You've optimised your checkout UX. You've invested in user education. You've positioned Pay by Bank prominently in your payment options. When customers do choose Pay by Bank, the end-to-end conversion rate is high.

Yet adoption remains stubbornly low.

Here's the uncomfortable truth: two-thirds of UK shoppers say they'd try Pay by Bank, but when they reach checkout, most still default to card payments, even if they find the downsides of card payments frustrating. And forcing your customers to try a new payment method without an obvious benefit to them — even if it would be beneficial to you — can lead to unnecessary churn.

The reason? Habit is powerful, and breaking it requires more than just a better product.

This is where incentives become critical, not as a cost, but as a strategic investment that transforms payment economics. When done well, incentives turn interest into action and first-time users into repeat customers.

What is Pay by Bank?

Pay by Bank is a payment method that lets customers pay for things directly from their bank account via their bank app, without the need for card networks.

The adoption gap: when better doesn't mean chosen

Pay by Bank offers clear advantages: instant settlement, lower transaction costs, and zero chargebacks. For ecommerce merchants, it's better than card payments in many ways.

But customers don't care about your cost structure. From their perspective, cards are familiar. They've been using them for decades. And for all their limitations, switching to a new payment method — even one that's faster and more secure — requires overcoming psychological inertia.

This creates a value gap. You want lower costs and better settlement terms. They want confidence, convenience, and a reason to change their behaviour. Incentives bridge that gap by answering the customer's fundamental question: "What's in it for me?"

Incentives and their place in the Pay by Bank flywheel

Incentives in the world of payments are simply a promise of some kind of gift or benefit for making a payment using a specific payment method.

At TrueLayer, we’ve learned through helping hundreds of businesses implement and launch Pay by Bank at checkout, incentives are a key lever in building a high-performing Pay by Bank experience: one which customers choose (AKA adoption), are able to successfully complete (AKA conversion) and choose time and time again (AKA retention).

