20 million reasons to choose TrueLayer

Welcome to the TrueLayer network, home to 20 million+ users primed to Pay by Bank. We’re Europe’s leading Pay by Bank network, connecting Europe’s thriving businesses to customers who convert better.

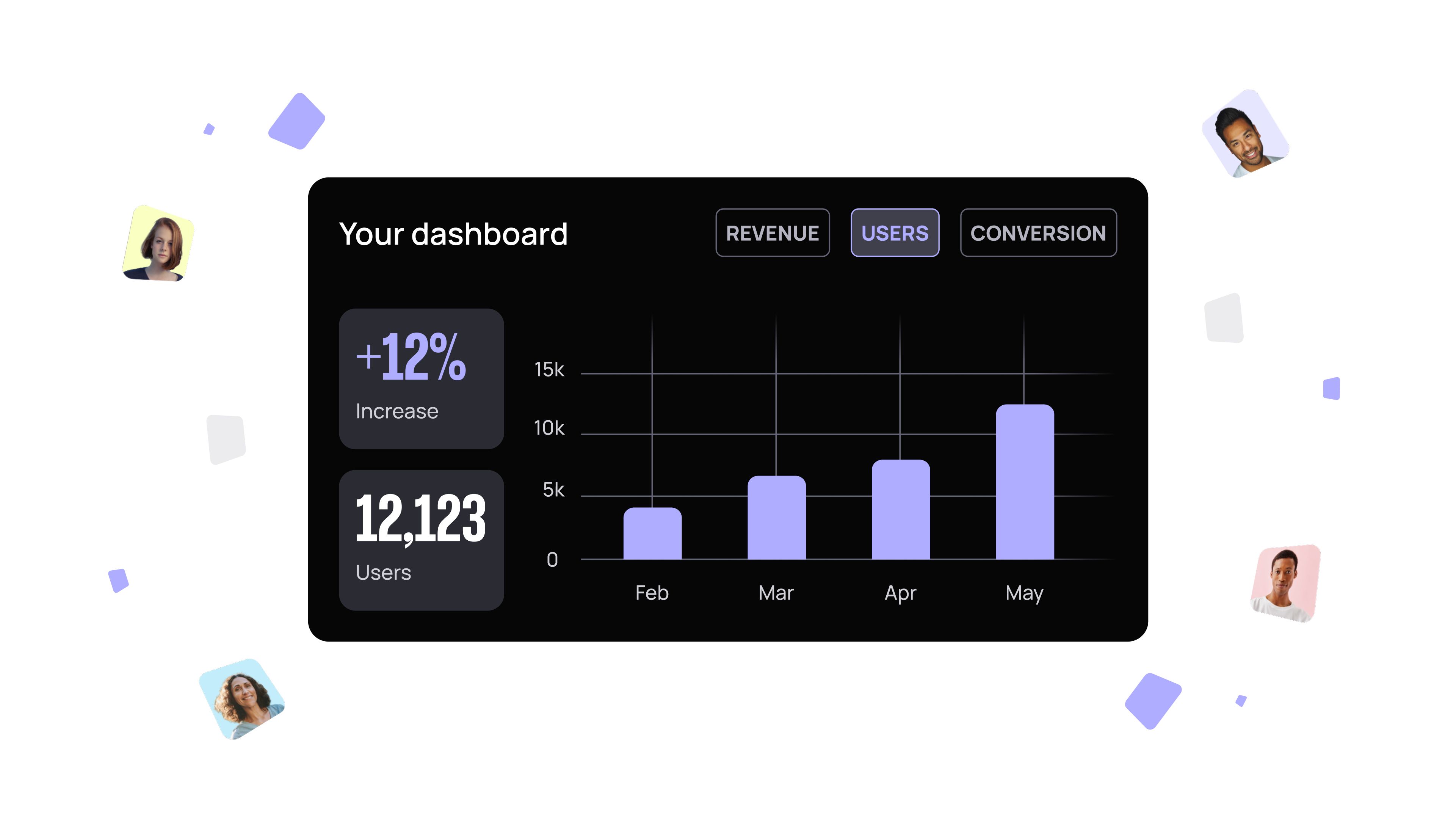

A data universe rich in customer insights

With light years worth of customer data in our network, we can mine vast amounts of user insights to help us optimise products and personalise payments experiences.

This in turn boosts your conversion rates and customer loyalty. It’s called a user network effect, and ours is so powerful, it will set your businesses off on a starry trajectory.

