In this blog, I’ll review the 4 predictions I made last year — on consumer adoption of open banking, the rise of payment initiation and the global spread of open banking. And I’ll make one prediction for 2021: it’s the beginning of the end for card payments.

2020 has been challenging for us all. We have missed our families, our friends and our colleagues, all the while trying to adapt to new fully-remote working practices.

Looking for silver linings is tricky. But, we did see the power of technology, and fintech for good. It was great to see so many people in the community collaborate to build, test and get new services live to help those in need during that time.

With everything that has happened, making predictions for next year could be difficult. But I believe the trends identified a year ago remain true and in some cases will accelerate.

Let’s review how I did and also why these trends will continue.

1. Time for general public understanding 🔊

“In 2020, I expect to see widespread adoption and understanding of open banking among consumers. It will reach mainstream adoption in the UK following an explosion of new use cases; investment, insurance, KYC, renting, money management, loans, and remittances will all be hit by a wave of new open banking enabled functionalities.”

Not bad! Adoption is increasing, now with more than 2m users, a figure that doubled in six months. OBIE has also stated that half of Britain’s small and medium-sized enterprise (SME) sector — are using services offered by open banking providers.

There has been a huge uptake in people using savings and investment apps as people stayed at home. We partnered with companies like Nutmeg, Stake, Trading 212 and Freetrade to implement open banking and empower their customers with the tools they need to invest and save money more effectively.

Other use cases have come to market too— for example, Portify building credit scores and loans, LendInvest’s mortgages marketplace, CreditLadder’s tenant and reference checks or Greensill examining supply chain finance. I expect to see a lot more firms across a variety of use cases enter the market in 2021.

2. Removing friction from payments 💸

“Alongside open banking, payment initiation’s popularity will increase significantly in 2020. Its benefits are hard to ignore: it removes friction from the flow of money between financial applications. That means cheaper, faster, and more secure payments for businesses and consumers. Adoption in the UK will increase and shorten the gap to other European countries, as it becomes more established as a way of paying and transferring money.”

This happened perhaps even more than I imagined! Across 2020, we saw the use of our payments API grow very rapidly, as more consumers embraced instant bank payments and more clients looked to implement payment initiation capabilities, including Revolut, Trading 212 and Freetrade . We’ve also seen that the majority of payments growth has come from people with bank accounts held at traditional financial institutions such as Lloyds or Barclays. This indicates an increasing broader acceptance of payment initiation beyond the more technologically progressive users at the challenger banks.

3. Adoption of open banking-based apps will increase across Europe 📱

“Driven by the decline of screen scraping and other less-secure techniques, European countries will start closing the gap when it comes to the adoption of open banking-based apps. Consumers in those countries will see a rise in applications that will improve their financial lives.”

The picture across Europe is mixed. New digital banks continue to emerge across the continent, suggesting an appetite for providers that can meet changing consumer expectations for digital services.

But the biggest hurdle to adoption remains: unreliable bank APIs have a knock-on impact on the ability of businesses to provide reliable and quality payment initiation services to users. In some countries, we are also seeing complex and confusing authorisation flows that create a poor user experience. I expect to see improvements in API quality during 2021, particularly when it comes to supporting payments.

4. Open banking will go beyond Europe 🌏

“New markets across the globe will continue to adopt open banking. Australia will be the country to watch.”

While the CDR in Australia was delayed by six months it eventually went live in July. It remains a fascinating development since it includes data sets that we typically reference when talking about ‘open finance’ in the UK, such as data on telcos, home loans, investments, personal loans and joint accounts.

While Australia is a country to watch, Brazil is also fascinating as it embraces open banking-style rules that are being phased in throughout 2021. That should see new comparison platforms, digital banks and financial management tools emerge.

2021: calling time on cards ⏰

So here’s my single prediction for 2021: it is the beginning of the end for card payments.

Why? As more customers have turned to digital channels to manage every aspect of their lives, they have experienced poor payments experience and service.

The problem is cards. They were not built for a digital-first experience and have been retrofitted into current online payment flows. Google Pay or Apple Pay paper over those cracks but don’t change the fundamentals.

