Papa Johns is a household name across the UK — with the popular pizza delivery chain visible both on the high street and on our smartphones.

Hot off the back of their successful Pay by Bank launch, we caught up with Papa Johns Senior Product Manager, and in-house payments expert, Eamon Lindsell to chat all things Pizza and Pay by Bank.

What sets Papa Johns apart from its competitors, especially when it comes to customer experience of buying online?

I think takeaway pizza has as broad appeal as just about any product or service you can think of. We want our ordering experience — which of course, includes the digital ordering experience — to be as intuitive and enjoyable from start to finish for every customer.

And like a lot of takeaway businesses, we offer plenty of deals, discounts and rewards to our customers. We want to make sure every customer can find the value where it lies. It’s better for us that they can find the best deal quickly, and it’s good for them. Again, the digital ordering experience is key to this.

What made you want to diversify your payment offerings? Were there pain points you were facing before adopting Pay by Bank?

In the online customer experience, payments are the vital final step of a successful order. The main reason we looked into offering a new payment method beyond cards and PayPal was to futureproof our payment experience. Customers might not expect it today, but I do believe they’ll be demanding it in a few years.

Another consideration for us is failed payments. There are a whole load of reasons why card payments can fail, from expired cards to insufficient funds, and Pay by Bank can mitigate a lot of those issues. For a start, customers see their balance, so they know if they’ve got insufficient funds. And with seamless biometric SCA instead of the 3DS check, it’s just more intuitive for our customers. And, of course, there are the fees. Fees are going through the roof, because the payment market has basically been cornered by a few major players. Adding Pay by Bank in the mix makes the whole thing a bit more competitive.

“The main reason we looked into offering a new payment method beyond cards and PayPal was to futureproof our payment experience.

Eamon Lindsell, Senior Product Manager

And what made you settle on TrueLayer as your partner for launching Pay by Bank?

As the conversations with various providers progressed, it became clear the TrueLayer offered the right balance of existing experience and expertise to actually be able to build our use case, but agile enough to give Papa Johns the attention we need to make sure what we launched is tailored to our business and customers — and not just be a cookie cutter version everyone gets.

TrueLayer also showed us how we can use Pay by Bank as a sales recovery method as an additional way to recover failed payments and reduce costs. As well as being a standalone checkout option, we can also use Pay by Bank to recover failed payments from other payment methods.

By integrating TrueLayer’s Pay by Bank solution, we’re improving our customers’ digital experience and increasing customer retention, all while reducing fraud, eliminating chargebacks and lowering our cost of payments by more than 40%.

With Pay by Bank being a relatively new payment method — and Papa Johns being early adopters — how did you approach getting buy-in across the Papa Johns team?

It’s a good question. I put the business case together with two different focuses. I started by pitching the sales recovery method to the rest of the team. This is the wedge use case that gets Pay by Bank through the door, because if you can recover 20% of failed payments by offering Pay by Bank as an alternative, we can rescue over £1million in revenue each year.

The other angle is the savings on fees. Depending on what share of checkout we achieve using Pay by Bank, and the early signs are positive, we could save hundreds of thousands each year on fees. The higher the share of checkout, the more we save. And those savings go to our franchisees to increase franchisee profitability, so it’s in everyone’s interest to see Pay by Bank be a success.

“Pay by Bank originally piqued my interest because it is low risk to implement as part of a diversified checkout. But as the adoption of Pay by Bank across industries grows, you’re going to want to have it on your checkout soon.

Eamon Lindsell, Senior Product Manager

Pay by Bank with Papa Johns has been live for a few months now. While it’s early days, how have you and your customers found it so far?

Like you say, it’s still early days but the process working with TrueLayer has been great, really collaborative, with both sides of the merchant-provider relationship offering feedback and solutions. We’ve got consumer incentives and education planned to grow the usage of Pay by Bank, but the pure organic adoption has been positive. It’s already taken over some payment methods that have been established on our checkout for years.

And finally, what advice would you give to other payment leaders in the retail space considering adding Pay by Bank to their checkout?

It’s as simple as this: just get started. It originally piqued my interest because it is low risk to implement as part of a diversified checkout. But as the adoption of Pay by Bank across industries grows, you’re going to want to have it on your checkout soon. And beyond that, there are plenty of business benefits, from better conversion to reduced costs. That’s music to my ears and should be to yours as well.

