The future of recurring payments? What lenders need to know about sweeping

Estimates put the current personal loan market at $31 billion, but it stands to grow to an enormous $158 billion by 2032. So why are lenders, credit providers and banks happy to settle for recurring payment experiences that are slow, lack security and are costly (in more ways than one)?

The reality is lenders haven’t really had a choice. While direct debit and card-on-file have their benefits, they both lack functionality that your borrowers want and you need. But is there a solution that combines the best of both with a few entirely new features?

The answer is variable recurring payments (VRP). A method of recurring payment powered by open banking technology. It’s basically the recurring version of Pay by Bank, which is why, at TrueLayer, we’ve termed it Bank on file. And while certain use cases like subscription payments and one-click checkout are still in the works, a key use case known as sweeping is very much live and proven — and it just so happens to be the main use case for unsecured loan and credit repayments.

In this guide we’ll look at the challenges facing lenders when it comes to recurring payments, what the limitations of the current offerings are, how sweeping can improve the payment experience and specific features to look out for.

Back to basics: what is VRP. And what is sweeping?

VRP stands for variable recurring payments. It’s a way to collect recurring payments using open banking technology.

VRP includes sweeping payments (more on that below), and also all kinds of recurring payments to third-party accounts, like paying business for goods and services. Moving money to third–party accounts isn’t possible yet, but is in scope for late 2025.

Sweeping simply means the automatic transfer of money between two accounts belonging to the same person.

With VRP, sweeping can be fixed subscriptions, which is a payment of the same amount at the same time each month; a variable subscription, where a payment is made at the same time each month but the amount varies; or even ad-hoc payments where both the amount and frequency is variable.

Sweeping can be used to move money to a current account, to intelligently move money to a savings account and — importantly for lenders — includes several ways to move money to pay off a loan or credit card, specifically:

Repaying a credit card account: the CMA supports the use of sweeping to credit card accounts. Consumers can set up VRP with pre-agreed parameters to pay off their credit cards from current account funds.

Repaying an unsecured loan: Borrowers can use VRP to sweep funds from a current account to destination to pay off unsecured loans.

Unbundling overdrafts: unbundling refers to offering a line of credit or loan to borrowers that can be used to supplement their current account balance and prevent them from going into a more expensive overdraft. Sweeping is then used to move money back from the current account to the credit account to pay off the loan.

In the UK, the CMA9 banks are mandated to offer sweeping payments, while many other major banks have followed suit.