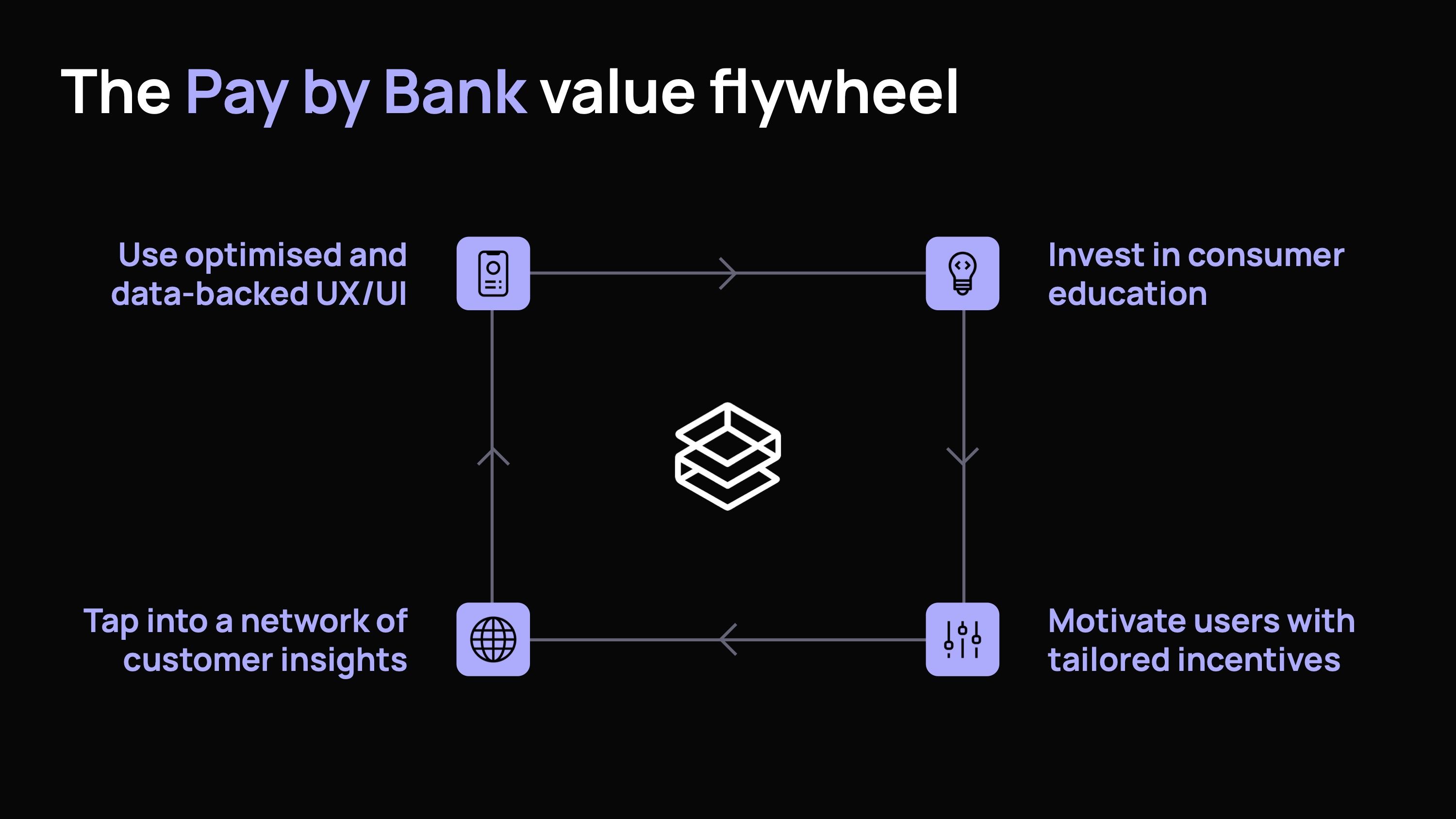

The flywheel includes:

Using optimised, data-backed UX/UI

Investing in user education in the checkout and beyond

Motivating shoppers with tailored incentives (what we're talking about here)

Tap into a network of customer insights

Together these factors create a virtuous circle, where one element could be the spark that compels the user to select Pay by Bank, another to get them over the line, and another to keep them coming back to Pay by Bank in the future.

Designing incentives that drive behaviour

But even within this framework, incentives are unique. Good UX and consumer education create readiness. The cross-merchant network of user insights steadily improves ALL Pay by Bank experiences. Incentives, more than any other tactic, inspire action.

And not all incentives are equal. The most effective programmes match reward type to customer psychology and transaction context.

