European tour of alternative payments

Key Takeaways

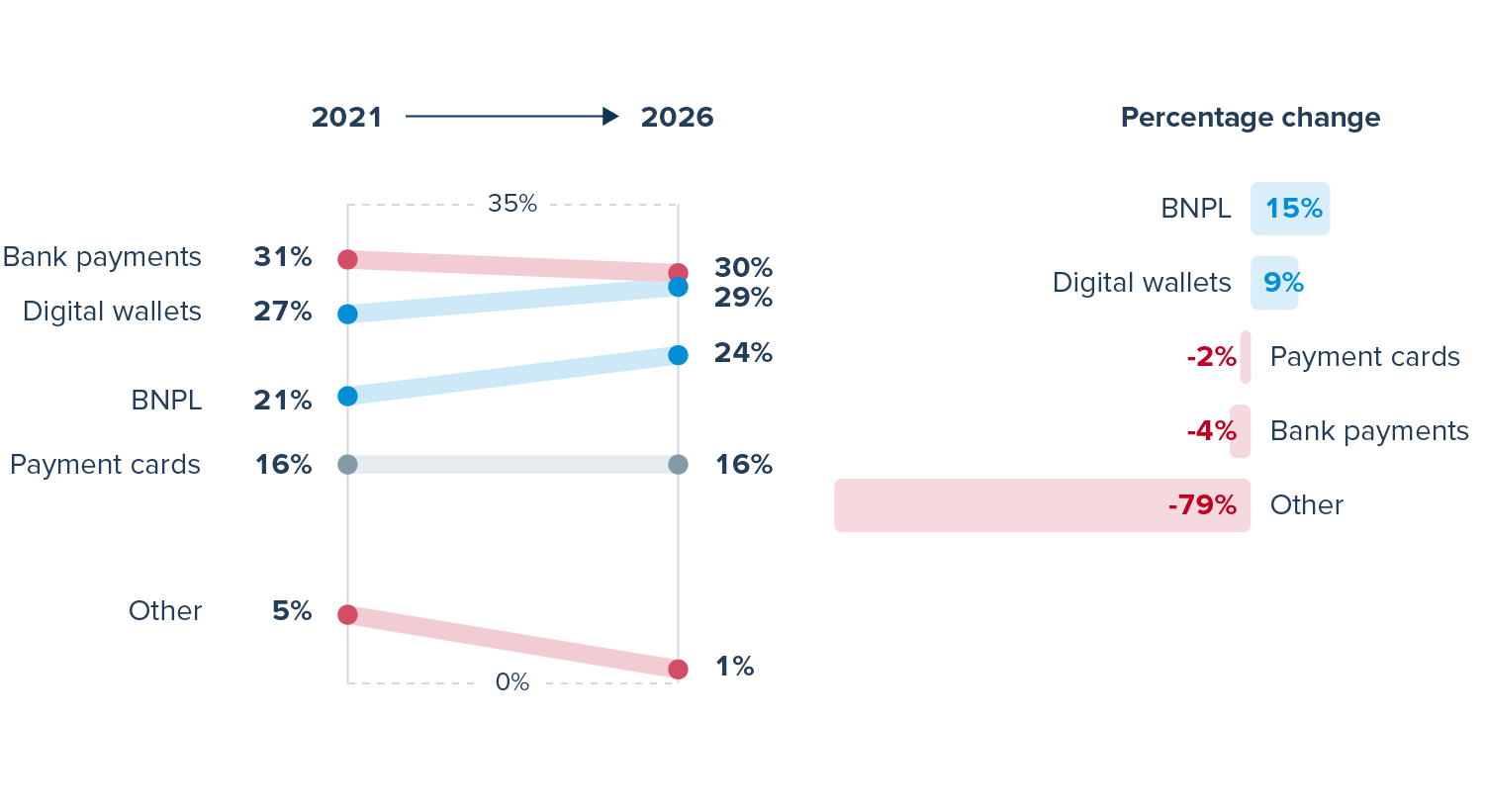

Even in card-centric markets such as the UK and France, overall market share of payment cards is expected to decrease as bank and digital wallet payments grow.

