Future of payments: What the UK’s new payments stack means for Pay By Bank

As the late Ozzy Osborne sang, “we’re going through changes”.

This has scarcely been more true than in UK payments, where significant change is set to take place at multiple layers of what we can broadly call the payments stack (see fig. 1). So, what exactly is happening and what are the opportunities for Pay By Bank?

What is Pay By Bank?

Pay by Bank is a payment method that lets customers pay for things directly from their bank account via their bank app.

It works because fintechs, like TrueLayer, can connect to consumer bank accounts and make payments, with the consumer’s permission, directly from those accounts to merchants.

What does the current payments stack look like?

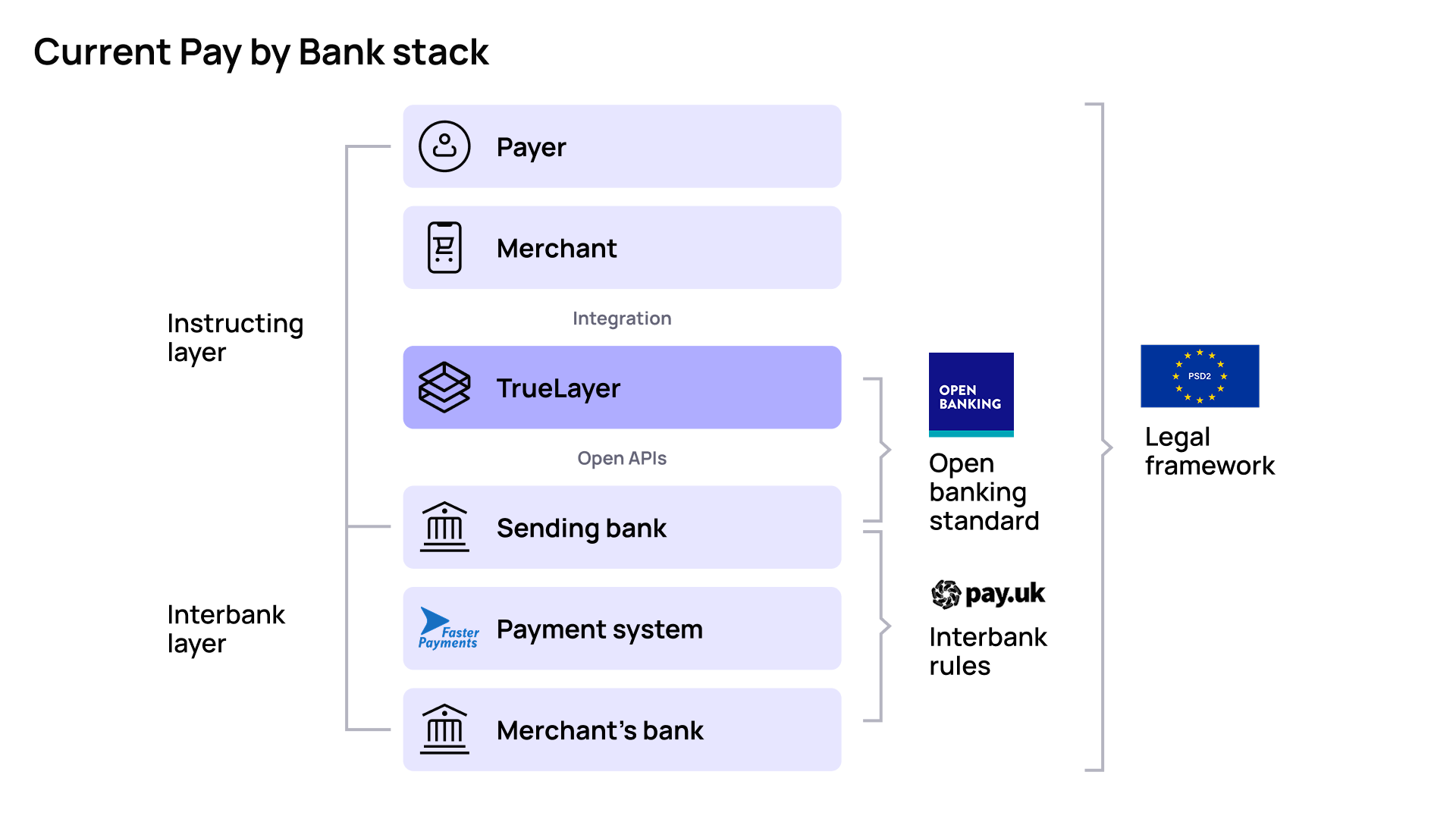

To understand incoming changes, it’s useful to review the system that underpins Pay By Bank today.

