Following a decade where payments went from back-office plumbing to supercharging fintech growth, the UK Government has asked for input on what should come next, in its Payments Landscape Review: Call for Evidence.

In this blog, we outline our feedback on how to improve UK payments. Specifically, that:

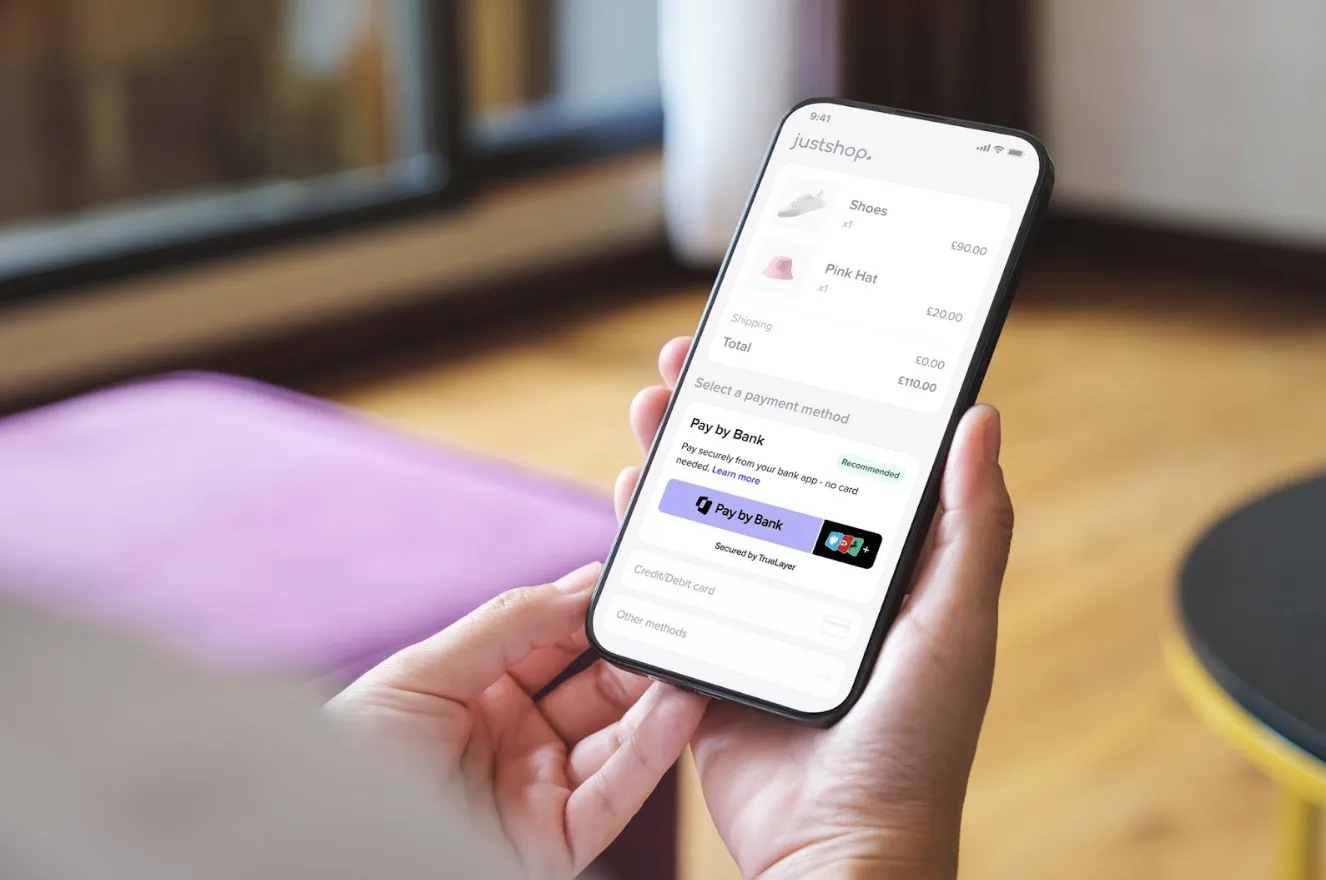

Better bank APIs and user journeys are the key to boosting payment initiation services.

Open finance should be used to develop the UK payments network. This can be achieved by replicating the PSD2 ‘access right’ (as we also discussed here) and by mandating APIs outside the CMA9.

Government and regulators should address barriers to entry for third party providers.