Where there is a strong national bank transfer scheme, it typically dominates ecommerce market share – for example Blik in Poland, iDEAL in Netherlands and Swish in Sweden.

Open banking payments are growing rapidly in the UK and show high conversion rates. They have strong potential in markets such as Germany, where bank transfer payment methods are preferred.

Market Insights

🇧🇪 Belgium

Overview

Although payment cards are predominantly used for ecommerce payments in Belgium, digital wallets, bank payments, and BNPL are all set to gain market share from cards over the next five years. Ecommerce as a percentage of total sales is relatively low compared to other Western European markets. As in the Netherlands, key online sellers include Coolblue, Bol and Zalando.

For bank payments, the Centre for Exchange and Clearing (CEC) and TARGET2 form the core of the Belgian payment infrastructure. CEC is the retail payment system which processes domestic payments within the country. Bancontact, formerly Mister Cash, is the domestic debit brand that is issued widely in the country.

Payment methods

Popular APMs: Klarna, Bancontact, Payconiq

Payment cards are popular for making online purchases, but their share of ecommerce payments is expected to decline from 50% in 2021 to 43% in 2026. Both BNPL and digital wallets are expected to grow, reaching 17% and 14% of ecommerce payments by 2026.

Bancontact is the most popular method in Belgium, with almost every citizen using a Bancontact card. It's a debit card which is used for both physical and online payments and also allows the setting-up of recurring transactions via SEPA Direct Debit. Sofort (now owned by Klarna) is also popular for bank payments.

🇫🇮 Finland

Overview

Finland is a small country with just over five million people who are highly connected to financial services providers. It's estimated that 95% of online consumers using internet banking. Bank payments are popular and are expected to grow. Most popular retail sites include Verkkokauppa, Gigantti and Zalando.

For Finland, the most significant system related to retail payments is the pan-European STEP2 system, managed by EBA Clearing and used by banks operating in Finland for the processing of credit transfers and direct debits throughout the euro area. Settlement is undertaken over TARGET2, the European RTGS system.

Payment methods

Popular APMs: Klarna, Paytrail, MobilePay, Siirto, OP, Jousto, Walley

Alternative payment methods represent a majority of ecommerce payments in Finland. Cards are only used for an estimated 29% of ecommerce payments, equally divided over credit and debit cards. Alternative payment options are growing in popularity and as a result the market share of payment cards is expected to decline to 22% by 2026.

Finnish online shoppers prefer to pay through online bank transfers, which make up 37% of ecommerce payments in 2021 and are expected to grow to 39% by 2026. Bank payments take place through payment solutions from Paytrail or others offering instant payments. Paytrail enables customers to pay for goods and services online using cards or bank accounts.

For payments over mobile devices, MobilePay, Pivo, Siirto, and Apple Pay are prominent. BNPL is expected to grow from 13% of ecommerce payments in 2021 to 16% in 2026. BNPL providers include Op, Jousto and Walley.

See also: the bank-led initiative P27 mentioned under the profile for Norway.

🇫🇷 France

Overview

France is the fifth largest ecommerce market globally. Around 80% of consumers make online purchases in France. Amazon dominates online sales, followed by Cdiscount and Veepee. The most popular product are fashion goods and accessories. The top three markets French online merchants sell to are Belgium, Spain and Germany.

French card spending is amongst the highest in Europe at approximately $8,000 per card and each payment card averages 15 transactions per month. As with other developed markets, the population is highly banked.

France’s instant payment system known as STET (Systèmes Technologiques d’Echange et de Traitement) is the driving force in APMs' projected growth. It has now implemented a new pan-European clearing and settlement mechanism to process instant payment transactions. The STET framework is helping the implementation of open banking payments.

Payment methods

Popular APMs: PayPal, Lydia, Cartes Bancaires, Cashway

French online shoppers have a strong preference for payment cards, which made up 50% of the ecommerce market in 2021. However, card market share is projected to decline to 44% by 2026. Debit and deferred debit cards are more commonly used for payments over credit cards.

Wallets are becoming increasingly popular among French consumers, accounting for just over a quarter of ecommerce payments in 2021. French consumers tend to use wallets for payments with limited focus on stored value (eg PayPal and Lydia are mainly used as staged or pass-through wallets).