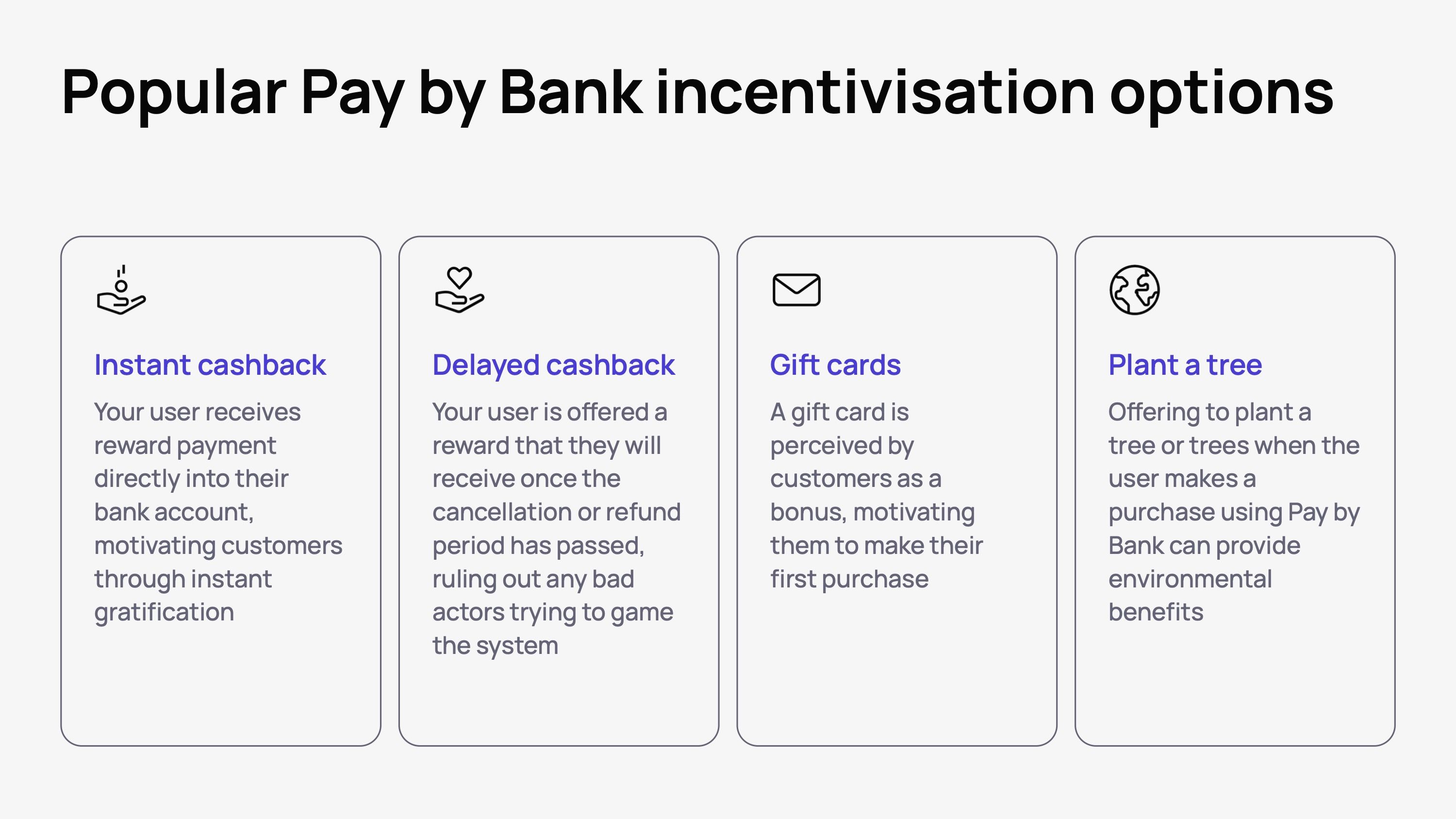

Instant cashback works through immediate gratification. The customer completes their payment and receives money directly into their bank account within seconds. This creates a powerful emotional response and clearly shows the benefit of using the method.

Delayed cashback offers protection against fraud and returns abuse while still providing meaningful value. By setting the reward to arrive after your cancellation window closes, you minimise concerns about customers gaming the system.

Gift cards are perceived as bonus value rather than direct cost savings, making them psychologically appealing even at lower nominal values.

Environmental incentives like tree planting resonate with values-driven customers and align with broader ESG commitments, creating a compelling narrative beyond pure economics.

The key is matching the type of incentive to your customer segments. High-value, infrequent purchasers may respond best to larger delayed cashback. Frequent buyers in lower-value categories might prefer instant gratification. Testing different approaches across segments lets you optimise both effectiveness and cost.

Making incentives visible and compelling

And the best incentive in the world won't drive behaviour if customers don't notice it. Successful programmes embed incentive messaging throughout the payment journey:

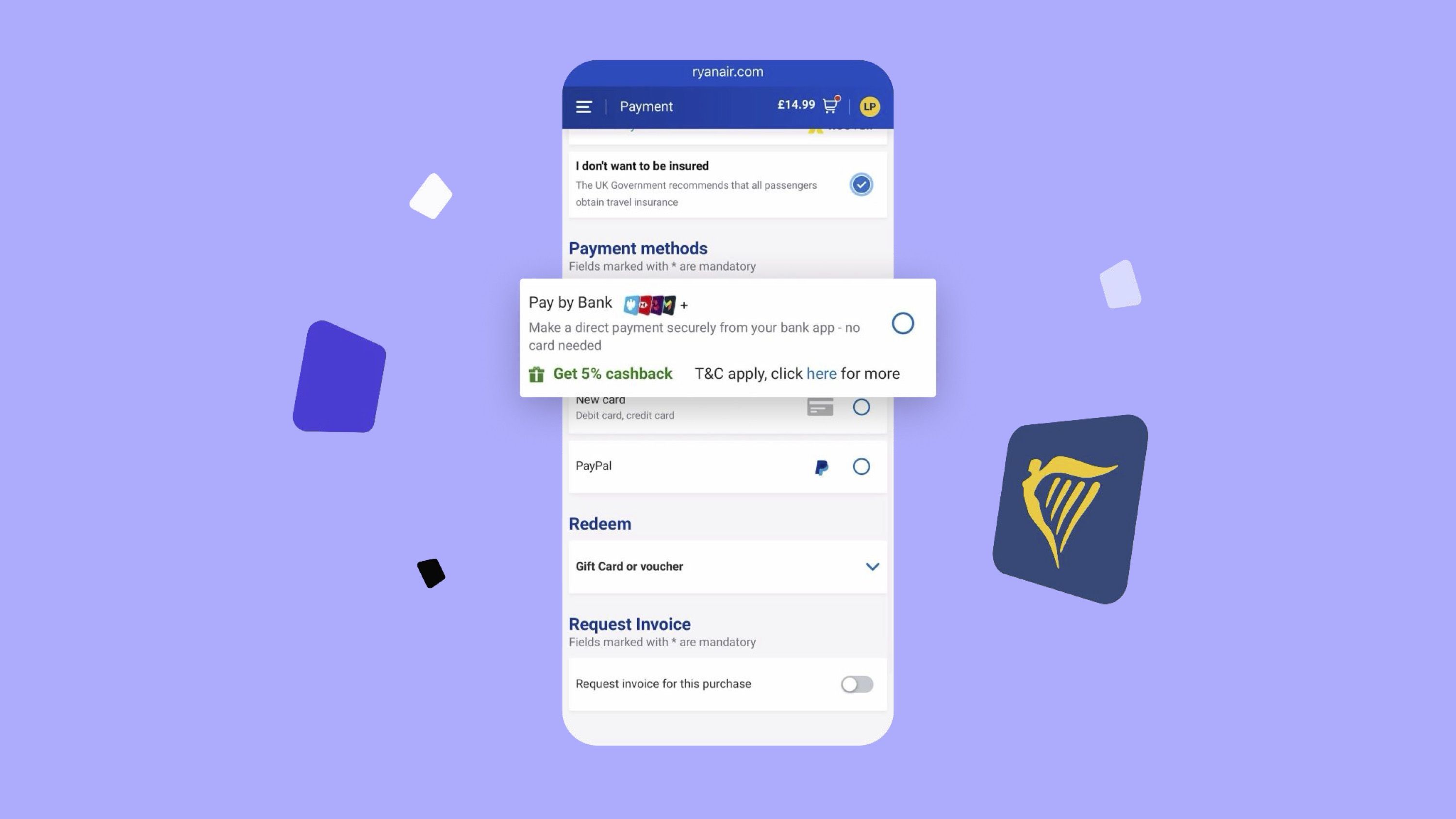

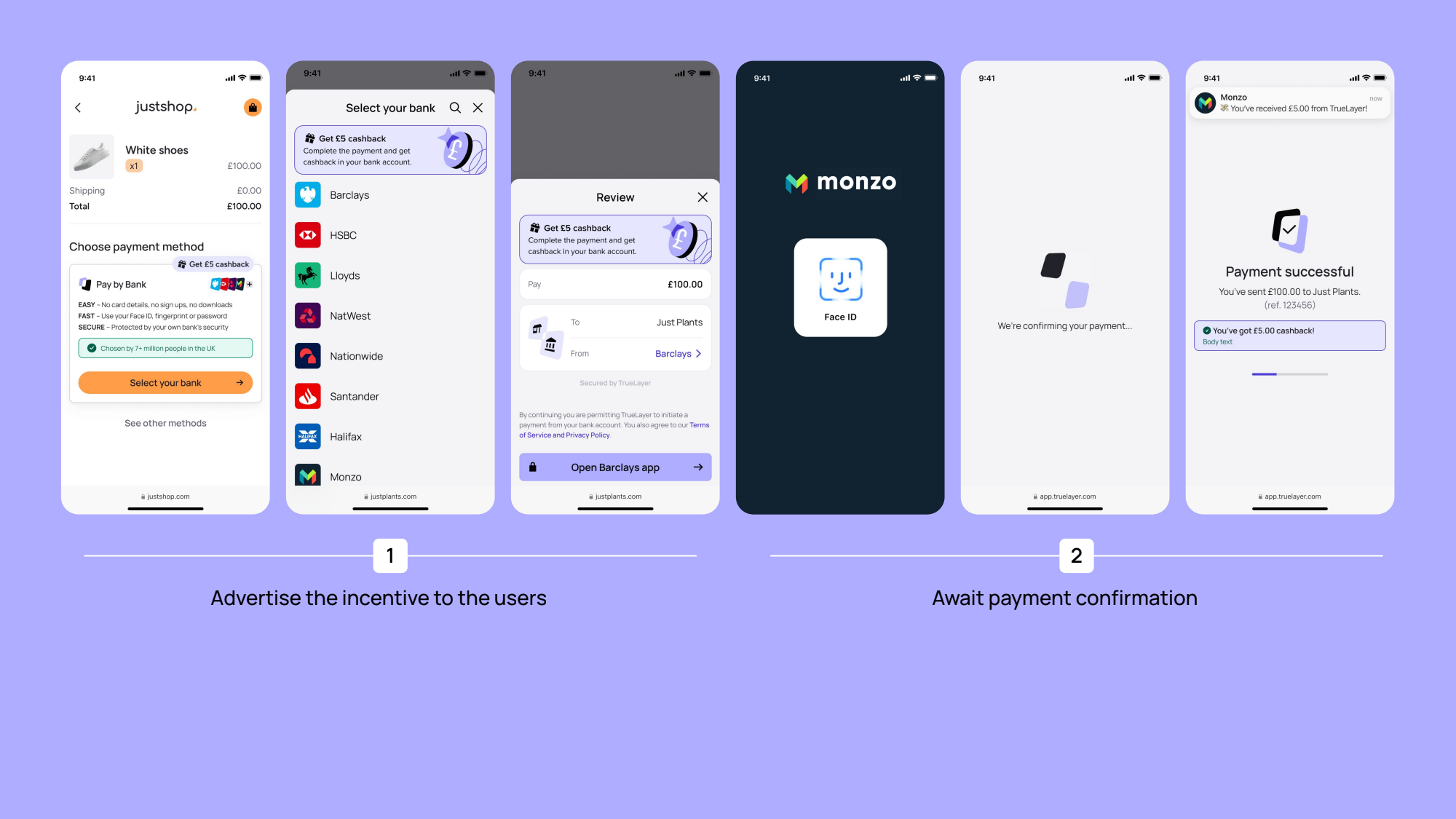

At the checkout page, position Pay by Bank first with a clear incentive badge: "Earn £5 cashback" or "Get 10% back instantly." This creates immediate awareness at the critical decision point.

During bank selection, reinforce the coming reward: "Your £5 cashback will arrive in your account within 60 seconds." This maintains motivation through the authentication process.

At payment confirmation, clearly communicate delivery: "Payment successful! Your £5 cashback is on its way." If you've promised instant payout, deliver instantly. Nothing undermines trust faster than an unfulfilled promise.

Beyond checkout, promote incentives through email newsletters, website banners, in-app notifications, and dedicated landing pages: one TrueLayer merchant saw a 10% conversion uplift simply by adding an in-app banner recommending Pay by Bank with an incentive. Multi-channel communication compounds your investment by increasing awareness before customers even reach checkout.

The ROI of building Pay by Bank habits

While incentives aren't the whole answer to payment adoption, they might be the overlooked piece that makes everything else click into place.

Beyond the initial incentive-driven transaction, we found that shoppers who've used Pay by Bank before demonstrate 22% higher conversion rates than first-time users. And ecommerce brands are seeing that Pay by Bank, once over the initial adoption hurdle, has a strong repeat user base, including cashback app JamDoughnut who see 85% of all of their Pay by Bank transactions coming from returning customers.

And this is where the long-term value of incentives becomes clear A £5 incentive on a £50 transaction might seem costly at first, but if that customer makes further purchases using Pay by Bank each time, and each time you’re saving on costly card fees, chargeback costs and the opportunity cost of failed payments, you’ll very quickly recoup that initial cost.

Common incentive pitfalls and how to avoid them

The most common mistake is over-incentivising — creating dependency rather than driving genuine preference. If your incentive is so large that customers would never choose Pay by Bank without it, you've failed to demonstrate the method's inherent benefits. Start with modest incentives and test threshold levels where adoption lifts significantly.

Equally problematic is under-communication. Invisible incentives waste effort and budget without driving behaviour. If customers discover the incentive only after payment completion, you've missed the critical decision moment.

Finally, don't let incentives become a band-aid for poor user experience. If your Pay by Bank flow is confusing or unreliable, no amount of cashback will create loyal users. The incentive exists to overcome initial hesitation and habit, not to compensate for poor UX. Fix the experience first, then use incentives to accelerate adoption.