A decade of change in payments

Over the last decade, huge improvements have been made to the UK’s payments network, through successful interventions by the Government, including:

addressing bank ownership and control of the payment systems

driving forward true faster payments

creating an implementation entity for open banking

implementing a new payments architecture

Alongside this, the UK has comprehensively adopted major EU legislation:

The Electronic Money Regulations 2011

The Interchange Fee Regulations

The Revised Payment Services Regulations

The UK’s payment network now leads the way in terms of benefits, rights, protections and ease of use. Card fees have been reduced and competition has been injected into the payments market in the form of new providers, particularly e-money institutions and payment initiation service providers (PISPs). These businesses provide innovative, user-friendly, cheaper, faster and more convenient ways to pay.

To stay ahead, the UK needs to capitalise on the success of open banking, and apply similar principles to open finance to meet the holistic needs of consumers. At the same time, more work is needed to realise the full potential of PSD2. We need to ensure that bank APIs and user journeys are performing and we need to address the limitations that are preventing wider take up of payment initiation.

1. Bank API performance is key

HM Treasury asks: does consumer protection for faster payments need to be improved to boost take-up of payment initiation and does this impact its competitiveness with card payments?

We agree that consumer protection is vital to encourage the adoption of both faster payments and PIS. But there is already a clear framework for consumer protection and security under PSD2, and more safeguarding measures to come — the contingent reimbursement model code and confirmation of payee.

PIS is also already inherently safe and secure:

PISPs do not come into possession of funds

Payments cannot be initiated without strong customer authentication at the user’s bank

PISPs are not allowed to store user credentials (and do not store data such as card numbers which can be used to commit fraud)

We think addressing the reliability and functionality of bank APIs is more important to boost take-up:

Unreliable bank APIs continue to have a knock-on impact on the ability of businesses to provide reliable and quality payment initiation services to users, and they make PIS less competitive as a payment option.

Poor user journeys where users are redirected to their banks can cause customers to abandon making a payment (conversion is as low as 17% with some banks).

Functionality is missing. For example, PIS cannot currently compete with card-on-file payments and direct debits, because the customer must be present for each payment – variable recurring payment APIs are needed to address this.

2. Develop the payments network with open finance

HM Treasury asks: what should industry, regulators and government do to promote and develop the UK payments network?

We believe the rollout of open finance is the next step needed to develop the UK payments network. While PSD2 took more than five years to implement, open finance can be achieved more quickly through a mixture of targeted rules and industry collaboration.

Extend ‘access right’ to savings and investments

The rights-first approach of PSD2 was key to its success. The development of open finance needs to start by securing the right for third-party providers to access their wider financial data via third-parties. Sequencing will be important to make the open finance roll out manageable. We support starting with investments and savings accounts, as this builds on open banking, giving consumers a more holistic view of their financial lives.

Encourage collaboration and testing

We believe that a testing environment between data holders and third parties could accelerate the move towards open finance, and help regulators to develop rules that unblock, rather than restrict innovation.

Mandate APIs

Ultimately, PSD2 has shown that APIs are a more secure, efficient and accessible method of accessing financial data for third parties, than other methods such as screen scraping. Open banking demonstrated that where APIs were not mandated, eg outside the nine largest retail banks, they were not built, or were built slowly and to a low standard. This locked some retail customers out of open banking. Because APIs require an up-front investment, making API implementation mandatory is the only way to guarantee open finance will progress.

3. Address the barriers to entry

The Treasury asks: Has the government’s objective to promote and develop new and existing payment networks been met?

We believe the underlying infrastructure of the UK’s payment network is well developed, and it will be further developed with the New Payments Architecture.

PSD2 and open banking improved the payments network by introducing an ‘instructing layer’ consisting of businesses such as PISPs, which could instruct payments on behalf of users, without having to directly participate in systems and without coming into possession of funds.

Given the limited role of businesses in the instructing layer, government and regulators should be mindful of imposing requirements that are designed for direct participants of the payment systems. In particular, application of anti-money laundering regulations to AIS and PIS providers creates barriers and duplication.

Any development of the faster payments scheme also needs to be assessed for the costs or barriers it could impose on PISPs – and ultimately users.

The next decade

Government and regulatory initiatives over the last decade have opened up the UK payments market more than ever before. Over the next decade, with the right balance of targeted rules and facilitation, we believe that the broader financial services market will follow suit. Consumers will no longer be tied to incumbent providers by trapped data, or inconvenience, but will vote with their feet in a truly competitive, multi-layered market.

Payment incentives: the secret sauce in your Pay by Bank recipe

TrueLayer and Stripe power Pay by Bank in Finland

)

)

)

)

)