Tech-savvy consumers are increasingly using neo banks for day-to-day transactions and for secondary bank accounts. BNPL is also expected to grow, making up 9% of market share in 2026.

How are open banking payments developing?

Open banking payments had a rocky start in France as the the user experience provided by the banks wasn't intuitive: authentication flows were long and errors were frequent. However this is changing.

The regulator of open banking in France, the Autorité de contrôle prudentiel et de résolution (ACPR), is ensuring that banks improve their PSD2 implementations (or DPS2 as it’s known in France).

In the last year, the volume of open banking payments in France has increased by 800% and this is set to accelerate further in 2022. Conversion rates have also increased by 15% over the past year and TrueLayer anticipates they'll continue to improve, as the regulator has now set a timetable for when all banks will release app2app journeys.

🇩🇪 Germany

Overview

Germany is the fourth largest economy in the world and the sixth largest ecommerce market globally. German consumers prefer bank payments and digital wallets as they're seen as convenient and secure. The ready availability of overdraft facilities also dampens the demand for credit cards.

Overall, card payments will likely retain their market share (16%) for ecommerce payments over the next five years, as consumers value the convenience, rewards, and discounts card products offer. Major online retailers include Amazon, Otto and Zalando.

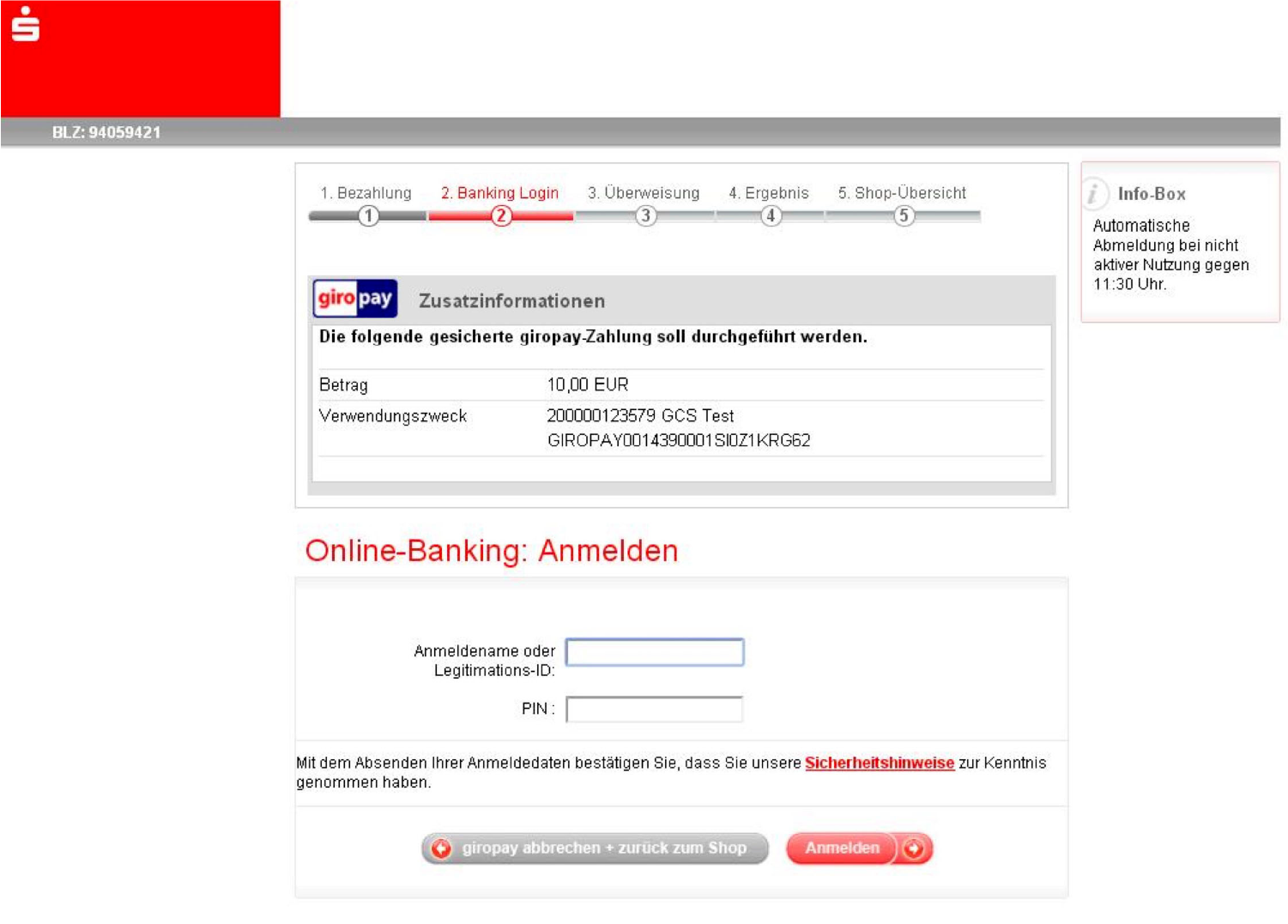

Online bank transfers are provided by third party providers such as Giropay and Sofort (now part of Klarna). Bank transfers are popular among retailers, as the payment is simple and cannot be reversed.

Elektronisches Lastschriftverfahren (ELV), an electronic direct debit system created by retailers in the 1980s to leverage debit cards at the point of sale, allows quick and easy payments. ELV/OLV “hybrid” payments are specific to Germany and offer low cost payments (compared to credit cards) initiated and managed by merchants.

Payment methods

Popular APMs: Giropay, Sofort, PayPal, Klarna

Open banking has significant potential in Germany due to the country’s cultural preference for bank payments and aversion to credit cards. PayPal is widely used in Germany, especially for cross-border ecommerce payments.

Germany ranked second in Europe in terms of daily active users of the PayPal app in 2019, just behind the United Kingdom. International payment solutions such as Apple Pay are gaining traction for online and in-app payments in the country.

