With over 4 million people in the UK now using open banking in one form or another, it’s clear that consumers are beginning to accept a new way of accessing their financial data and making payments.

But what will bring about the shift to open banking payments in online retail? Some brands have begun integrating open banking payments, and they are seeing the benefits of offering faster and more cost-effective payment experiences to their customers. However, a large-scale change to consumer payment behaviour will take time.

“Open banking is not just another payment method. It’s an entry point into an entirely new payments framework.

Oliver Latimer-Shaw, Head of Fintech

Contactless payments were introduced in 2007 in the UK, for example, but it wasn’t until 2014 — seven years later — when TFL began using them on the London public transport network, that they became mainstream. In July 2021, there were over 1.2 billion contactless payments made. It took time and patience to convince UK consumers, but they’re certainly convinced now.

We spoke to payment experts from Ticketmaster, JustGiving, the Open Banking Implementation Entity (OBIE), and the Electronic Money Association (EMA) about how open banking is already being used by ecommerce businesses, and how more uptake in online retail might come about.

Consumers are building muscle memory

As of October 2021, over 2.8 million open banking payments are processed every month in the UK. Alan Ainsworth, Head of Policy, Legal and External Communications at the Open Banking Implementation Entity (OBIE), believes many consumers are getting used to this new payment method and sharing their data using open banking. He describes this process as consumers building their “muscle memory”.

As to why we’ve not yet seen the critical mass of online retailers offering open banking payments, Constanza Castro Feijoo, Stakeholder Engagement Manager at the OBIE, believes it’s simply a matter of time: “I joined the OBIE a year-and-a-half ago, and since then the number of users in open banking has doubled every six months to over 4 million.” With a dynamic ecosystem in place, “it’s now getting consumer adoption.”

But even with the lag in widespread online retail adoption, Judith Crawford, Policy Director at the Electronic Money Association, pointed out that “if you have a couple of large merchants taking on open banking as an option at checkout, then more consumers will start to try it out.”

Until now it has been quick-to-innovate brands like Cazoo that accept open banking payments. But more traditional enterprises will also be considering how open banking payments can help their business.

An entry point to an entirely new payments framework

Some ‘new’ payment methods, including mobile wallets like Apple and Android Pay, have found traction at the checkout in recent years, with 32% of the adult UK population now registered to use mobile payments (an increase of 75% since 2019).

But mobile payments are still effectively bolt-ons to card payments. They address some of the customer experience issues but are still just as costly — if not more costly — than traditional card payments.

Oliver Shaw-Latimer, Head of Fintech at JustGiving, thinks open banking is fundamentally different: “Open banking is not just another payment method. It’s an entry point into an entirely new payments framework.”

This new framework offers online retailers a real chance to rethink and improve the payments experience. Tin Cheung, Director of Payments at Ticketmaster, agrees. “Historically, merchants have been dealing with how to bolt things on top of how they work today, whether it’s finance, tech or operational,” says Tin. “Open banking allows a bit more open thinking about what is possible.”

Internal and external education is key

The fact that there are now over 4 million users is a sign that open banking has been successful, but there’s more to do to gain even wider adoption. And just as important, heads of payments need to be able to sell it internally to their stakeholders who don’t necessarily understand the benefits.

“I had to get this integration on to my roadmap over two years ago,” explains Oliver shaw-Latimer. “I spent the best part of six months explaining it to non-payments people, and this is why payments innovation takes a while.”