Broadly, there are two layers:

The instructing layer: this is where open banking technology enables fintechs like TrueLayer to connect securely into banks, and instruct them to make payments on behalf of consumers. This is made possible by a combination of regulation (PSD2) and standards (developed by Open Banking Limited), which mean banks must provide standardised open APIs (application programming interfaces) that fintechs can connect to and initiate payments through.

The Interbank layer: this is what enables money to move between banks, via the payments system (currently Faster Payments). The rules and standards for interbank payments are overseen by the Payment System Operator Pay.UK.

These two layers combine to enable Pay By Bank. A fintech like TrueLayer instructs a sending bank to pay a merchant via an open API. The sending bank executes a payment through Faster Payments, and the merchant receives the funds into their bank account.

What changes are coming?

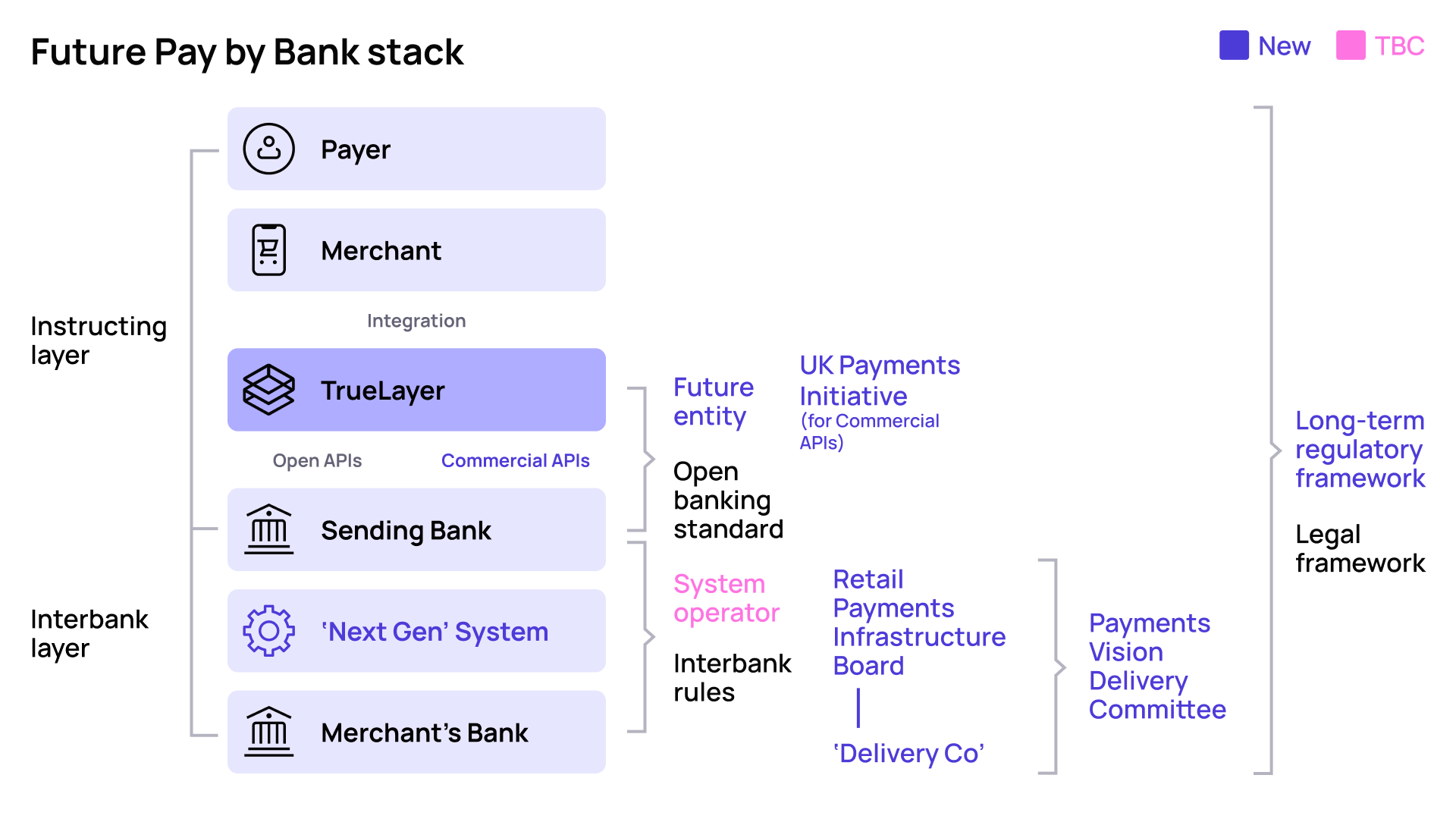

Changes have been proposed to the instructing layer, interbank layer and to the legal framework governing electronic payments in the UK. It’s all change.

Instructing layer changes

In August, the Financial Conduct Authority set out its vision for changes to how open banking is overseen and further developed.

Under powers granted by the new Data Use and Access Act, Open Banking Limited will be replaced by a new body: the Future Entity. This new body will continue to develop API standards for open banking, but will likely also have a future role to develop APIs for open finance (opening up new types of accounts such as mortgages, pensions etc).

In addition to standards setting, a new layer of commercial API schemes will exist that can develop the payment services enabled by open banking APIs, on a commercial basis. Banks will be remunerated for supporting new functionality with these APIs, such as variable recurring payments (VRP).

The UK Payments Initiative is one such commercial scheme, and it’s currently being established to launch variable recurring payments on a commercial basis in 2025.

Interbank layer changes

In July, the Payments Vision Delivery Committee (PVDC) announced plans for reform of the UK interbank payments system. The plan is to eventually replace the ageing Faster Payment System (launched in 2008), with “next generation” infrastructure, in line with the Government’s National Payments Vision.

To do this, the PVDC is proposing that two new bodies be established:

A Retail Payments Infrastructure Board (RPIB), chaired by the Bank of England

A Delivery Committee led by industry to procure and fund next generation infrastructure

The work of both bodies will be overseen by the Payments Vision Delivery Committee, which will continue to set strategy and a forward plan for retail payments. The Committee’s strategy for retail payments is expected this Autumn.