BNPL, an emerging global trend particularly among Generation Z consumers, has been particularly popular in Germany for the past several years in the form of invoice payments.

This trend is likely to continue, helped by the increase in online payments during the pandemic and a rising number of merchants and payment providers offering this service.

Popular BNPL companies in Germany include Klarna and Afterpay (acquired by Square). PayPal also offers BNPL with PayPal Credit, and American Express partnered with Solarisbank to use its BNPL service called SplitPay.

How are open banking payments developing?

In Germany, account-to-account (A2A) payment options are common and well used. Open banking enhances the existing A2A experience by improving security and user experience (for example, by giving businesses using these APIs access to payment statuses).

Some German banks have complied with PSD2 in a different way than banks in other EU member states. Instead of redirecting consumers from a third party provider to their bank to authenticate access, some banks follow an ‘embedded’ approach. This means that a third party provider asks the consumer for their credentials and then transmits these credentials to the bank.

🇮🇪 Ireland

Overview

Ireland has one of the highest GDP per capita indicators in the world, ranking in the top ten, but this is misleading as GDP is influenced by the multinationals who have their European main offices in the country. Cards are the preferred method of payment for Irish consumers.

Using mobile devices to pay for ecommerce purchases is also popular, making up 42% of total ecommerce sales. Top online sellers include Amazon, Argos and Tesco.

The majority of ecommerce payments in Ireland are made with cards.

Along with the UK, Ireland leads open banking in Europe in terms of regulation and adoption.

Payment methods

Popular APMs: PayPal, Apple Pay

In 2021, payment cards dominated the market for ecommerce with a share of 60%, but this is forecast to decline to 50%. Debit cards represent the majority of card payments online.

Bank payments are estimated to increase from 8% in 2021 to 13% in 2026. Digital wallets, which had 23% market share in 2021, are forecast to increase to 28% in 2026.

Similar to the UK, PayPal is by far the dominant digital wallets player in Ireland.

How are open banking payments developing?

Open banking payments in Ireland are yet to find their stride, unlike fintech more widely, which has grown quickly among a young and tech-savvy population (one third of Irish adults now have a Revolut account, for example).

