WTF is VRP?

If you work in payments, chances are you’ve heard the acronym VRP flying around. But WTF is it, really? And why is it such a big deal?

Let’s break it down.

Variable Recurring Payments, aka “Bank on file”

VRP stands for Variable Recurring Payments. At TrueLayer, we call it Bank on file because it deliberately echoes what it is intended to replace: card-on-file. For decades, tokenised cards have been the default method businesses stored payment details for faster checkouts. Bank on file is the bank-based alternative.

So, why bother with the new name? Because simple, analogous naming matters. Pay by Bank has become a success because the industry rallied around a simple, intuitive name — instead of confusing terms like A2A or instant bank transfer.

Complex acronyms and technical language inhibit adoption. But “bank on file” instantly clicks for product teams, CFOs and most importantly, it's understandable for consumers.

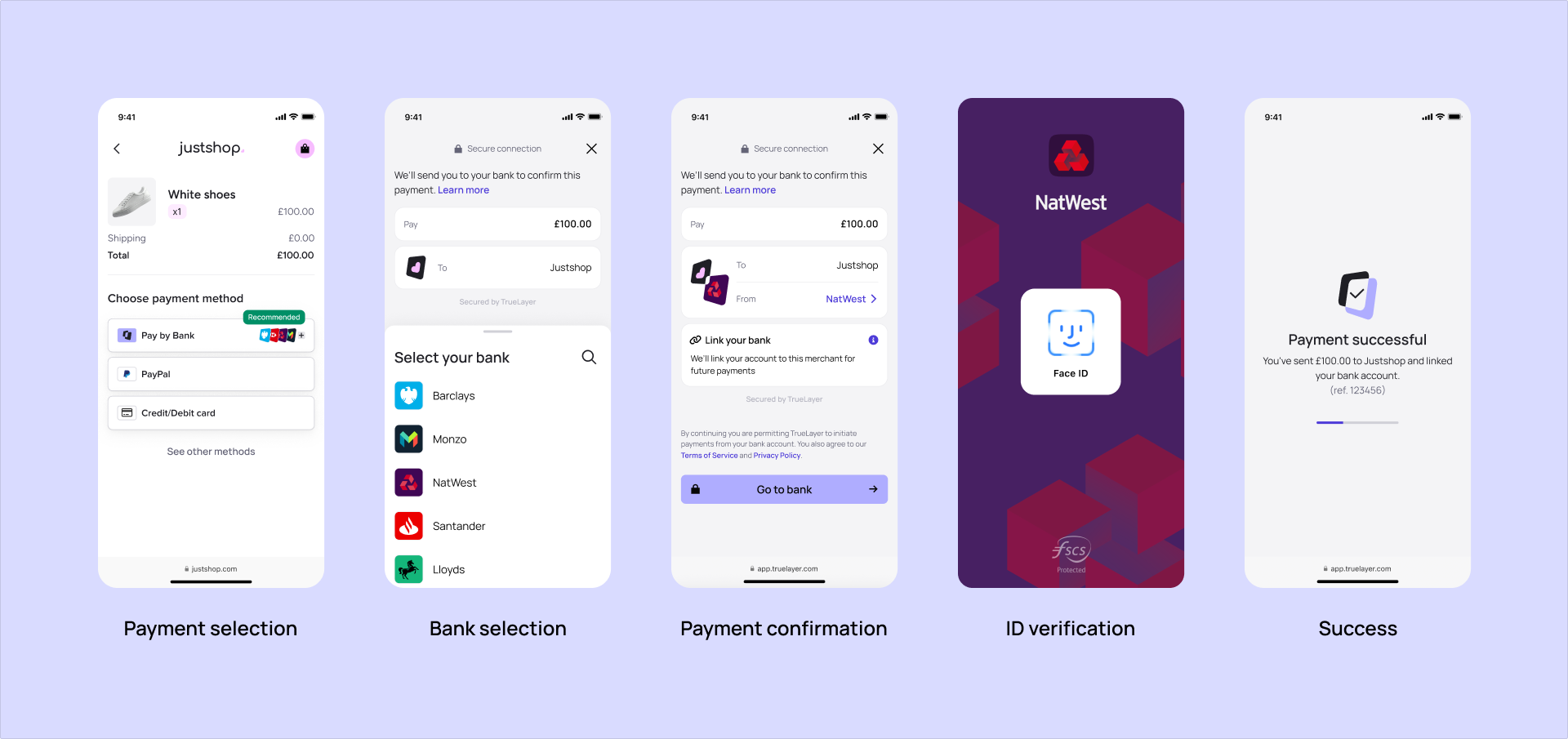

How Bank on file (VRP) works

Like Pay by Bank, Bank on file (VRP) is built on open banking. It enables businesses to collect payments directly from a customer’s bank account — with the customer’s consent.

