Payouts — when funds are transferred from a merchant's account to a recipient's account — are both a key part of the overall payment journey and a huge headache for many businesses. You may know them as withdrawals or refunds, but any time you have a need to send money to your customers or vendors — and you don’t have an automated solution — you’ll know the pain all too well.

Who actually needs payouts?

There are several industries where a mechanism for paying out money online is a key part of your payment operations. These include:

Insurance providers

Lenders

Marketplaces

Proptech

Gig economy businesses

The problem with manual payouts

Typical payout options for businesses today include the likes of manual bank transfers, card payments and options like Visa Direct. While they’re all different, they all suffer from some combination of the following issues:

Slow settlement speed

Consumers want instant payments, and the same is true for payments coming into their accounts. Cards, for example, can take up to five days to settle. Manual bank payouts (sent through Bacs in the UK or SEPA credit across the Eurozone) are only marginally quicker on average. They can take up to three days to settle. Faster alternatives — such as Visa Direct — are better, but still fail to provide real-time solutions, with settlement speeds of between 30 minutes and six hours. Better, but certainly not instant.

Fragmented coverage across Europe

Current payout solutions are typically fragmented across Europe. This means if your business operates in several countries, or even simply has plans to expand internationally, you face the prospect of setting up and managing different payouts solutions in each market, each with their own specifications that your team has to navigate.

High failure rates

Not all attempted payouts reach the intended recipient at the first time of asking. Manual options like bank transfer require manual uploads of batch files and CSV tracking. It’s easy to see how human error can result in failed payouts, and payments teams lack visibility on which payments have failed and why. Card payments can fail, too, whether that’s because someone manually inputs incorrect details or because a card is lost, stolen or expires.

High transaction costs

Card-based payouts typically come with high and — potentially — inhibitive fees for some merchants. In the case of refunds, the merchant is charged a transaction fee for the payout and does not recoup the interchange fee charged for the initial payment.

As frustrating as these problems are, they probably aren’t a surprise to you. But when your payouts consistently suffer from these issues, your business can be impacted in other — more insidious — ways, which can be damaging in the long run.

The 3 hidden dangers of poor payouts

1. High operational costs and overhead

In addition to high transaction fees, manual and error-prone payouts can involve a huge operational burden, which in turn leads to high operational costs. As mentioned, manual bank transfers require manual upload of batch files and CSVs tracking, along with manual reconciliation.

And even then, payouts can and do fail. When a payout fails, your team has to spend time resolving the complaint directly with your customers, uncovering the failed payout in question and then retrying that payment again. Retrying a payout restarts the manual admin loop.

2. Customer dissatisfaction and churn

When you combine the inability to pay out in real time along with some payouts failing, and add to that difficulties with identifying and correcting those failed payments, you have a perfect storm of potential customer dissatisfaction. And dissatisfied customers aren’t afraid to turn to your competitors if they think they’ll enjoy a faster withdrawal process.

For example, almost half of current investors (46%) would be likely to switch providers if the new platform offered instant withdrawals, and in iGaming, 55% of all players would make the switch. In short, bad payouts equals higher churn. How comfortable are you with losing customers you fought so hard to win over a poor payouts process?

3. Loss of customer lifetime value (LTV)

Losing customers to your competitors will obviously impact LTV, the total worth to a business of a customer over the whole period of their relationship. But even if your customers do put up with a slow and prone-to-failing payouts process, you may be missing out on additional customer spend.

For example, more than one-third of current investors (37%) would consider investing more, given the ability to withdraw their funds instantly. Poor payouts leave money on the table. Build an instant payouts experience instead, and you’ll stand to:

win customers that switch from your competitors, because of their poor payouts process

retain more of your existing customers, losing fewer to involuntary churn

increase the average lifetime value of your customers

So, how can you build a better payouts experience for you and your customers?

At TrueLayer, we know the pain of bad payouts, which is why we’ve built our own instant payouts solution. Built on the fastest payments rails across the UK and EU, Payouts settle in real time with close to 100% of those payouts settling successfully at the first attempt. That means no more CSVs and manual payout-tracking processes. Cut operational costs, and build a payouts or withdrawal experience that will help you win and retain more customers.