For open banking payments to take off in Ireland, some of the largest banks need to improve their authentication user journeys – for example, replacing outdated methods like card readers and simplifying clunky interfaces.

Still, there is plenty to be excited about. Some banks – such as Permanent TSB – are investing in features like app-to-app authentication and improving their user experience more widely. Progress could happen quickly here, as the Irish retail banking landscape will soon be condensed to three main providers.

🇮🇹 Italy

Overview

Italy has the fourth-largest GDP in Europe after Germany, the UK and France. However, the ecommerce market has historically been underpenetrated and underdeveloped, though this is improving.

Overall, Italy is still cash-based, estimated at over 85% of all payments, in contrast with the other large European markets. Major online sellers include Amazon, Apple and Zalando.

Nexi operates the country’s Automated Clearing House (ACH) and processes SEPA transfers. MyBank enables real-time bank transfers via internet banking authentication. It's increasingly used for P2M payments and is connected to most banks.

Instant payments are enabled by EBA Clearing via RT1, which is the payment infrastructure service for processing of SEPA Instant Credit Transfers (SCT Inst). Bancomat is the local debit card scheme and interbank network for ATMs. Most Bancomat cards are co-branded for international use with an international scheme.

Payment methods

Popular APMs: PayPal, Bancomat, Satispay, MyBank

Cards are popular and used for nearly a third of ecommerce payments, but wallets command a greater share of total ecommerce payments (36% in 2021).

PayPal is by far the dominant player in the wallet space with more than 80% of all wallet transactions. While PayPal is the leading P2P payment service provider, Bancomat Pay is emerging in Italy with more than 10 million registered users. It's mainly used for personal transfers, but the number of ecommerce merchants accepting Bancomat Pay is growing.

Satispay, a digital wallet founded in 2015, is popular in the metropolitan areas of the north (Milan and Turin). Satispay offers users cashbacks to incentivise purchases both in-store and online.

The market share for online payments is still low but growing. With MyBank, consumers are redirected to their internet banking for completing and authorising the purchase using their bank credentials.

🇳🇱 Netherlands

Overview

The Netherlands is a significant ecommerce market and has unique characteristics relating to payments. It is one of those markets where consumers have been averse to using open-ended credit and prefer bank transfers to meet their payment needs.

Major online retailers include Bol, Coolblue and Zalando.

Banks participate in domestic bank transfers that are cleared through the country’s clearing system supervised by the central bank, DNB. The Dutch payment system, iDEAL, which enables direct banking payments, dominates ecommerce payments.

The Netherlands’ giro system has been upgraded and instant payments were rolled out in March 2019. Payments via mobile and online banking are processed immediately and credited to the beneficiary’s account usually within five seconds.

Payment methods

Popular APMs: iDEAL, Klarna, paysafecard, Afterpay

Bank payments dominate ecommerce, making up 64% payment marketshare in 2021. These are growing but will lose overall market share marginally by 2026.

Payments using digital wallets like PayPal are expected to register the fastest growth increasing from 8% in 2021 to 13% in 2026. Payment cards are also used online and are expected to maintain their share of online payments at 13% between 2021 and 2026. BNPL is also forecast to grow.

iDEAL represents a significant part of online bank payments. While iDEAL is used by Dutch consumers, the payment method is now accepted by a growing number of merchants in over 60 countries. Online shopping and payment over mobile devices are popular and around 70% of iDEAL payments are made via consumer mobile banking apps.

Besides ecommerce purchases, iDEAL is also extensively used to pay energy bills, make charity donations, buy mobile pre-paid credit and pay taxes and fines. iDEAL payments continue to grow, increasing by 33.5% in 2020 over 2019.

How are open banking payments developing?

Consumers in the Netherlands are used to paying by bank transfer. The local banks have optimised their open banking implementations with slick app2app flows, like those that have powered the success of open banking payments in the UK. TrueLayer is seeing promising payment conversion rates as the volume of open banking payments grows.

🇳🇴 Norway

Overview

Like Finland, Norway is a small country and one of the richest in Europe by GDP per capita. Cards are popular for ecommerce payments and were used for around 40% of online purchases in 2021. Top online retailers include Elkjop, Komplett and Zalando.