Instead of manually approving every transaction, the customer gives permission once and then future payments can happen automatically.

That’s where the variable part comes in. Once a customer gives permission, VRP can flex. It could be £10 today, £15 next month, £12 the month after, depending on usage.

According to the FCA’s own research 7.4 million consumers feel burdened by bills and credit commitments, and 5.5 million have missed payments in the last six months. The flexibility built into Bank on file gives consumers more certainty of what will leave their account when, which also means fewer failed or bounced payments for merchants.

Two main use cases: sweeping and commercial

There are two primary use cases for bank on file (VRP):

Sweeping VRP (sVRP): This is the use case already live today — it’s mostly people managing personal finances; it empowers consumers to move money between their own accounts(for example, sweeping excess balance into a savings account).

Commercial VRP (cVRP): Although not live with all banks yet, this is where things get game-changing for merchants. This allows consumers to use Pay by Bank to make ‘one-click checkout’ payments, subscription payments, and even usage-based billing for things like utilities and phone bills. cVRP, therefore, is what will make Pay by Bank truly competitive with card-on-file payments.

One-click checkout, without the card

Here’s the magic: with Bank on file (VRP), merchants store a customer’s consent, not their card details. That means true one-click checkout with Pay by Bank. No typing, no redirect fatigue after setup, no forgotten passwords or expired details. Just a smooth, instant payment straight from the bank with no slow or costly intermediaries.

Subscriptions without the card headache

Think about subscriptions: music, streaming, fitness, software. They’re all built on recurring payments, and right now most of those subscriptions run on cards. But cards fail all the time, with various studies stating card rate failure sits at a significant 5-10%, reaching even higher for subscriptions. Why? Insufficient funds is the main reason but cards also expire, get lost or stolen and need to be replaced.

Not to mention fraudsters frequently use stolen card details to pay for subscriptions, creating fraud cost and complexity for merchants.

For businesses, that means churn, missed revenue, and costly dunning cycles — failed payments on subscription services cost businesses approximately 9% of their annual revenue. For consumers, it means late fees, fines and service interruptions because a perfectly good subscription didn’t get paid on time.

And whilst merchants can use services like Account Updater to get updated card details from their provider, the service has a high failure rate and has a steep cost per card update comparatively.

With Bank on file (VRP), there’s no card to expire (or be stolen), no number to update. Payments are taken directly from the secure bank account, making subscription payments smarter and fairer for both sides.

The merchant economics

This isn’t just about smoother payments. It’s about more efficient business models.

Lower cost per transaction: Bank on file avoids card scheme fees and interchange, improving margins.

Higher retention: Fewer failed payments mean fewer involuntary churn events - a silent killer in subscription businesses.

Eliminates card fraud: Eliminating card details eliminates the losses associated from card fraud. Bank-on-file payments are authenticated at the source.

Faster settlement: Funds flow in real time, improving cash flow compared to the lag of card settlement.

Privacy: merchants store a customer’s consent, not any sensitive details that could be compromised. Consent can be withdrawn at any time.

In other words: Bank on file (VRP) doesn’t just improve the customer journey and experience, it directly improves your P&L.

The bottom line

Bank on file (VRP) is the missing piece to make Pay by Bank go mainstream. Merchants get one-click checkout and subscription functionality, fewer failed payments, lower costs, and higher retention. Consumers get smarter money management. And with Bank on file as a term, we finally have a simple, intuitive way to explain it all.

It’s still early, but the direction is clear: the future of recurring payments isn’t card-based. It’s bank-based. And Bank on file (VRP) is how we get there. And eliminating confusing acronyms is a part of the process.

How Pardna is powering a new era of financial inclusion

Everything you need to know about the TrueLayer Network in 90 seconds

)

)

)

)

)

)