A major part of the open banking launch in the UK has been the anticipated release of the first payment APIs. And now, finally, that time has come. Say hello to our new product: the TrueLayer Payments API!

The Payments API is a new product that allows you to make a payment directly from one bank account to another. Thanks to this easy-to-implement and unified API, you will be able to receive funds instantly (through Faster Payments) from your customer’s bank account, while providing a secure user journey.

This is called Payment Initiation in the PSD2 regulatory framework and TrueLayer is one of the few authorised PISPs (Payment Initiation Service Providers) in Europe — that means you can start using the API straight away.

What is it for?

Whenever you need to receive money from one of your users or customers, you can use our Payments API.

Here are some typical use cases:

You’re an asset management, cryptocurrency exchange or funds management company and provide investments or other financial services for your customers, and they need to provide initial funds to you or top up their accounts monthly

You are a travel company or selling tickets, and are selling a one-time or infrequent major service to a customer, such as an event booking

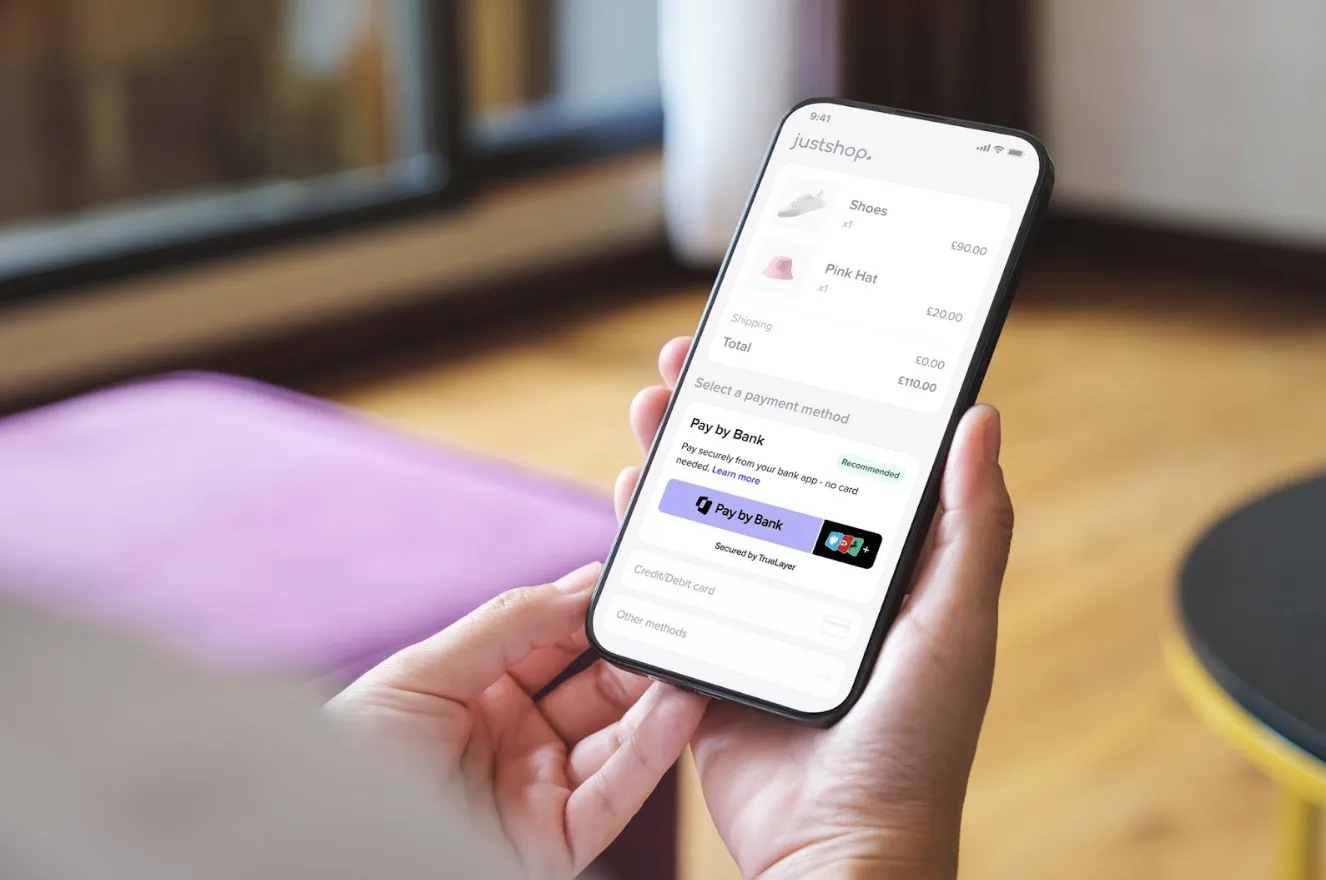

You are an ecommerce platform and are selling goods to your customer online, e.g. fashion, electronics, motors