Norway has advanced banking and payment systems. It has its own domestic debit card scheme called BankAxept, which is bank-owned. It was launched in 1990 and is managed by Finance Norway.

For inter-bank payments, banks have access to Norges Bank’s settlement system (NBO) via the international SWIFT network, or a system resembling a web-based banking application called NBO Online.

Payment methods

Popular APMs: Vipps, paysafecard

Cards are the preferred way to pay online in Norway. They're used for a majority of physical payments, as the use of cash has declined significantly. Alongside Iceland, Norway has the highest usage of cards per capita in the world.

The use of alternative payments online is growing and digital wallets, bank payments and BNPL will together represent nearly two thirds of total payments in 2026.

Additionally a mobile payments service called Vipps is very popular. Initially designed for P2P payments, it's now used to pay for online purchases as well. As is the case for Venmo in the United States, Vipps is now used as a verb, with consumers “vipping” to pay others.

A new joint initiative, P27 – intended to represent 27 million Nordic citizens – by Danske Bank, Handelsbanken, Nordea, OP Financial Group, SEB, and Swedbank, aims to establish a pan-Nordic payment infrastructure for domestic and cross-border payments in the Nordic currencies and the euro.

🇵🇱 Poland

Overview

Poland is a high growth market in terms of ecommerce and will outperform major developed markets significantly in the future. But it's currently underpenetrated for ecommerce. Growth is expected to be driven by a young and educated consumer base with a preference to shop online, online connectivity and high smartphone penetration. Major online retailers include Media Expert, Euro and Zalando.

Poland’s payment systems are technologically advanced. It was one of Europe’s earliest adopters of contactless card technology.

Poland’s national clearing house and payment infrastructure provider is KIR, which enables bank transfers including direct debits. It has also developed the Express Elixir System, which clears and settles bank payments in real-time without any intermediary institutions. Express Elixir claims to be the second oldest instant payment system after the UK’s Faster Payments service in Europe.

Payment methods

Popular APMs: BLIK, YetiPay, Przelewy24

Bank payments commonly referred to as Pay-by-link (PBL) account for just over half of total ecommerce spending. These are popular due to high conversion rates and consumer familiarity, and are perceived to be highly secure compared to payment cards as no payment details are shared with merchants.

A popular mobile payment method in Poland is BLIK, which is embedded in banking applications and covered by all major Polish banks. Over 90% of Polish bank customers have the option of using BLIK in mobile banking applications.

Wallets are gaining popularity for both domestic and cross-border ecommerce and in specific verticals that require consumers to keep track of their spending. The top three wallets in Poland are PayPal, Google Pay and Apple Pay.

As in other growing markets, cash-on-delivery is still popular for buyers who don't like to pay online for security reasons or because they may want to inspect goods before paying. However, this method is steadily declining.

🇪🇸 Spain

Overview

Spain is one of the largest and fastest growing ecommerce markets in Europe. It has historically been underpenetrated and underdeveloped, but ecommerce has grown significantly since the pandemic.

Top ecommerce product categories include fashion, leisure, footwear and digital communication devices. Major retailers who sell online include Amazon, El Corte Inglés and PC Componentes.

Spain’s instant payment system, known as Bizum, enables people to make instant bank payments by linking their phone numbers and email addresses to their bank accounts for both P2P and P2B. The three Spanish acquiring networks (Euro 6000, ServiRed and Sistema 4B) merged to form Sistema de Tarjetas y Medios de Pago (STMP). Their processing arms merged to form Redsys, which processes an estimated 85% of domestic payments.

Iberpay operates the country’s Automated Clearing House (ACH) rails and processes SEPA transfers.

Payment methods

Popular APMs: PayPal, Bizum, Klarna, paysafecard, SEPA Direct Debit

Payment cards accounted for an estimated 45% of payment transaction volume for ecommerce in Spain in 2021. Card holding is roughly similar to the European average, but transactions per card and annual spend per card are both lower than peers.

Credit card issuance is high when compared to other European markets, except the United Kingdom.

Wallets are expected to increase their market share from 31% in 2021 to 35% in 2026 at the expense of payment cards.