To find out more, talk to one of our payment experts about how TrueLayer could benefit your business.

Software engineering in the age of AI: run the mile you're in

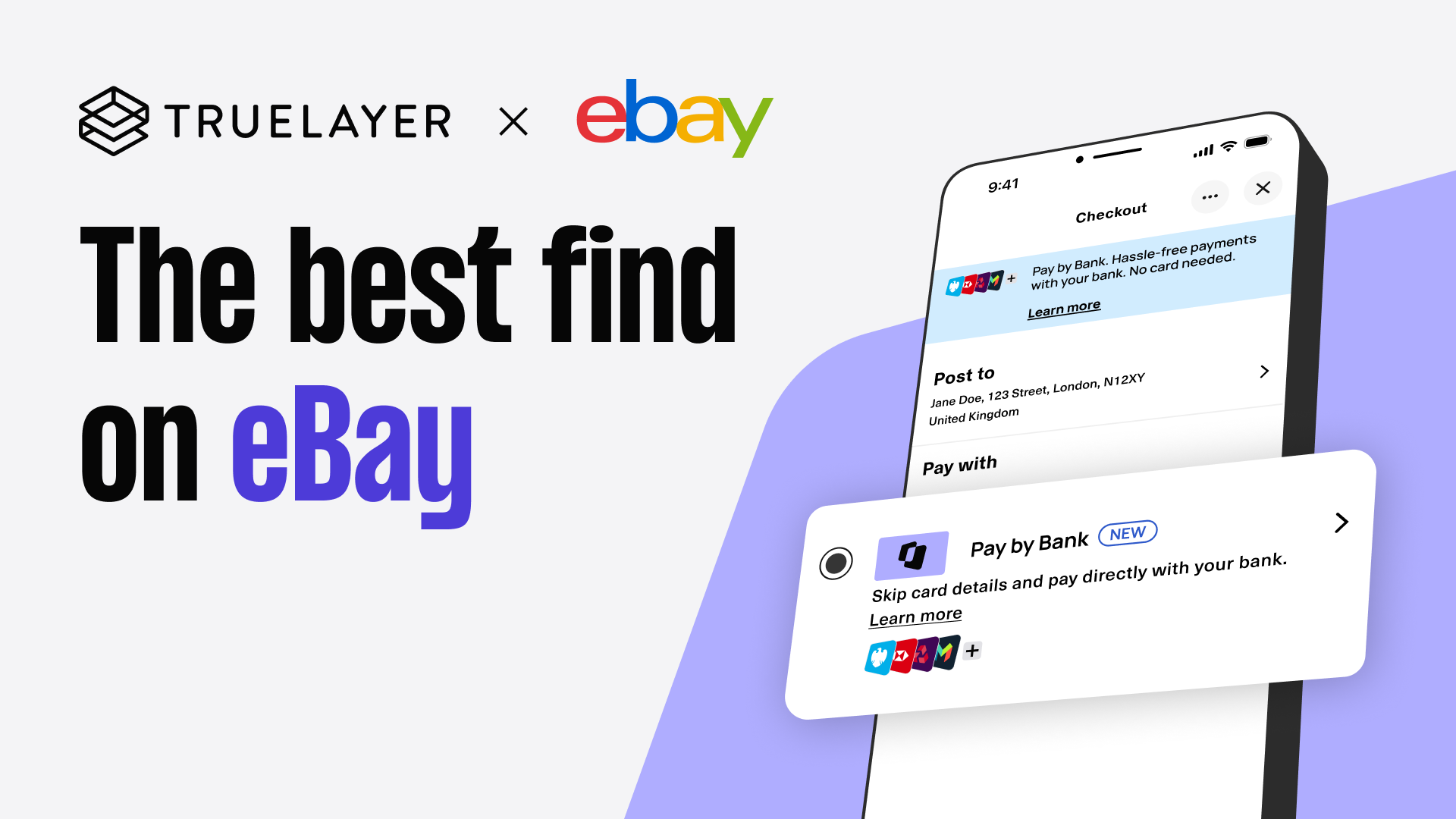

eBay partners with TrueLayer to offer Pay by Bank at checkout

)

)

)

)

)