While life — and business — have returned to relative normality post-pandemic, the travel sector has faced a longer road to recovery than most sectors. But after several difficult years, the travel industry is now showing strong signs of a revival. New survey data suggests that 2023 will be the year that holidaymakers embrace travel again, with many planning multiple holidays in a single year.

However, pent-up post-pandemic demand alone won’t be enough to sustain the recovery for many merchants operating in the travel sector. In order to stand out from the competition, savvy brands must invest in their customer experiences — from payment to refund — to retain and attract customers.

In collaboration with YouGov, we surveyed more than 2,000 UK consumers* to find out their travel plans for 2023, as well as their expectations and concerns when it comes to booking travel.

Travel is back on the agenda in 2023

71% of people say that they plan to take at least one holiday in the coming year, with January traditionally being the busiest month for holiday bookings. This is set to be even more the case this year, thanks to the combination of a cold snap and January blues, along with the reduction of most international travel restrictions across the globe.

And more than half (51%) of those surveyed won’t stop at just one holiday. 22% intend on going on two holidays, while 29% plan on going on three or more. It’s clear that, for many, the previous year or two has been about testing the waters of travelling post-pandemic, while 2023 is the year to fully re-embrace it.

A trend that goes well beyond travel is the increase in online payments vs brick-and-mortar payments. From 19.1% in February 2020, the share of internet sales as a percentage of all retail sales has risen to over 30% in November 2022 (the most recent available UK figures).

In the travel industry, specifically, the preference for online booking is even stronger. 71% of respondents prefer to book their holiday online, using either a smartphone, desktop or tablet.

Refunds and lengthy checkout processes frustrate potential holidaymakers

Many potential holidaymakers still feel frustrated when booking travel. Almost three in every four respondents (73%) of those surveyed said that they had experienced problems and frustrations during the booking process.

While the inability to make changes to a booking (29%), and the lack of an option to speak to a travel agent (28%) are both valid concerns that every travel provider should consider, it’s the prevalence of payment-related issues that point to the most urgent fixes needed.

The most frustrating element of the booking process is the need to enter or re-enter lots of details when booking (34%), which is often exacerbated by the input-heavy card-payment experience. A poor or unclear refund policy is also a major frustration (28%), while some respondents highlighted failed payments or lack of payment confirmation (11%).