PayPal is the dominant player in the digital wallet space in Spain. Launched over a decade ago, it was the first means of making quick P2P payments besides A2A bank transfers. Wallet initiatives have now been launched by more players including banks (BBVA Wallet, CaixaBankWallet), mobile network operators (Orange Cash), mobile phone manufacturers (Apple Pay, Samsung Pay).

How are open banking payments developing?

While Spain is still a card-dominated market, open banking payments are showing promising signs of growth. Early-adopter fintechs and PSPs such as HeyTrade, Revolut and Paysafe now offer this payment method.

Growth of open banking payments in Spain has been driven by the roll out of app2app authentication in 2021, which significantly improved user experience, causing payment conversion rates to jump 10% on average.

🇸🇪 Sweden

Overview

Mobile device usage for digital payments is high in Sweden, as it is in most Scandinavian markets. Swish, a mobile payment app operated by the country’s leading banks, allows person-to-person as well as ecommerce payments and is used by two thirds of the population. Major retailers include Apotea, CDON and Zalando.

The core backbone of Sweden’s inter-bank payments is the payment system called RIX. Banks, clearing organisations, the Swedish National Debt Office and the Riksbank participate in the system.

A new service called RIX-INST will enable payments to be settled between banks in real time. The P2P payment service Swish is very popular and has now overtaken cash in terms of payments market share.

Payment methods

Popular APMs: Klarna, Swish, Apple Pay, Google Pay, paysafecard

Sweden is the home of BNPL leader Klarna and traditionally consumers have preferred to be invoiced for a purchase to pay at a later stage. Sweden is an advanced market where APMs including BNPL represented two thirds of the ecommerce payment mix in 2021, growing to 70% in 2026.

As mentioned above, Swish payments have become increasingly common. The global pandemic has led to an increase in non-cash payments and fuelled the growth in Swish payments. Apple Pay and Google Pay are also becoming more popular.

Payment cards are also important for ecommerce payments, holding a third of the payments market share. They're extensively used for physical POS payments, accounting for 75% of all physical world payments. However, for ecommerce, payment cards are expected to lose overall share to digital wallets, BNPL and bank payments by 2026.

See also: the bank-led initiative P27 mentioned under the profile for Norway.

🇬🇧 United Kingdom

Overview

The ecommerce market in the United Kingdom is the largest in Europe and the third largest in the world.

Online marketplaces Amazon and eBay dominate the landscape. Shoppers are internet savvy with well over 85% making purchases online. Key online retailers include Amazon, eBay and Argos.

Vocalink, part of Mastercard, operates the underlying payment systems for bank transfers and ATM transactions. Card transactions are processed by the card schemes on their switching networks.

Faster Payments is the local bank payment system for instant payments. Launched in 2008, it was one of the first in the world. Direct Debit payments are enabled in the UK by the BACS Direct Debit scheme.

The UK does not have a domestic card scheme. The UK has progressed well on open banking payments which leverage the Faster Payments system.

Payment methods

Popular APMs: PayPal

The UK is a card-centric payments market. Payment cards accounted for 51% of online payments by value in 2021. The UK is a mature payments market, and the payments mix is not forecast to undergo significant changes through to 2026.

Payment cards will remain the predominant online payment method, but their market share is projected to decrease to 47%.

Wallets are popular in the UK, making up nearly a third of online payments in 2021, increasing to 35% by 2026. PayPal is used extensively by UK consumers and Paysafe wallets are also used widely.

BNPL, though small, will grow to 9% market share in 2026 as the market expands.

How are open banking payments developing?

While the dominant UK payment method is still cards, open banking payments are growing rapidly. The UK open banking ecosystem has benefited from strong regulation and a common API standard. Banks have delivered consistently on features like app-to-app payments and biometric authentication, which have led to a frictionless user experience.

In 2021, more than 20 million payments were made, with an estimated total value of more than £10 billion and there are now more than 5 million open banking users – with one million new users joining every few months.

UK consumers can already make a variety of transactions through open banking. Among other examples, they can pay their tax, top up their investment or trading accounts through platforms like Freetrade, buy a car through retailers like Cazoo and give to charity through platforms like JustGiving.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)