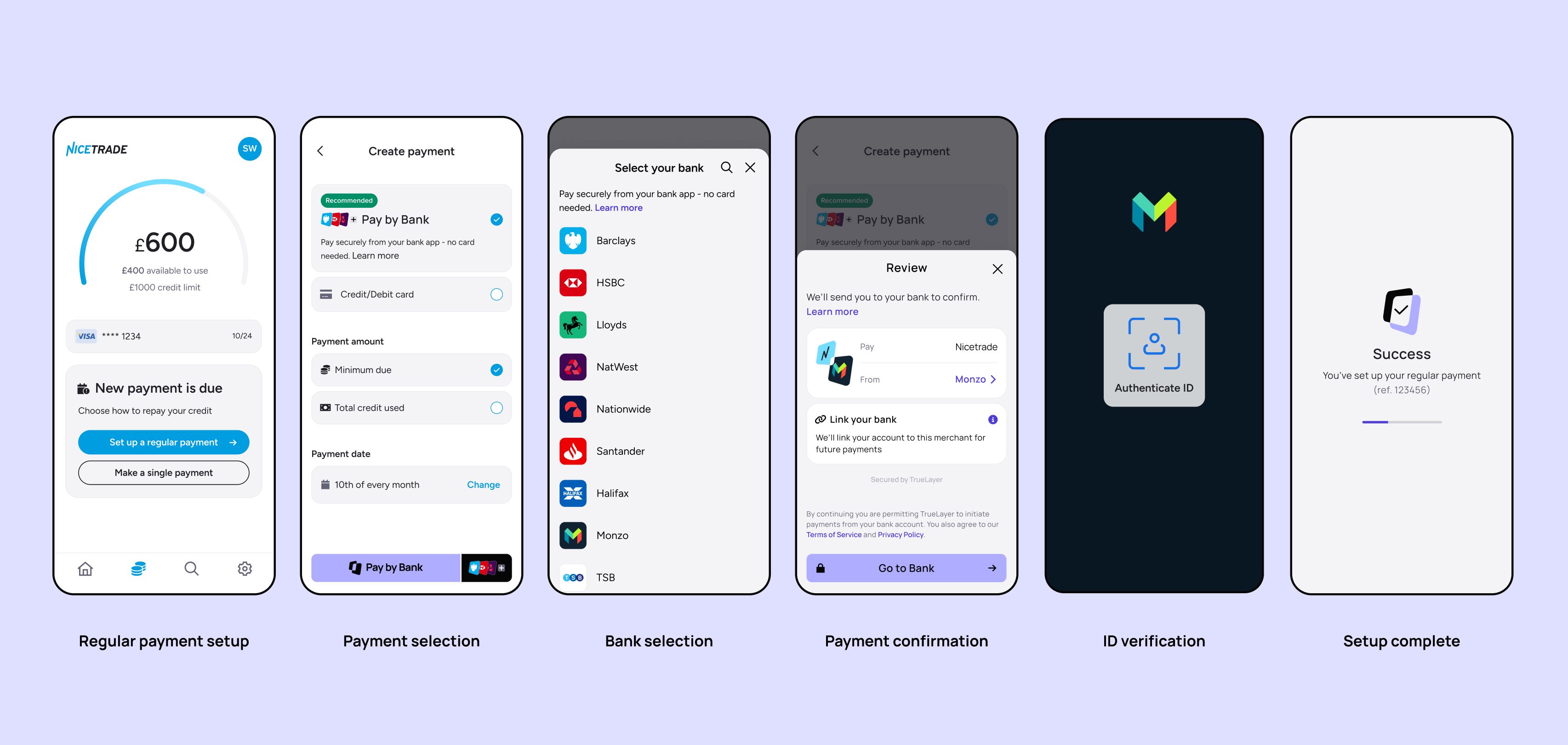

What does VRP look like to borrowers?

The process of setting up a VRP mandate is simple and quick for consumers. It works like this:

A consumer chooses to set up a regular payment with their lender or credit card provider

They select the VRP option at checkout

They choose their bank from the list of available options

They are then redirected to their bank account to authorise the mandate

They review and accept the parameters of the mandate

That’s it. The whole process takes place in one seamless mobile journey, and can be completed in as little as 30 seconds.

Why is the current state of loan and credit repayments in need of change?

Currently, businesses looking to collect payments on a recurring basis have three options, each of which have some advantages but equally glaring gaps in what would be considered a good payment experience for consumers AND businesses. These are:

Card-on-file payments

A card-on-file transaction (also known as a continuous payment authority) is a transaction where a cardholder authorises a merchant to store the cardholder’s payment details, and also authorises that same merchant to bill the cardholder’s stored account for recurring loan repayments.

While card-on-file has well-established consumer protections, any card turnover from card expiry or loss will render the mandate useless. Consumers also have little visibility or control over the mandate, meaning they can fall victim to subscription traps by unscrupulous merchants.

For merchants, card on file means the same high card fees as you would have with ad-hoc payments, along with potential settlement times of up to three days. Chargebacks are also a challenge with card on file payments. They’re difficult to manage or appeal, and there’s no time limit for consumers to request them.

Traditional direct debit

Direct debit is an instruction from your customers to their bank or building society. It authorises the organisation you want to pay to collect varying amounts from your account – but only if you’ve been given advance notice of the amounts and dates of collection.

Direct debit comes with the direct debit guarantee, meaning consumers are protected if businesses act within defiance of the mandate. On the flipside, the set up experience is often prone to human error — with users manually typing (or mistyping) several pieces of information. And visibility of active mandates is poor, with consumers often struggling to amend or cancel mandates.

For merchants, they can avoid the costly fees of card payments when using direct debit, but — again — slow settlement causes cash flow issues, and unfortunately makes direct debit unusable for merchants who need the first payment in real-time.

⚠️

We use the term ‘traditional direct debit’ here, as some payment providers — TrueLayer included — are building upon direct debit, often combining them with other payment methods to modernise the user experience.

Standing orders

Standing orders are regular payments, set up directly by the consumer via their bank, often using online or mobile banking. The consumer is in complete control of the set up and ongoing use of standing orders.

Alongside the control that consumers have over their standing orders, and the Faster Payments service in the UK means these payments are typically instant. Unlike direct debit, however, standing orders don’t have any form of consumer protection.

For merchants, the fast settlement times are useful, as is the fact that standing orders are free for both parties. But standing orders offer no flexibility, control or visibility on the part of the merchant, fully relying on the consumer to navigate to their bank and complete set up.