Build your own high-performing Pay by Bank experience

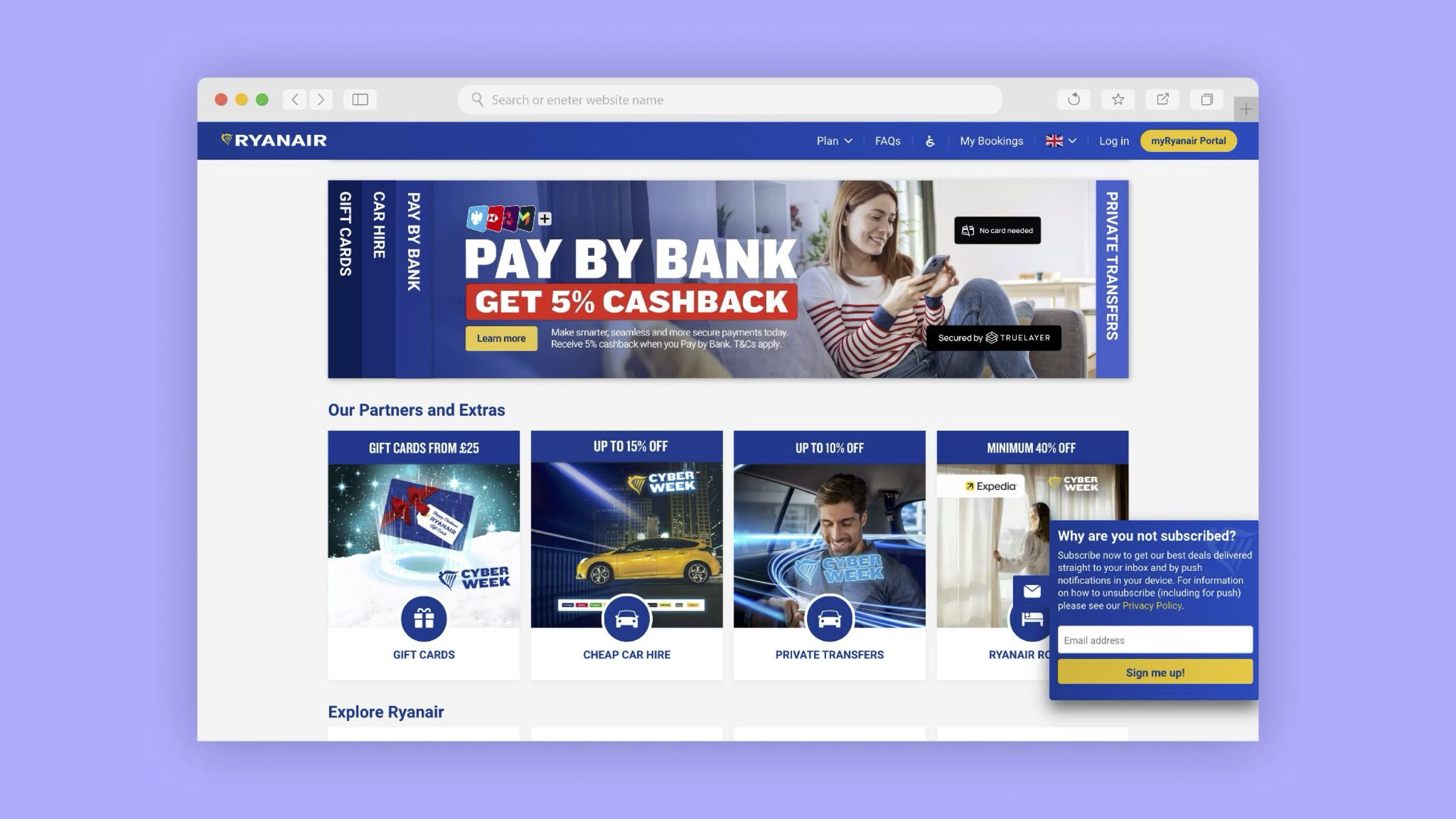

TrueLayer is Europe’s largest Pay by Bank provider, processing over $100 billion worth of payments each year. We power smarter, faster and safer payments online and in-app. We work with the likes of Just Eat Takeaway, Ryanair, lastminute.com, Papa Johns and more to offer Pay by Bank as a payment method in some of the world’s busiest online checkouts.

In our Pay by Bank in action guide, we condensed our hard-earned learnings on Pay by Bank into one tactical, digestible and data-backed guide.

Why your iGaming payment stack needs to work as one

We don’t need another Wero: building on Pay by Bank

)

)

)

)

)

)

)

)

)

)