If you’re reading this, you’re probably in one of two categories. You’re thinking about adding Pay by Bank to your checkout. Or you've launched Pay by Bank. The good news is, although several major ecommerce brands are adding Pay by Bank to their checkouts, you’re still ahead of the curve.

But you don’t want Pay by Bank to be a niche payment method for a small percentage of your customer base, because the value of Pay by Bank, the cost efficiencies, minimised friction, lower fraud etc. compounds when more and more customers choose it at checkout.

And while convincing your customers to move from cards to Pay by Bank might seem daunting, we’ve worked with hundreds of merchants to build Pay by Bank experiences that maximise adoption, and keep customers using it time and again.

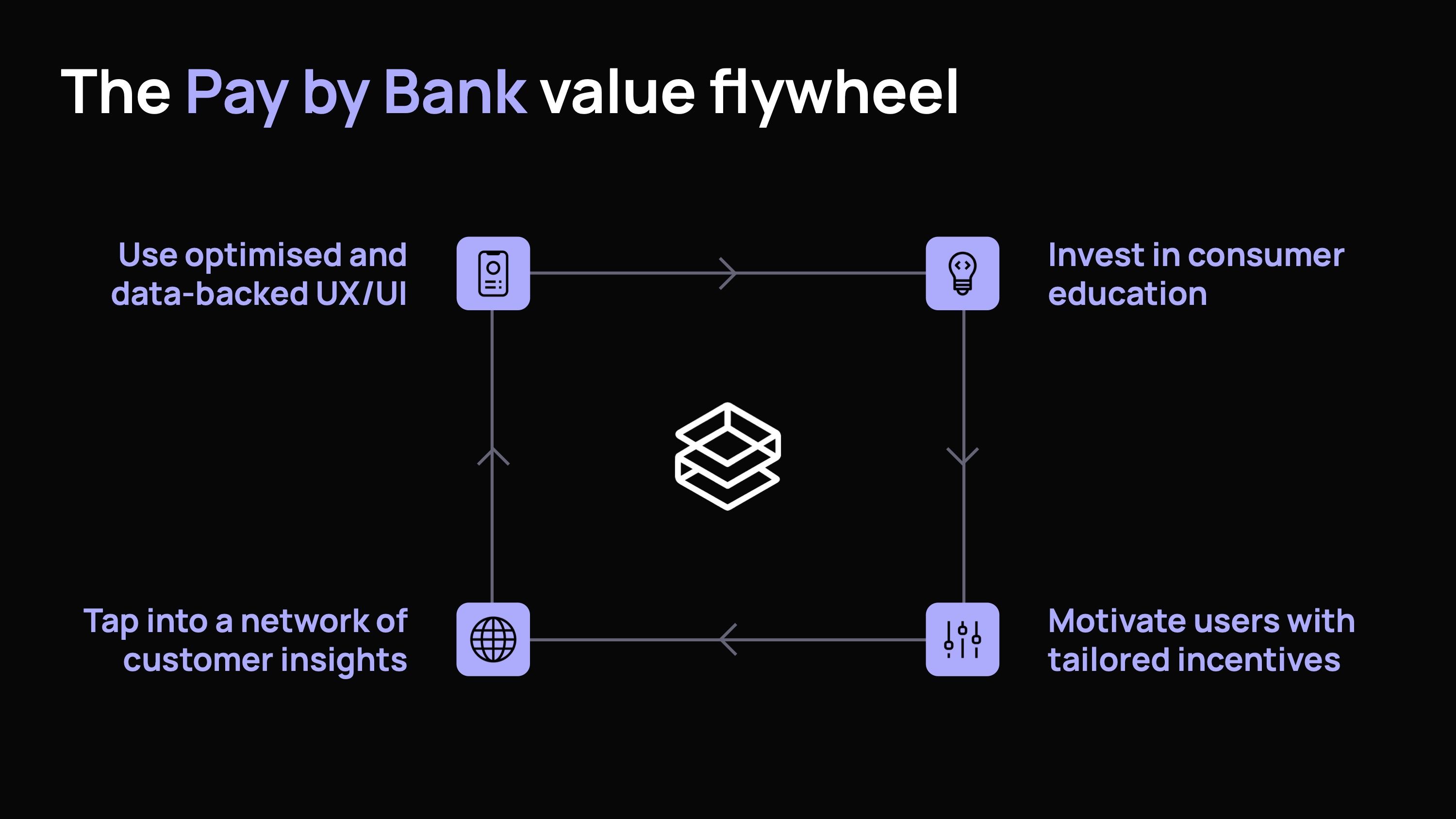

It’s called the Pay by Bank value flywheel.