VRP sweeping and its benefits

The combination of different recurring payment options, along with their unique drawbacks and benefits, means credit and lending providers typically face several of the following challenges:

High operational costs and fees

Slow settlement speeds

High failure rates

Low conversion

Fraud (including chargeback and card-not-present fraud)

Lack of visibility (for merchants and consumers)

VRP has been designed to combine the best aspects of existing recurring payment methods, removing the limitations of existing recurring payment methods

1. Instant settlement: With VRP, funds settle instantly, allowing lenders to use capital more effectively.

2. Better user experience: Borrowers don’t need to manually enter payment details, they simply need to authorise the first payment with their bank app. Also, subsequent payments don’t require re-authentication or re-authorisation.

3. Reduced fraud: All VRP payments are authorised directly with the bank, and chargebacks are virtually eliminated with VRP, reducing costs even further.

💡

Estimates suggest that up to 80% of all chargebacks are a form of friendly fraud.

4. Higher payment success rates: Payment consent is tied to a bank account and doesn’t expire until it’s revoked, unlike card payments which can fail when a card expires and is replaced.

5. Lower total cost of ownership: VRP typically has lower cost-per-transaction (particularly against cards), and lower operational costs compared to direct debit.

There are also some new features to VRP that expand and improve how merchants can offer and manage recurring payments:

Instant confirmation of funds

An important feature of VRP is instant confirmation of funds. Confirmation of funds allows lenders to check if a customer — the borrower in this case — has sufficient funds in their account before attempting to collect the payment.

This insight allows lenders to react quickly to a notification of insufficient funds by reducing the collection amount to avoid payment failure and/or communicating with the borrower to add funds to their account.

Confirmation of funds is supported by a wide range of UK banks and, importantly, is silent — meaning no additional stress on your borrowers caused by unnecessary notifications.

Many lenders are already using confirmation of funds for dynamic and customer-friendly collection strategies that lead to higher collection success rates, with the added benefit of helping your customers avoid any negative impact on their credit score.

Consent parameters

Consent parameters are specific rules and limits that a customer sets when authorising a third-party provider to move funds between their own accounts. Consent parameters that a consumer can control include:

Maximum amount per payment: a mandatory parameter that limits the maximum amount that can be made in a single payment

Maximum amount per month: a mandatory parameter that limits the total payment volume per time period. Time periods can be day, week, fortnight, month, quarter, or year

Expiry date: an optional parameter that can be set according to your wishes. If it’s not set, the consent will not expire

In addition to giving the consumer greater control, an ambition stated by the FCA when building VRP, it gives the consumer confidence. It also reduces the likelihood of unexpected expenditure. Combined, all of this means businesses offering VRP equally have greater confidence that a consumer’s payments will settle as expected.

💡

51% of UK consumers would be more willing to sign up for subscription services if they were easier to cancel.

This all results in a recurring payment method that’s better for lenders and borrowers. You can see the comparison of VRP, compared to card on file and direct debit below:

| Card on file | Direct Debit | VRP | |

|---|---|---|---|

| Setup speed | ✅ Fast | ❌ Slow | ✅ Fast |

| Settlement speed | ❌ Slow | ❌ Slow | ✅ Fast |

| Simplicity | ❌ "Hold on… where’s my wallet?" | ❌ Often paper based and prone to human-error | ✅ App2app |

| Consumer control & visibility | ❌ Low. Consumers prone to subscription traps and unexpected charges | ❌ Low. No flexibility to adapt direct debit mandate | ✅ High |

| Price | ❌ Expensive | ✅ Cheap | ✅ Competitive |

| Lifespan | ❌ Limited | ✅ Perpetual | ✅ Perpetual (subject to consumer controls) |

| Security | ❌ Weak (high fraud) | ✅ Strong | ✅ Strong (all VRPs require SCA to set-up) |

Recurring payments with TrueLayer

TrueLayer’s recurring payments are built on VRP, all via a single, orchestrated API that scales and improves as new innovations arrive — putting your business consistently at the forefront of recurring payments.

TrueLayer combines all the benefits of VRP, with an expertise in building sweeping products for some of the biggest and most-forward thinking lending platforms, including Lendable and Zopa.

To understand more about how TrueLayer could help you transform your recurring payment experience for your borrowers, get in touch with one of our payment experts.

TrueLayer completes acquisition of Zimpler

Why your iGaming payment stack needs to work as one

)

)

)

)

)

)