You’re renting a service (e.g. an apartment), and your customer needs to provide a deposit for the lease, or you need to receive monthly rental funds;

You are a peer to peer marketplace or a crowdfunding platform, and you need to transfer funds between campaign bank accounts

You are a remittance service and you need to collect funds from the user’s main bank account before converting in a different currency

You are managing or facilitating B2B payments and you need to verify executed payments to third parties (such as suppliers and collaborators)

You’re a communications provider, and your customer wants to top up their pre-paid calling credit.

We are sure you will come up with lots of other creative ways to make use of this API, and we are excited to see what you will build with it!

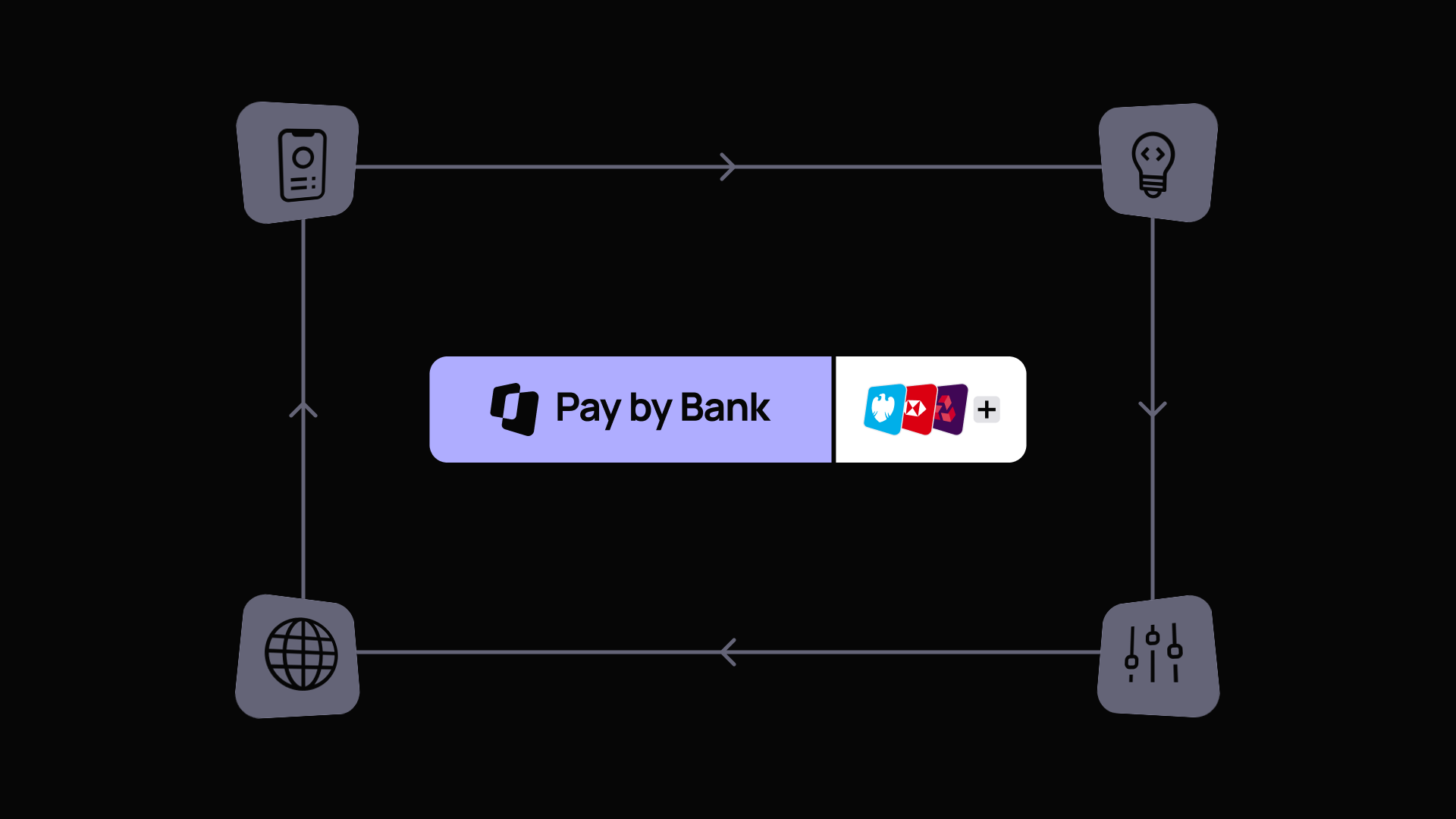

How does it work?

Once you have agreed to execute a payment with your customer, the next steps are pretty simple:

You create a new payment resource by calling the POST method of the Payments API

You redirect your user to the TrueLayer URI you receive in the POST response

[Optional] Your customer navigates to the TrueLayer UI to select their bank — or you can build your own

TrueLayer sets up the payment initiation with your customer’s bank

TrueLayer redirects your customer to their bank

Your customer authenticates and authorises the transaction

We execute the payment, as long as your customer successfully authenticated their bank account;

We redirect your customer back to your site

You check the status of the payment

To make sure that both you and your customer can identify the transaction in your bank statements, the TrueLayer Payments API lets you specify a transaction description that will appear in your customer’s transaction detail (and populate a unique ID in your transaction detail).

With our product, you will also be able to specify both the source and destination bank accounts (in case you already have this information). Alternatively, you can specify only the destination bank account, so that your customer can choose their preferred bank account to pay from.

Some good reasons to use the TrueLayer Payments API

Immediate transfer: our Payments API will enable you to receive funds in a few minutes

Cost effective: Avoid high fees for online payments, especially for high value payments — our Payments API is more convenient compared to any other payments method including Direct Debit, Debit and Credit Cards

Streamlined: Your customers don’t need to manually type in your bank account number to transfer money to you

Any bank account: our Payments API works with any bank account in the UK whether it’s your business account (many-to-one) or third party account (many-to-many)

