, steadily increasing, or costing your business a considerable amount of money to settle or dispute, then getting an alternative payment method on your roadmap is a must. Instant bank payments aren’t built on card payment rails, so don’t include chargebacks as part of the purchasing journey. Customers still benefit from relevant consumer rights and protections to make sure their purchases are safe and secure.

4. You need to offer a better refund experience

One way to reduce chargeback claims is to make sure your refund process is clear, simple and quick. It’s not a great leap to recognise that if a consumer knows they can make a refund easily, they’re less likely to start a chargeback claim if their purchase didn’t match their expectations.

And refunds are now basically table stakes. 81% of consumers expect refunds in one week or less. 2 in 3 customers at least partially choose to shop with a brand based on refund times.

For many brands, including fashion brands — and even food and grocery delivery — a seamless refund experience is vital to their operations. And with card payment refunds taking up to five days, you can no longer rely on this singular payment method.

When should you act?

If the promise of quick and simple refunds are key to your brand promise, then the time to act is now. Consider what payment methods can improve your refund experience. Instant bank payments — when combined with additional functionality, like TrueLayer Payouts — can make refunds automatically happen in real-time.

Even if you can live with your customers being frustrated by your refunds process (and if you can, I urge you to rethink), there’s still a lot to gain by removing unnecessary operational costs that come with a manual refund process.

5. Card fees and operational costs are dragging you down

Why are card payments so expensive? It’s easy to paint the card networks as greedy goliaths that can charge what they want. But while Visa and Mastercard are both reportedly planning fee increases, it’s the amount of parties that are involved in each card transaction that add to that overall cost. There is the merchant service charge (MSC), interchange fee, card-not-present (CNP) transaction fees, minimum monthly service charges, payment gateway fees, authorisation fees, PCI compliance fees and more.

And that’s before you even get to associated costs, like chargeback fees, administrative costs, lost revenue from failed payments and churn, etc.

In an economic downturn, making sure your payment operations are as cost-efficient as possible should be a top priority.

When should you act?

As long as your new payment method will result in money saved, then now is as good a time as any to explore alternative options. While fees and costs are different for each merchant, the reason open banking payments are typically more cost-efficient is down to the much simpler model of parties involved in a transaction: the customer’s bank, the merchant’s bank and the open banking provider.

When you add in other advantages like the lack of a costly chargeback model, high payment acceptance and conversion rates (meaning less time chasing up failed payments and lost customers), and a seamless payment and refund experience that builds loyalty and customer lifetime value, open banking payments represent a strong option.

6. You want to be prepared for the future and be more resilient

You’ve probably heard the term ‘future-proofing’ a million times. It’s a nice, safe concept that makes big investments in technology seem like no-brainers. But what does it actually mean? And how do you know any decision will actually make your brand future proof? In online payments, the future is most likely a world where cards are no longer the default choice, where the customer and the merchant both have more choice.

At 2023’s Money2020, during a chat with TrueLayer CEO Francesco Simonecshi, Amazon’s Megan Bramlette, Director of North America & EU Payment Acceptance at Amazon, summed it up well: “My job is to ensure [Amazon] customers have all payment options that meet their needs. We want to do that in the most low cost, frictionless and easy-to-use way possible. Bank payments are a part of that revolution.”

Another way of thinking about future proofing your payments stack is resilience. Resilience is about reducing the likelihood that a single payment method, whether through fee hikes or prolonged downtime, can significantly impact your ability to convert customers and collect payments.

When should you act?

In this scenario, ‘acting’ is more about research. Where is your payment experience fragile? Do you rely on one payment method for all transactions? What would happen if the costs of managing that payment method suddenly increased?

Open banking payments are finding increasing adoption among consumers, and are a modern way to diversify your payment options at checkout.

Increase your payment resilience with open banking payments

How many of these scenarios are true for your brand? It’s possible it could be all six, but I’m confident that for most ecommerce businesses that rely on card payments for most of their transactions, at least two or three will ring true.

To find out more about how open banking payments can help you cater to customer expectations and build a best-in-class payment experience, book a demo with one of your payment experts.

Why your iGaming payment stack needs to work as one

We don’t need another Wero: building on Pay by Bank

)

)

)

)

)

)

)

)

)

)

)