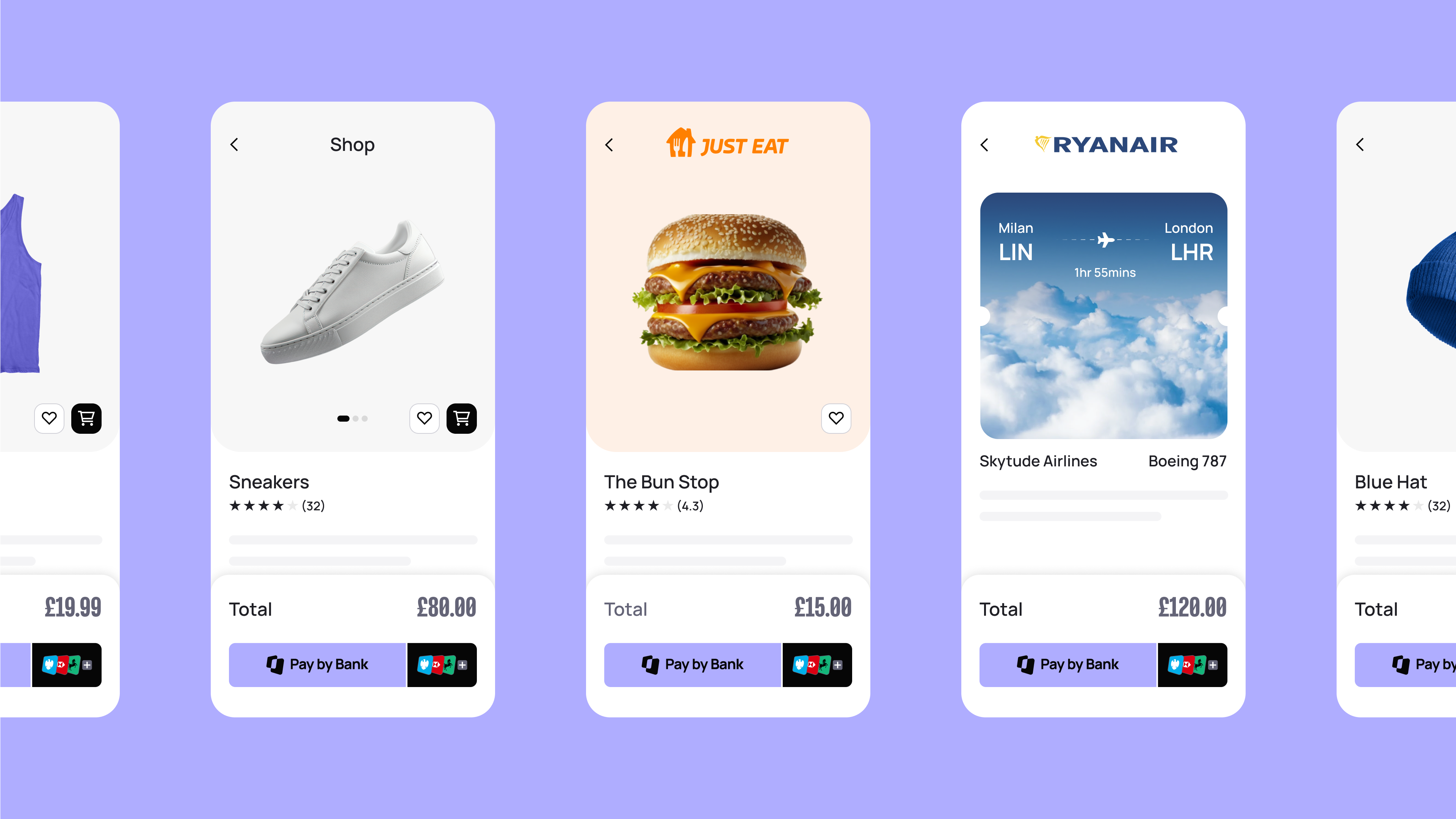

The TrueLayer network is a Pay by Bank conversion engine

The TrueLayer network is growing at lightning speed. It securely stores customer bank data wherever they’re shopping with Pay by Bank— anywhere from ordering pizzas to topping up ISAs.

This gives us payments insights across many industries and use cases, giving us great opportunities to help you optimise promotions and incentives.

When you add our Pay by Bank to your checkout, you get all the benefits of a better connected network. Existing network customers convert 20% higher and 90% of returning customers convert.

We’re Europe’s leading Pay by Bank network

How does bigger work better for your business?

It’s the phenomenon known as the user network effect. A new user joins our Pay by Bank network every 3 seconds, that’s one million each month and growing, making us Europe’s leading user-network.

As new businesses and customers are added to the network, the power of the network increases exponentially—that’s down to better optimisation leading to higher conversion rates. So bigger really does mean you get more bang for your buck.

Increased sales

We remember the preferences of your repeat purchasers helping us pre-fill details and reduce checkout screens. That leads to a conversion rate of 90%+ for returning customers.

Increased loyalty

With more user data than other Pay by Bank providers, we can better optimise and personalise our products for your customers. Our easy, fast and secure payment experience builds customer trust and loyalty.

Better conversion

By offering shoppers a consistent and recognisable Pay by Bank experience, users already in our network convert at a 20% higher rate than users who’ve never tried Pay by Bank before.

Pay by Bank– customers just get it, and it gets them

Quick and convenient

We simplify the checkout process by eliminating excessive forms, pre-filling user information, and enabling one-click checkout. This means customers can pay in an instant straight from their mobile.

Instantly recognisable

We increase customer loyalty to our brand by presenting a recognisable and rewarding payment experience across industries. This builds on the trust they already have with their bank app.

A payment system they trust

We build users’ trust in our brand by being consistent and prominent in the checkout flow. We detect and prevent fraud, and offer payment protection guarantees. There is no safer way to pay.

Personalised incentives

By offering cashback, discounts and loyalty rewards to our network of users, customers are further incentivised to use and stick Pay by Bank. This helps push your brand loyalty through the roof.

Why choose to work with us?

With 20 million users, and a million more each month, the TrueLayer network is our inimitable source of insights that power Pay by Bank to better conversion. But why should you work with us versus anyone else?

Made for you

Our TrueLayer network is made for TrueLayer’s customers. So you get highly personalised products and services.

Independent

TrueLayer is independent from the major incumbents which means we can move at speed, economically.

Security by design

TrueLayer leads the way in enterprise security. We’re fully SOC and ISO27001 certified.

Talk to us

Our teams are on hand to advise and answer your questions.

Want to learn more?

Stripe and TrueLayer Partner to launch Pay by Bank integration in France and Germany

Why iGaming operators are turning to TrueLayer to power their player onboarding experience

TrueLayer hits latest industry milestone, surpassing 15 million consumers

)

)

)

)

)

)

)

)

)

)

)

)

)