Software engineering in the age of AI: run the mile you're in

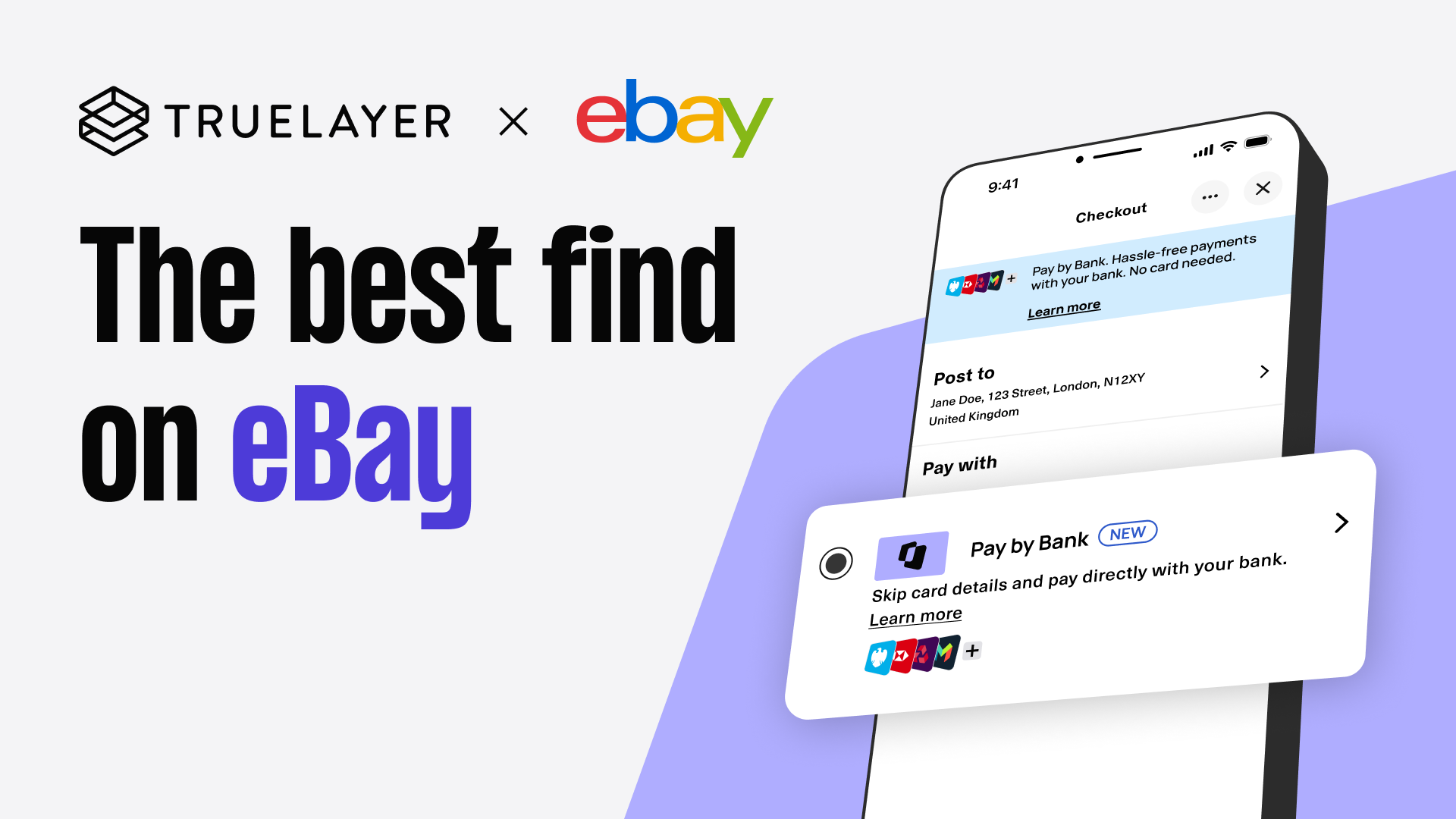

eBay partners with TrueLayer to offer Pay by Bank at checkout

)

)

)

)

)

)