Since the rollout of open banking in Spain in 2019, fintechs have focused on using bank data to give Spanish consumers more visibility and control over their finances – for example, we’ve been working with Plum on their smart savings service there.

Few Spanish businesses have offered open banking payments however, because the payments experience has been lacking. Until now. With the roll out of app2app authentication, open banking payments are now much quicker and easier.

TrueLayer processes more than half of all open banking payments in Spain, for businesses including HeyTrade, Revolut and Paysafe. We’re the only open banking provider to support app2app journeys for all the Spanish banks. In this blog, we’ll cover what has happened in Spain, the impact and what’s next.

What has happened in Spain?

TrueLayer launched our data and payments platform in Spain in 2020, but found the performance of bank user journeys was lagging behind some other European markets.

The main reason for the poorer performance was how banks had implemented open banking payments, requiring people to go through an additional step to allow access to their account, as well as the usual payment authorisation.

Plus, if you wanted to make an open banking payment in Spain, you needed to manually key in your username and password – making the process slower, cumbersome and error-prone.

In June 2020, the PSD2 regulator in Europe, the European Banking Authority (EBA), stepped in. They made it clear there must be parity between the online banking experience that banks provide directly to their customers, and the service they provide through PSD2 APIs.

The EBA followed up by stating if banks didn’t remove obstacles to the open banking experience by April 2021, the national regulators should take further supervisory action, including imposing fines.

The banks set to work improving the open banking authentication experience to match the slicker experience of their own banking apps. All Spanish banks have now enabled app2app biometric authentication, making it faster and easier for people to authenticate an open banking payment or data request, and bringing the experience in line with countries like the UK.

What’s app2app authentication?

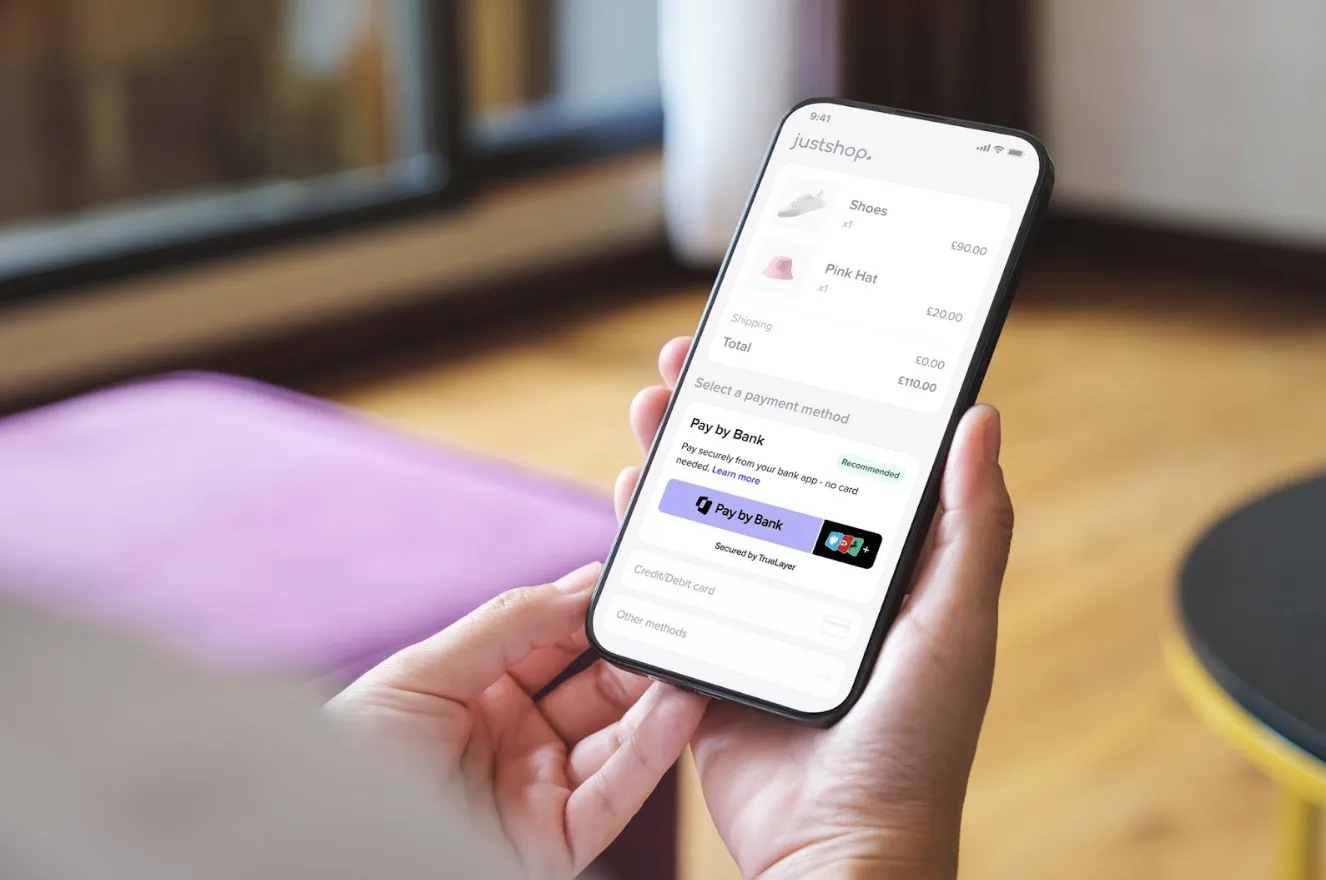

App2app authentication for open banking is a faster, easier way for people to give permission for a third party to access their bank data or make a payment on their behalf.

Without app2app, a person trying to make an open banking payment on their mobile phone is redirected to a web version of their online banking, where they need to log in by entering a username and password, before being asked to confirm the payment.

With app2app, the person is automatically redirected to their online banking app, where they can log in biometrically with their face ID or fingerprint.

App2app journeys have been implemented in the UK since 2018 and are a big reason that open banking payments in the UK are taking off (with 500% growth in the last year).

What’s the impact in Spain?

TrueLayer is the only open banking provider to support app2app journeys across all the banks in Spain today.

We’ve been testing these journeys for data and payments since February, and over the last months we’ve seen conversion rates jump 10% on average. Some of our clients are now achieving 60-70% conversion.

Conversion rates for open banking payments now rival that of other payment methods like cards and we’re excited to work with more businesses to help them realise the benefits of open banking payments in Spain.

What’s next?

Now that usernames and passwords have been replaced with biometric authentication, we’ll be focusing on sharing more best practices with banks in Spain, drawing on our findings from across the UK and Europe to optimise the payments experience further.

Next up is France, where the regulator has now set a timetable for when the banks will release app2app journeys – so watch this space.

How does your business stack up on the Pay by bank value flywheel?

Payment incentives: the secret sauce in your Pay by Bank recipe

)

)

)

)

)