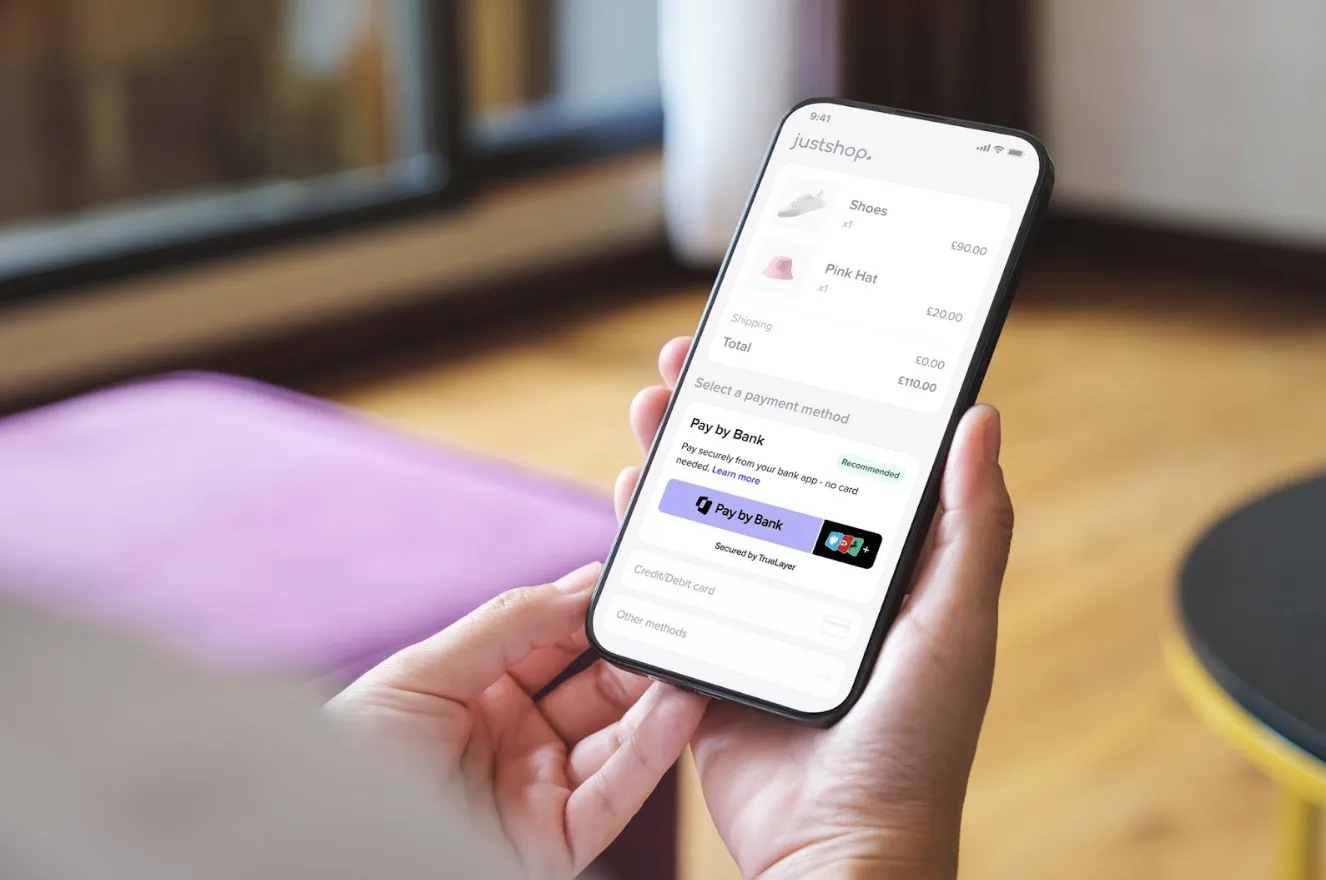

Open banking is digitally native and mobile first by design. Bank to bank payments moves money at a fraction of the cost, securely and conveniently, while also delivering a vastly better consumer experience. It’s a huge win for merchants too, with a higher conversation rate than cards and near instant settlement.

The impending introduction of Strong Customer Authentication (SCA) adds another layer of friction to cards, introducing workarounds that deliver a poorer customer experience. With open banking payments, authentication is integrated into the payment flow, often with the consumer using biometrics such as fingerprint or face ID to identify themselves in their banking platform.

Cards have had their time. 2021 will be the year that open payments, powered by open banking, come into their own — particularly in financial services, e-commerce and marketplaces, and in industries where average transaction values are high, such as property. I predict that we will also see open payments increasingly coupled with secure account and identity verification through premium APIs, particularly in high risk industries like iGaming and wealth management.

So there we have it — 2021 will be all about open payments. I’m excited to see what comes to market, as well as what the TrueLayer team has in store. But more on that soon!

For now, I wish you all seasons greetings and a Happy New Year! I hope, soon, we will get to see each other in person again.

Payment incentives: the secret sauce in your Pay by Bank recipe

TrueLayer and Stripe power Pay by Bank in Finland

)

)

)

)

)