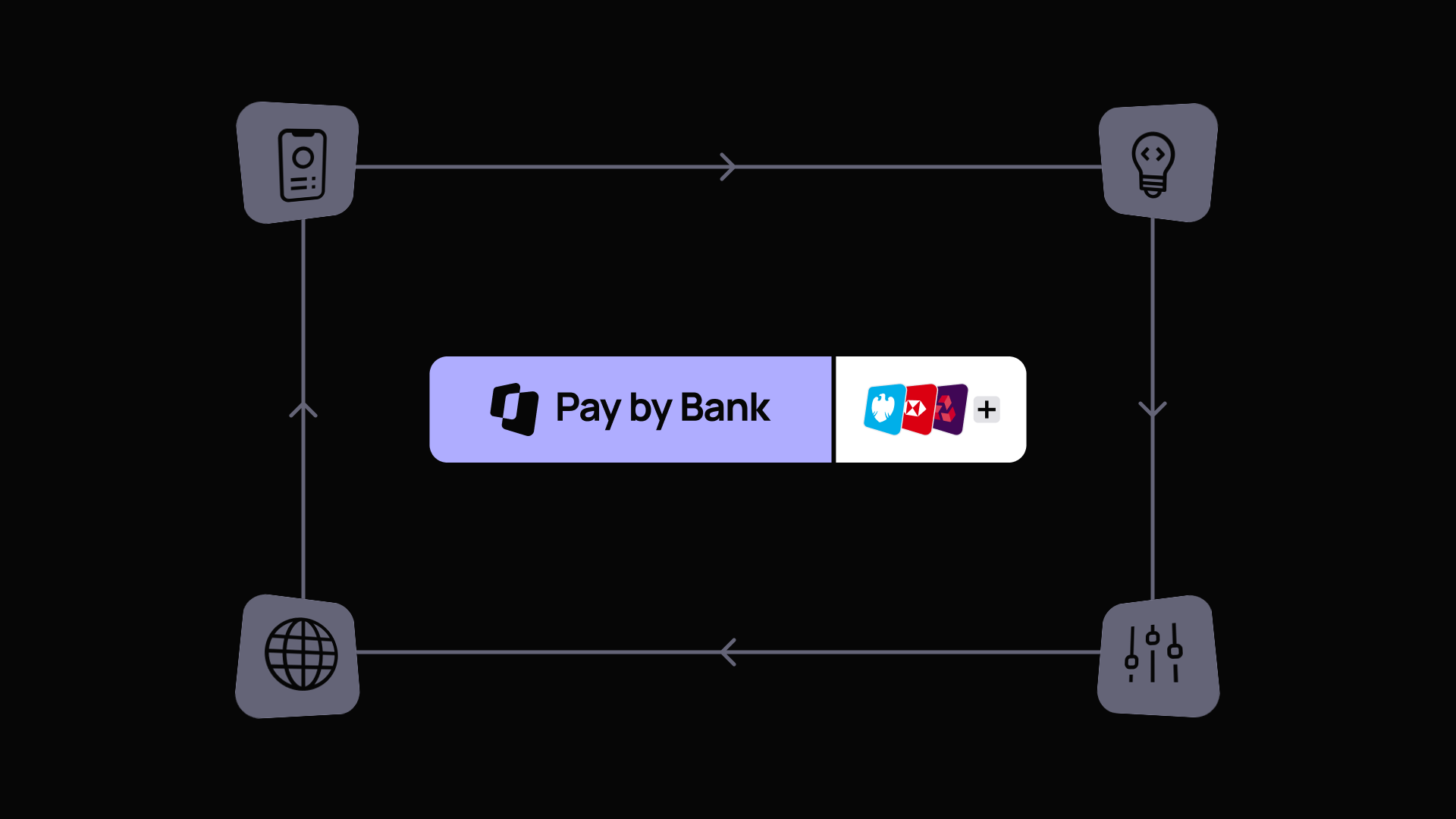

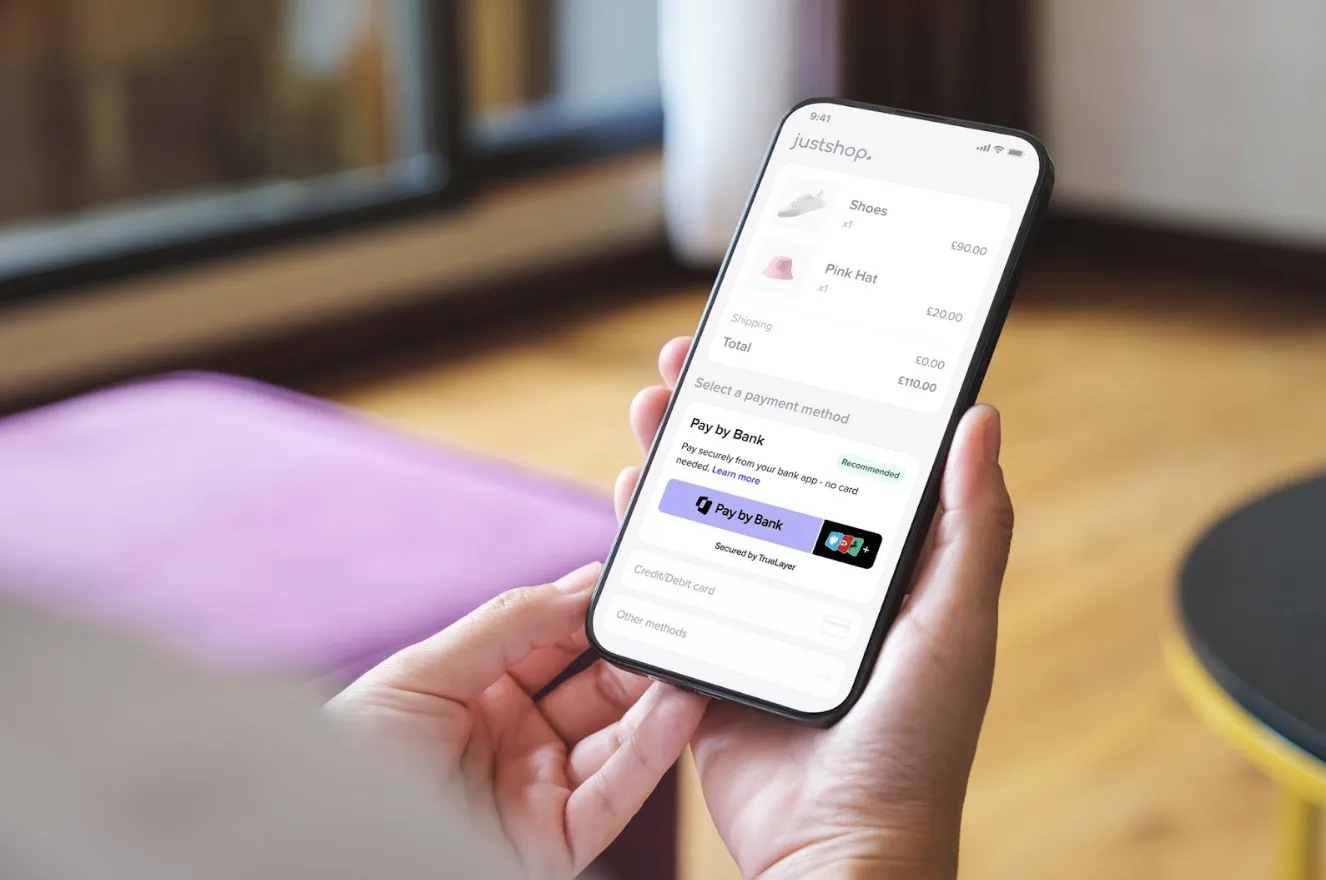

At TrueLayer, we work closely with our clients to make sure the open banking payment experience is user friendly and converts well. We’ve found referring to open banking payments as “instant bank transfers” on any customer-facing messaging (eg at checkout) creates the best understanding. Consumers instinctively know what it is, and the ‘instant’ part helps them understand the biggest benefit.

Where our clients offer instant bank transfers to their customers, we often see the payment method getting a 30% share of checkout or more a few months after launch.

A 12-month lag in Europe, but it’s catching up

The UK is leading the way in all aspects of open banking. Tin Cheung agrees that open banking is ready to use in the UK, but “if you operate globally or pan European…it still feels limited.”

TrueLayer’s Head of Policy, Jack Wilson, believes many EU countries are only about 6-12 months behind the UK. “We’re seeing real change in markets like France and Spain, where customers are happy to use open banking-powered products,” he explains.

This is good news for online retailers with a presence beyond the UK. Many of our customers who launched open banking payments in the UK are now planning their rollouts across Europe.

What happens now?

Like Ticketmaster and JustGiving have already done, now is the opportune moment to explore how open banking can improve your payment experience for you and your customers.

“Anyone who already accepts payments, I struggle to see why open banking payments wouldn’t be suitable.

Tin Cheung, Director of Payments

And while open banking payments are working well in the UK already, there is more to come. Open banking Variable Recurring Payments (VRPs), for example, could offer a faster, cheaper and safer replacement for card-on-file and subscription payments.

Finally, it’s important to build your open banking payments strategy with a trusted partner to help you navigate the opportunities of open banking and support you with implementation. You may also need a partner that can provide additional functionality not available through out-of-the-box open banking, like instant refunds.

TrueLayer helps fintechs like Revolut and Nutmeg, as well as ecommerce providers like Cazoo, to integrate open banking-powered payments into their customer journeys. If you want to know more about transforming your payment experience, get in touch.

You can also watch the webinar hosted by the Merchant Risk Council — where we originally spoke to JustGiving, Ticketmaster and more.

How does your business stack up on the Pay by bank value flywheel?

Payment incentives: the secret sauce in your Pay by Bank recipe

)

)

)

)

)

)

)

)

)

)