Growth in open banking shows online retailers the next big opportunity

While open banking payments (in the form of instant bank transfers) have found traction in industries like wealth management, iGaming, credit, lending and digital banking, most ecommerce businesses have yet to adopt this new payment option.

But is now the moment for more ecommerce brands to explore how open banking payments can help their business? With card payments struggling under legacy infrastructure, this article looks at why open banking payments have grown so rapidly in the last year, and how ecommerce businesses can benefit.

The findings and data in this article are from our recent future of ecommerce payments report. TrueLayer commissioned an independent research consultancy with extensive experience in payments, to better understand why open banking payments are particularly suited to challenge the dominance of cards.

Get your copy of the full report

Open banking payments have grown rapidly in the last 12 months

Open banking payments have been growing for a few years, but that growth has accelerated in the last year. For example, payments grew by 485% in the UK between August 2020 and August 2021, reaching almost 2.4 million successful payment initiations in a single month.

In addition to millions of payment initiations, almost 4 million people in the UK have now used open banking. On its current growth trajectory, 60% of the population will have used open banking in some form by September 2023.

So it’s clear open banking payments are beginning to enter the mainstream. They offer a strong alternative to the ubiquitous card networks. And as open banking users and successful payment initiations continue to surge, ecommerce businesses have a limited window of opportunity to join the most forward-thinking brands in shaping the future of open banking payments.

Ageing card infrastructure is highlighting the need for better alternative payment options

In 2017, debit card payments surpassed cash as the most common payment method across all purchases in the UK, with 15.8 billion debit card payments in the UK in 2020 alone. In short, card payments are popular.

And it’s not really surprising, because consumers generally recognise and trust them, and most ecommerce businesses accept them (often, cards are the only payment method that ecommerce businesses accept).

Despite their popularity, card payments are built on an infrastructure that was designed for the physical world, and as online retail payments continue to grow, this creates multiple problems for ecommerce brands, including:

High cost and fees

Card payments involve merchant charges of approximately 1.9% (for merchants with a turnover of between £380,000 and £1 million). Other fees include authorisation fees (1-3p per transaction), card terminal hire fees (£14-24 per month), PCI compliance costs (£2.50-5.50 per month) and chargeback fees (£15-25 per chargeback request).

Card-not-present fraud

Card-not-present fraud happens when a person attempts to make a card purchase when they do not possess the physical card. Card-not-present fraud in ecommerce is now the single-largest category of card fraud in the UK, accounting for 79% of all card fraud losses in 2020.

Strong customer authentication (SCA)

While SCA reduces the likelihood of fraud, merchants that have implemented it into their card payment journeys have typically seen a negative impact on conversions. As many as 14% of browser-based card transactions, and a quarter of app-based ones, were discouraged by SCA.

Chargebacks

Chargeback rules within card schemes were introduced as a means of fixing onboarding incentives and dispute resolution. However, schemes charge steep fees for processing chargebacks, often £15-25 but it can be as high as £150. And businesses that suffer high rates of chargebacks face having card-acquiring contracts cancelled, even if those claims are illegitimate or fraudulent.

