What is customer churn rate and how do you calculate it?

Put simply, customer churn rate is the rate at which customers stop doing business with a company. Voluntary churn rate, where a customer opts out due to dissatisfaction accounts for 80% of overall churn. Involuntary churn rate, where a customer wants to use your service but is unable to (often down to payment issues), accounts for the remaining 20%.

For long-term success, retaining customers — and keeping churn low — is as important as winning new ones. So, while the average churn rate for B2C companies is 7%, and 5% for B2B brands, the goal is to keep your churn rate as low as possible.

One example of customer churn is a customer ending their paid membership with a subscription-based company. However, it’s also a key consideration for financial services apps and fintechs, as an ongoing relationship with engaged users is key to success.

What is the impact of customer churn?

Customer churn rate directly impacts profits and business growth. When a business has a high churn rate, that is to say, it is losing a significant portion of subscribers or customers on a regular basis, you can typically expect profits to be lower and growth to be stilted.

A high churn rate is a sign that customer satisfaction is low, or that customers are not reliably able to access your services. This means customer churn rate can be used as a tool of assessing whether a company needs to invest in improving customer experience.

How to calculate customer churn rate

For a simple customer churn rate calculation, you need the number of customers that churned in a specific time period (we’ll use a month in this example), and the total number of customers at the beginning of the period.

The calculation can be expressed by the following formula:

(Number of customers churned in a given month / total customers at the start of the month) x 100 = customer churn rate

As an example, imagine a subscription service has 2,000 customers at the beginning of January. 120 customers churn during January. Therefore, the calculation looks like this:

(120 / 2,000) x 100 = 6%

If the company starts February with 2,500 customers (having acquired 500 new customers during January), but lose 135 during February, then February’s customer churn rate would be:

(135 / 2,500) x 100 = 5.4%

While the business lost more customers in February, the larger existing customer base means the customer churn rate actually improved.

How to reduce customer churn

Naturally, you will want to keep customer churn to a minimum to maximise the lifetime value (LTV) of each of your customers. Below are some tips for preventing customer churn:

1. Determine causes for customer churn

Knowing the precise reasons why customers are churning can help you act to prevent it.

For example, a common reason customers may leave is because a competitor offering similar services has more appealing pricing. In fact, 91% of consumers are more likely to shop with brands that have the best offers. Matching your pricing with similar providers can help prevent customers from churning and using the services of other brands.

2. Provide enough support and information

Often, customers leave a company or stop using its services if they fail to understand how to get what they want from it. For example, if they find a site or app difficult to navigate, they will likely lose interest and opt out. An Accenture survey found that 48% of consumers will leave a website if they have a poor digital experience using it. Providing ample information and guidance can help prevent this and keep customers satisfied using your service.

Consider having a help box, offering guides to services via blog posts, or offering guided onboarding.

3. Learn the early signs that a customer is going to leave

Being able to know when a customer is on the fence or thinking about leaving means you can step in before that happens. Common signs are a lack of use or engagement with the service, or short and infrequent visits to the site or app. When you see this, you can step in by offering resources or deals to persuade them to re-engage and stay on board.

You may also be suffering from involuntary churn, where customers don’t intend to stop using your service but are unable to access them. Involuntary churn often happens because a customer is unable to make a payment for your service. Look out for repeat payment failures from the same customer as a sign of impending involuntary churn. This is a particular problem for payment methods like cards, where payment failure rates fall between 5 and 14%.

Advantages and limitations of using customer churn rate

While customer churn rate can be a good indication of customer retention and inform business success predictions, it doesn’t paint the full picture. There are advantages of using churn rate as an indicator of performance, as well as some limitations.

Advantages of using customer churn rate

A big advantage of customer churn rate is that it can highlight any issues with customer dissatisfaction. A high churn rate, as we’ve already discussed, indicates poor customer experience.

Analysing the reasons and causes of a high churn rate can help the company to make vital changes to improve customer retention. Customer churn rate, when measured regularly, will tell you if the changes you make have had the intended outcome.

Limitations of using customer churn rate

A limitation of churn rate is that it lumps all customers into one category, and doesn’t differentiate between different customer profiles, and whether or not the customers that are leaving are long-time users or have just started using your service.

It also ignores how much revenue a customer gives your business. If you are primarily losing high-value customers, then customer churn rate won’t give you the full picture. Revenue churn rate, which substitutes customers for revenue, is useful to add more context to your overall churn picture.

As well as not giving information about the profile of customers that are leaving, it also doesn’t shine any light on their reason for leaving. In order to improve churn rate, it’s imperative that you understand the causes of it.

What is a good churn rate?

At the very least, you want the growth rate to exceed your churn rate. However, this doesn’t account for high-growth businesses, where customer acquisition can mask a leaky customer base.