What is the Pay by Bank value flywheel?

The Pay by Bank value flywheel is made up of four levers.

Use optimised, data-backed UX/UI

Invest in user education in the checkout and beyond

Motivate shoppers with tailored incentives

Tap into a network of customer insights

In isolation, they can improve adoption, conversion and retention. But together, they’re a virtuous circle where one element could be the spark that compels the user to select Pay by Bank, another to get them over the line, and another to keep them coming back to Pay by Bank in the future.

To use the flywheel effectively, you need to understand how each lever can be used effectively.

Lever 1: Is your UX actually optimised, or just functional?

A Pay by Bank payment typically has six steps:

the checkout page

the bank selection

the payment review

the bank login

the bank authentication

the status page.

Steps four and five are controlled by the bank the user selects. The other steps are directly within your control, and optimised UX can make a material difference to how many of your customers select Pay by Bank and follow the process through to a successful payment.

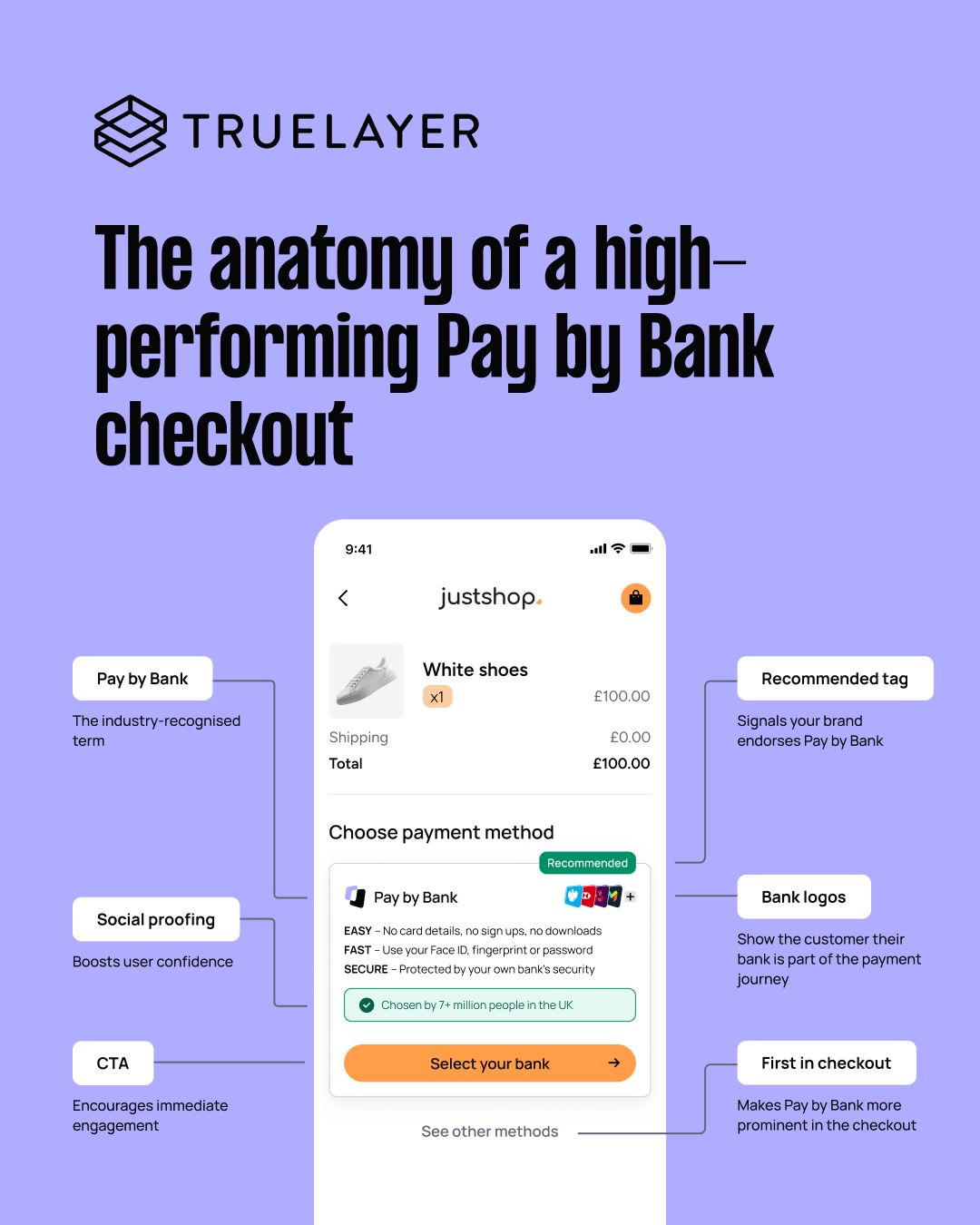

Optimising your checkout page

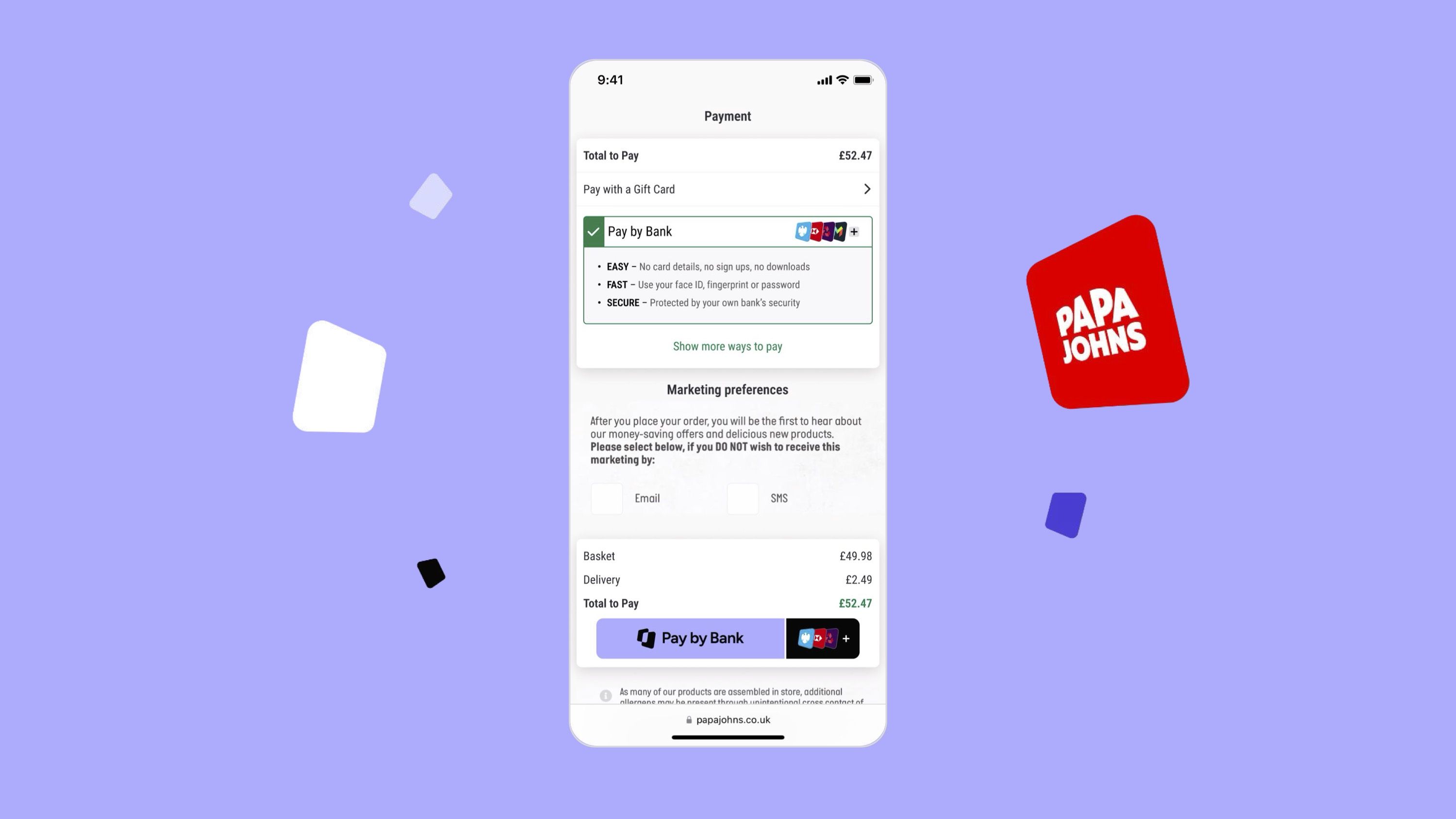

The checkout page, your customers' first interaction with Pay by Bank is your most important step. Start by making simple changes to the page, including positioning Pay by Bank first in the checkout, using the industry standard name ‘Pay by Bank’, using social proofing to give your customer more confidence and showing bank logos on the checkout page (a key indicator that your customers can trust this new payment method. Together these elements encourage and influence your customers to try Pay by Bank for the first time.

Find out more about the value of best-practice UX in the Pay by Bank journey

Lever 2: Are you educating customers, or assuming they'll figure it out?