This change calls into question the future role of Pay.UK which currently oversees Faster Payments. It is yet to be confirmed whether Pay.UK would oversee the next generation of infrastructure once delivered. However, Pay.UK is currently overseeing five tactical enhancements to Faster Payments as part of furthering the National Payments Vision.

Regulation changes

On top of these infrastructure changes, the UK Government and regulators are working on a long-term regulatory framework for open banking “to secure the existing achievements of Open Banking, unlock its future potential and ensure a sustainable economic model is in place”.

This is likely to involve using powers under the new Data Use and Access Act, but also a review of the Payment Services Regulations (PSRs), which currently underpin access-rights for open banking, and provides the framework for authorisation and supervision of open banking providers.

The UK is now significantly behind the EU which is due to finalise its revised framework for open banking under a new EU Payment Services Regulation towards the end of 2025.

What does all the change mean for Pay By Bank?

TrueLayer has been calling for change to unlock further improvements and developments for Pay By Bank.

New functionality: the new UK Payments Initiative will be key to introducing recurring payments that can be used to support VRP use cases like bank on file and 1-click checkout. TrueLayer funds and will sit on the Board of this new initiative.

Faster, cheaper, more certain payments: the move towards the next generation of payments infrastructure at the interbank level, will be key to unlocking cheaper, faster payments, which are delivered with more certainty than today. This is something we called on the National Payments Vision to address.

Regulation: regulation will continue to play a critical role in underpinning Pay By Bank. We want to see a clear focus on enabling regulation - which drives competition and fosters fintech development. This means maintaining the current strong baseline of open banking regulation ,as is the case in the EU), while allowing for commercial models to develop where they can deliver innovation quickly and sustainably.

A complete account to account (A2A) solution: with change across the board, there will be a big opportunity to leverage the success of open banking, and combine it with new underlying payment rails, to realise the Government’s vision of ubiquitous, seamless A2A payments, both online and at physical point of sale.

With change of this scale, and a commitment from Government and regulators to move at pace, the UK could be on the cusp of a real payments revolution.

We don’t need another Wero: building on Pay by Bank

Software engineering in the age of AI: run the mile you're in

)

)

)

)

)

)

)