There’s a disconnect between refund expectations and reality

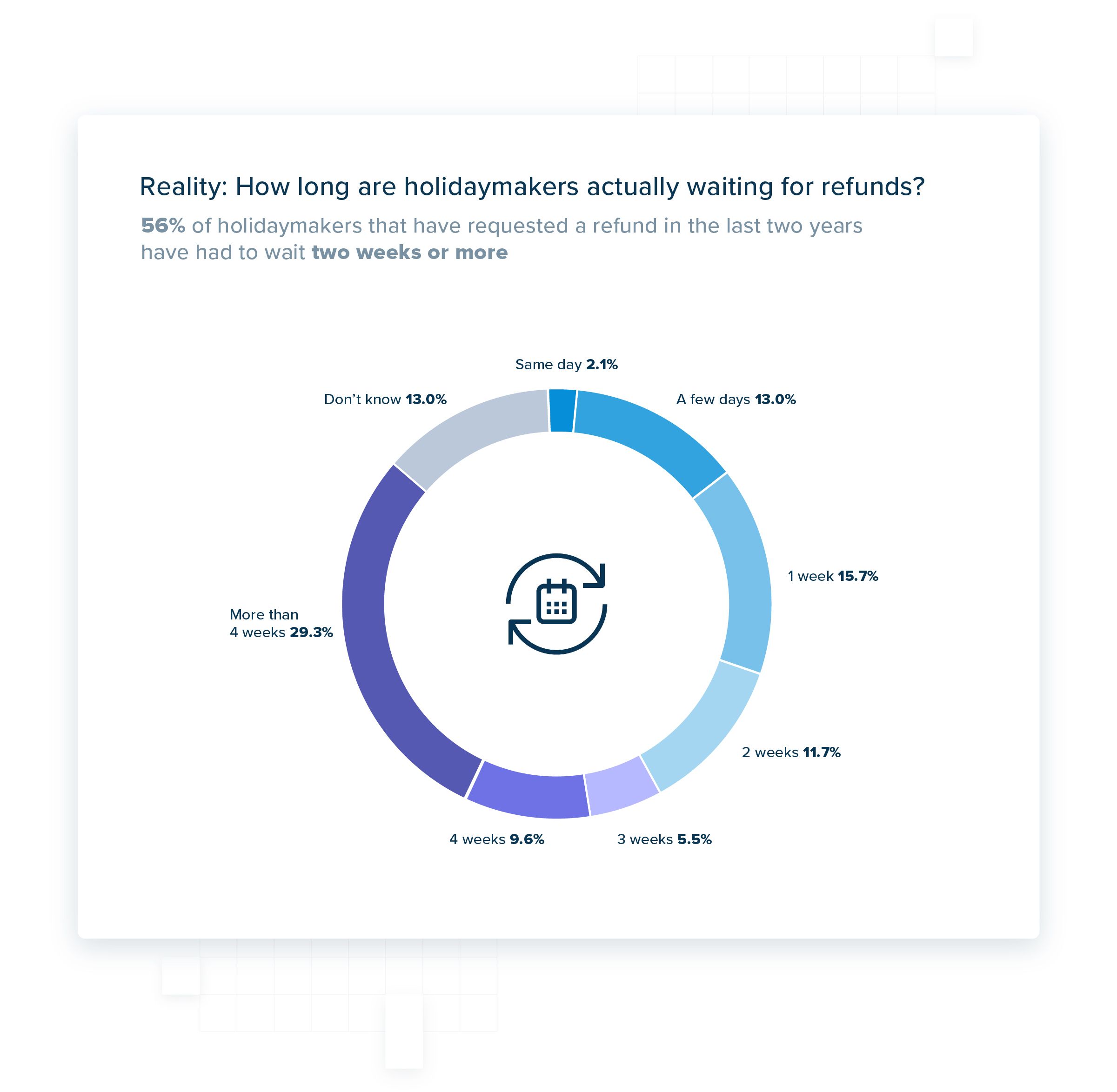

With slow refunds one of the most common causes of frustration, it’s worth considering what an acceptable refund process would look like. 63% of those surveyed expect to receive a refund in one week or less, while only 7% are happy to wait four weeks or more.

But when the same respondents recall their own experiences of waiting for a refund in the past few years, there’s a stark difference between expectations and reality. Only 42% of those who applied for a refund, received it in two weeks or less, while 39% were left waiting four weeks or more.

Right now, it’s clear that there is a huge disconnect between customer expectations and reality when it comes to travel payments and refunds. That’s why we’re calling on travel companies to make a change: with the travel industry in the early days of recovery, investing in best-in-class customer experiences through innovations like open banking will help savvy companies stay ahead of the curve.

How can open banking help forward-thinking travel brands?

One way for travel brands to deliver a payment experience that alleviates customer frustrations is to use open banking payments.

Open banking payments — often called ‘instant bank transfers’ — offer the kind of payment experience your customers expect to see. Importantly, instant and automated refunds mean you can maintain customer trust if the need for cancellation should arise. Plus, as strong customer authentication (SCA) is built in, you’ll minimise payment fraud while still offering seamless and — crucially — shorter payment experiences.

And open banking is swiftly becoming a strong alternative payment method that consumers are turning to more and more. In 2022, there were over 68 million payments made in the UK using open banking, while over 6 million people (or 11% of digitally-enabled consumers) in the UK have used at least one open banking-powered service.

Find out more about how open banking could help your brand provide a better travel payment experience for your customers.

*The findings were made in a YouGov survey of 2,091 adults on 6-9 January 2023. The figures have been weighted and are representative of all UK adults.

TrueTalk with Pasquale Morelli, Senior Brand Designer

Stripe and TrueLayer expand into France and Germany

)

)

)

)

)

)

)

)

)