Shoppers are creatures of habit and will be skeptical of any new payment method. To convince and reassure a shopper to try Pay by Bank for the first time, you need to answer three questions they’ll have in their mind:

How does Pay by Bank work?

Is Pay by Bank secure?

What’s in it for me?

Education should be embedded throughout your payment experience (and beyond), but there are two ways to quickly and effectively build trust with your shoppers:

The power of user education

💡 One merchant who launched Pay by Bank with TrueLayer saw a 10% uplift in conversion after adding a simple in-app banner recommending Pay by Bank to its users.

Use the easy, fast, secure descriptors

Pay by Bank is easy, fast and secure; three benefits that your customers will understand and appreciate. Using these three benefits to describe Pay by Bank at checkout helps build trust among shoppers, reinforcing the benefits and providing extra context on what they should expect:

Easy: no card details, no sign ups, no downloads

Fast: use your Face ID, fingerprint or password

Secure: protected by your own bank’s security

If limited space is available, a simple message like “Make a direct payment securely from your bank app — no card needed.” can also be impactful.

Find out more about the power of user education in overcoming Pay by Bank uncertainty

Lever 3: Are you using incentives strategically, or expecting customers to change age-old habits?

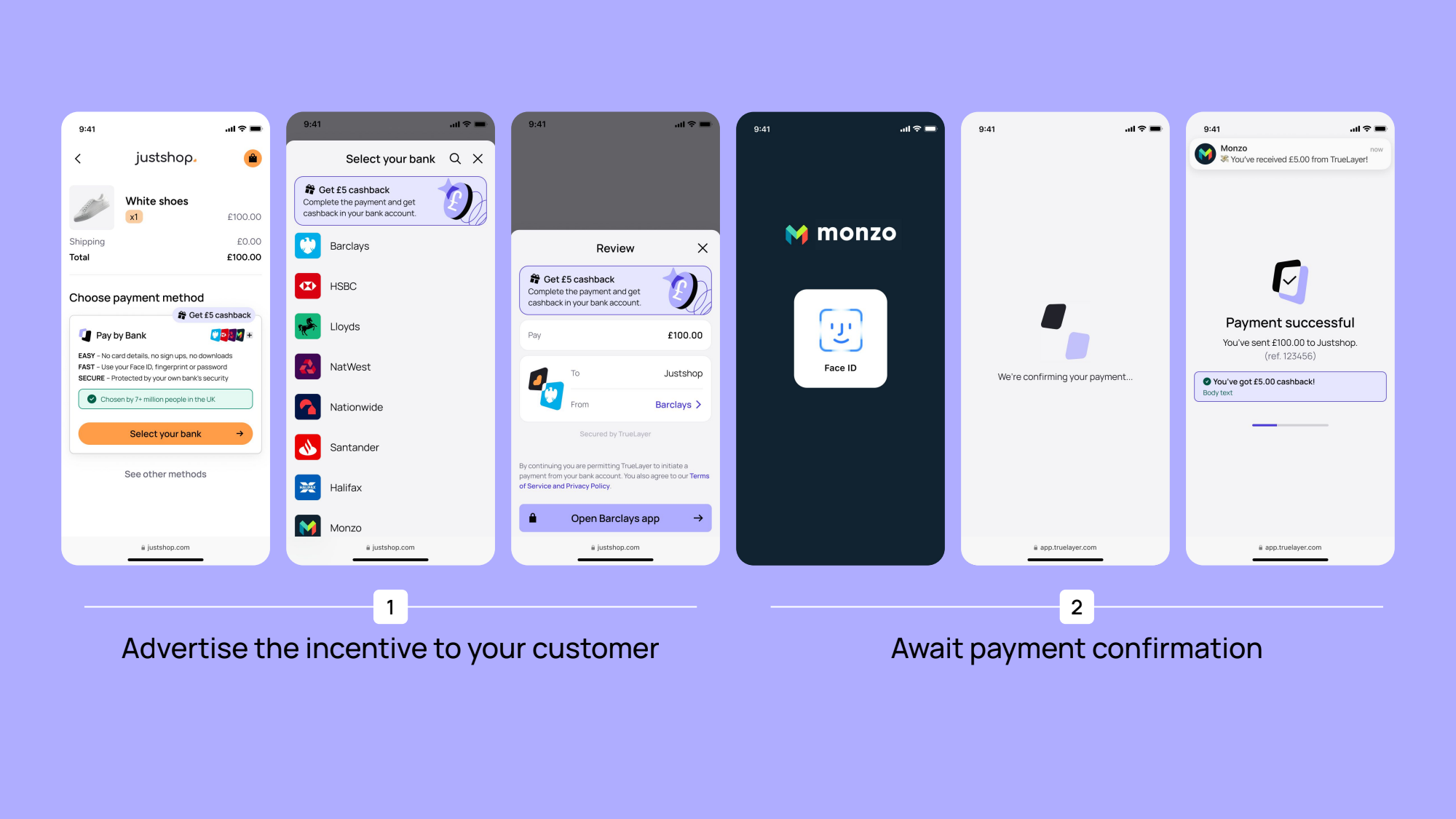

Good UX and consumer education create readiness. Incentives, more than any other tactic, create action. Because, while two thirds of shoppers are happy to try Pay by Bank if offered, choosing it over a payment method they’re already familiar with is a difficult habit to change. Incentives can bring about this change.

Incentives in the world of payments are simply a promise of some kind of gift or benefit for making a payment using a specific payment method.

Match the incentive to your customers and your use case

Different incentives will work differently for different people. You need to make sure your choice of incentives is the right tipping point to convince your customers to try Pay by Bank. We recommend one of the following four incentive options

Instant cashback: your user receives reward payment directly into their bank account, motivating customers through instant gratification

Delayed cashback: your user is offered a reward that they will receive once the cancellation or refund period has passed, ruling out any bad actors trying to game the system

Gift cards: a gift card is perceived by customers as a bonus, motivating them to make their first purchase

Plant a tree: offering to plant a tree or trees when the user makes a purchase using Pay by Bank can provide environmental benefits

JamDoughnut and incentives

To maximise adoption of Pay by Bank, cashback app JamDoughnut offered customers double the cashback or points if they paid using Pay by Bank.. The combination of a seamless user experience and motivating incentives led to:

90% conversion rate with Pay by Bank

85% of Pay by Bank transactions come from returning customers

90% of all JamDoughnut payments use Pay by Bank

Find out more about how incentives can turn interest into action