Secure and fraud-proof: our Payments API requires an active authentication before any money can leave the account. That means high security and extremely low fraud rates that makes this product ideal for financial applications and high-value transactions

Irrevocable: Transfers made are irrevocable and can not be reversed by your customer.

The TrueLayer advantage

There are a number of advantages when using our Payments API to facilitate a bank to bank payment:

There’s no chance of mistyping any of the bank account details, leading to lost money

You can specify the correct amount, so there’s no need for doing adjustment payments

You can transfer as much money as the online banking limit, which is usually up to £25,000 but can be higher, depending upon the bank

There’s an accurate audit trail which can be matched to identifiers in the transactions on the source and destination bank statements.

Under the hood, our payments are executed by the Faster Payments system in the UK. Because of that, most of the payments happen within seconds after the authorisation has been completed, so that you have faster access to your funds.

Do you want to check if the funds have arrived in your bank account? You can use the TrueLayer Data API. Simply match up the unique transaction identifier you get from the Payments API with the reference in your account transaction detail.

When is it live?

The Payments API Beta is live now! Follow the instructions below to get access.

How do you get started?

Request access to the Payments API Beta

Create a TrueLayer account (if you don’t already have one)

Read the API documentation

Integrate your app/site to the API

Start making payments 🚀

Do I need to have a PISP license, or have any other permission to use the Payments API?

No you don’t.

How much does it cost?

You can test out the API for free without making an actual payment. See here for pricing information.

Why is this a Beta?

It’s just the beginning for open banking, so the user experience will be brand new to your users. We will work with you to help optimise your integration and user experience, as well as educate users on how to navigate the payment journey.

We will also be working with the banks to improve operational and support processes for this new payment method. Finally, we’ll take your feedback to add features and make changes to make the product work best for you, before transitioning from Beta status to General Availability.

We are very excited by the possibilities that payment initiation is opening up and we can’t wait to see what you are going to build with our new product. Get in touch if you want to learn more!

How does your business stack up on the Pay by bank value flywheel?

Payment incentives: the secret sauce in your Pay by Bank recipe

)

)

)

)

)