What is considered a good churn rate will also depend on the industry that your business operates within. The best way to know whether your churn rate is good is to compare it to your competitors. The average churn rate by industry is as follows:

Media/entertainment: 5.2%

Education: 9.6%

Business services: 6.4%

Consumer services: 7.5%

Consumer goods: 9.6%

SaaS 4.8%

Don’t let your payment experience be a reason for customer churn

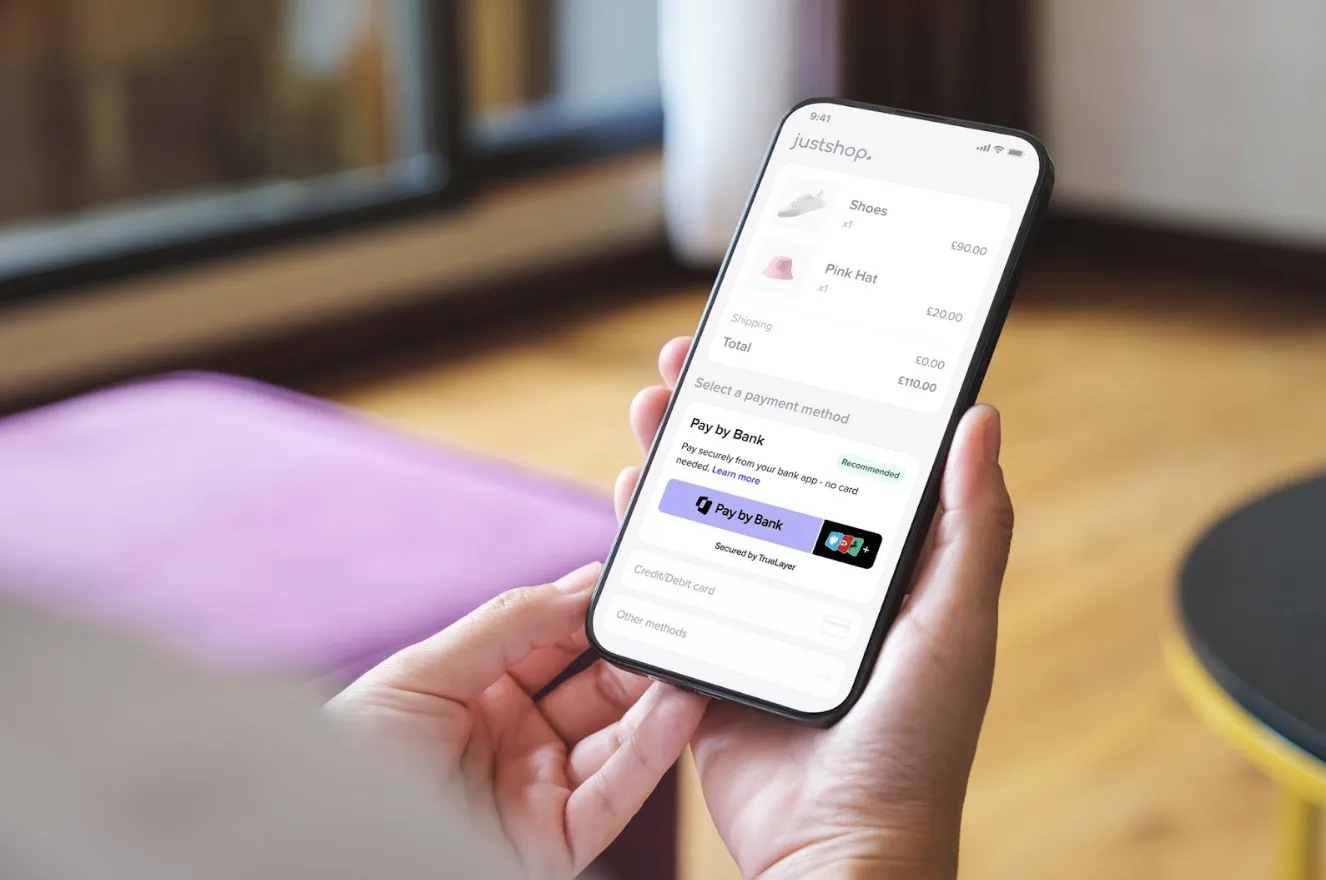

Involuntary churn accounts for 20% of all churn. Payment methods with poor conversion rates or high payment failure rates will only add to your rate of involuntary churn. Open banking payments, such as TrueLayer’s payments solution, can reach payment success rates of as high as 96.6%, and conversion rates 20% higher than card payments.

Find out more about open banking in our ultimate guide.

How does your business stack up on the Pay by bank value flywheel?

Payment incentives: the secret sauce in your Pay by Bank recipe

)

)

)

)

)