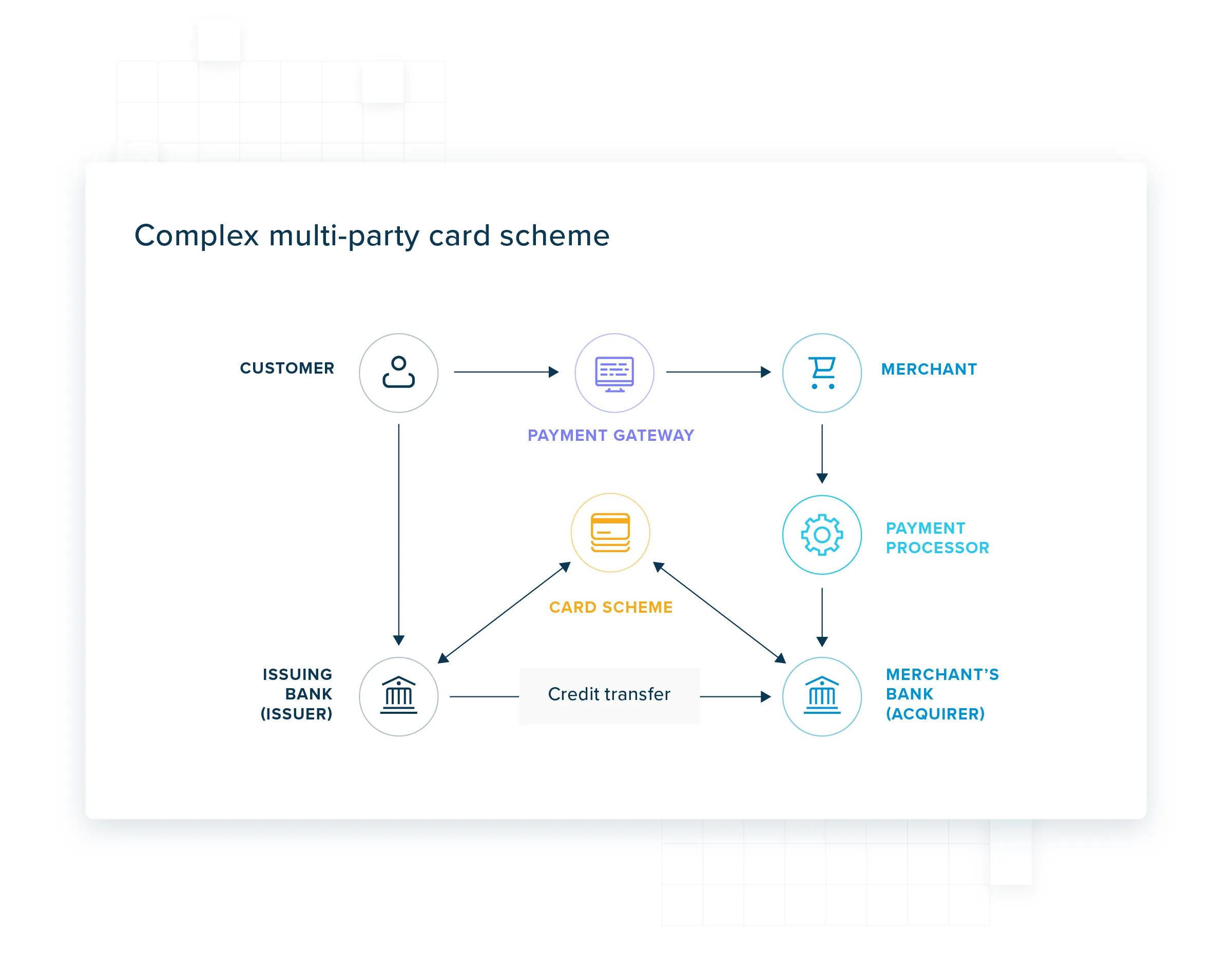

Complex multi-card schemes

There are seven parties involved in every single card transaction, including the customer, the payment gateway, the card scheme, the payment processor, the merchant’s bank (acquirer), the merchant itself, and the customer’s bank (issuer). This complex web of businesses adds further costs and resources to processing card payments.

Open banking directly addresses the problems caused by card payments

Part of the reason open banking payments have grown so much in recent years is that the benefits they offer solve many of the problems caused by relying solely on card payments.

For example, open banking payments offer lower and more predictable merchant processing fees than card acquirers do. TrueLayer’s average fee is less than 1% of the transaction value. Open banking payments don’t involve additional costs that card payments typically do, such as card terminal hire, PCI compliance and chargeback processing.

“It almost felt like open banking had been built with our challenges in mind.

Oliver Shaw-Latimer, Director of Fintech

There is also a reduced risk of unauthorised payments and fraud, thanks to embedded strong customer authentication (SCA). However, unlike card payments, this isn’t at the expense of the customer experience. In the UK, the open banking payments journey was significantly improved by the OBIE’s September 2018 customer experience guidelines. As a result, existing open banking SCA journeys are significantly shorter than the SCA journeys for some card payments.

Forward-thinking ecommerce brands are already embracing open banking payments

While use cases in other industries developed more quickly than in ecommerce - including the likes of wealth management and investing, as well as iGaming - some ecommerce brands have begun to add open banking payments into their payment mix to solve problems that card payments can’t.

One of those brands is Cazoo, the UK’s leading online car retailer. Cazoo is using instant bank payments, which are powered by open banking, to offer seamless and instant payments for both those buying and selling their cars.

Card payments have high failure rates, of anywhere up to 15%, and card payment limits can also hamper the payment experience. These limitations are bad news for any business, but are especially painful for retailers with high average order values. Cazoo is determined to make the whole process of buying or selling a car easy and hassle-free, and it needs a payment method to match.

When selling a car, Cazoo must authenticate the seller. Once again, by using open banking, it is able to compare the account holder’s name to their bank details in an instant, rather than the typical method of manually uploading bank statements that can take days to be reviewed and validated.

Cazoo uses payments by TrueLayer to enable its new open banking-powered experiences. Watch our on-demand webinar featuring Cazoo, to learn more about how the car retailer is using open banking payments.

Open banking payments are ready to challenge the dominance of cards

As open banking payments continue to grow, we’ll see more ecommerce brands adding it to their payment mix and improving their end-to-end purchase journeys.

““Anyone who already accepts payments, I struggle to see why open banking payments wouldn’t be suitable.”

Tin Cheung, Payments Director

Download our new report, the future of ecommerce payments, to find out exactly why open banking payments are ready to challenge card dominance. Or get in touch.

Payment incentives: the secret sauce in your Pay by Bank recipe

TrueLayer and Stripe power Pay by Bank in Finland

)

)

)

)

)

)

)

)

)

)