Lever 4: Are you benefiting from network effects, or building in isolation?

Pay by Bank payments are growing every month, with nearly 35 million taking place in the UK in December 2026 alone. But for it to be a truly mainstream alternative, merchants need to go beyond optimising their payment experiences in isolation, and harness the power of network effects to make Pay by Bank a shopper’s default payment wherever they shop.

The fourth and final lever of the Pay by Bank value flywheel explores how the widespread adoption of Pay by Bank and the universe of data and insights it gives us all can lead to greater adoption, conversion and returning-user conversion.

The TrueLayer network in action

The TrueLayer network is an ecosystem of over 20 million users who are already primed to use Pay by Bank. That means when you adopt Pay by Bank at checkout, an ever-growing segment of your customers already recognise and trust your new payment method — especially if you design your experience with consistent elements set out in lever 1.

At TrueLayer, we’ve seen a 22% uplift in conversion for shoppers who have tried Pay by Bank before — regardless of where they used it — compared to brand new users. That’s the power of network effects in action.

How does your business stack up? The Pay by Bank scorecard

Pay by Bank is positioned first in the payment flow to maximise adoption

You use social proofing to and a ‘recommended’ tag to increase consumer trust

You include bank logos at checkout to reassure your customers that their is a connected part of the payment journey

You use redirect priming to prepare shoppers to be sent to their banking app, and show a recap of the payment information to reduce drop offs

You give desktop users an option to scan a QR code and complete their payment on mobile

You write clear and simple confirmation copy to show when a payment has been made successfully (and what to do if it fails)

You educate shoppers in the card payment flow, by introducing Pay by Bank when a card expires, the user forgets their CVV or the payment fails.

You use in-app banners, newsletters, web banners and dedicated landing pages to educate your customers on Pay by Bank

You use the fast, easy, secure messaging framework to reinforce the benefits of Pay by Bank

You use incentives to maximise first-time adoption of Pay by Bank

You embed incentives messaging directly into your Pay by Bank checkout flow

You harness insights from beyond your own checkout, such as the TrueLayer network

How did you score?

0-4: You can easily upgrade your checkout and improve adoption and conversion

5-8: Good start, but there are still important changes to make to improve Pay by Bank performance

9-12: Your Pay by Bank experience is cutting edge. Where can you gain those final few advantages?

Start building your optimised Pay by Bank experience

Everything covered in this article is explored in greater detail in our Pay by Bank in action guide. And that guide is TrueLayer’s collective knowledge of building hundreds of optimised Pay by Bank experiences. Or speak to a TrueLayer payments expert; we're here to help you make the most of Pay by Bank.

TrueLayer completes acquisition of Zimpler

Why your iGaming payment stack needs to work as one

)

)

)

)

)

)

)

)

)