The ultimate guide to open banking examples and use cases

We’re almost three years on from the initial PSD2 deadline of January 2018, and open banking providers have emerged in almost every country in Europe.

There are 410 Third Party Providers (TPPs) in the EEA as of September, and only 4 countries with no providers at all (Latvia, Romania, Malta and Portugal). Of the 410, half (53%) are authorised to provide Payment Information Services (PIS), while almost all (93%) are authorised to provide account information services.

Open banking is also gaining traction among consumers, accelerated in part by the global pandemic and a surge in demand for online services. In September, the UK’s Open Banking Implementation Entity reported that usage of open banking had doubled in the previous six months, reaching 2m users. It also reported that one in five of 2000 adults surveyed started using online banking apps during lockdown for the first time, with more than half now using them regularly.

PwC meanwhile predicts that by 2022, 71% of UK SMBs and almost two third of adults will have adopted open banking, creating a £7.2 billion revenue opportunity.

Yet beyond the common applications, many businesses don’t yet know what open banking can do for them – even in the financial sector.

A survey among 2000 financial institutions conducted by INNOPAY and The Paypers in May, found that most global banks, fintech, and investors are looking to learn more about use cases enabled by open banking.

That’s why we’ve created a new report with The Paypers: The ultimate guide to open banking uses cases.

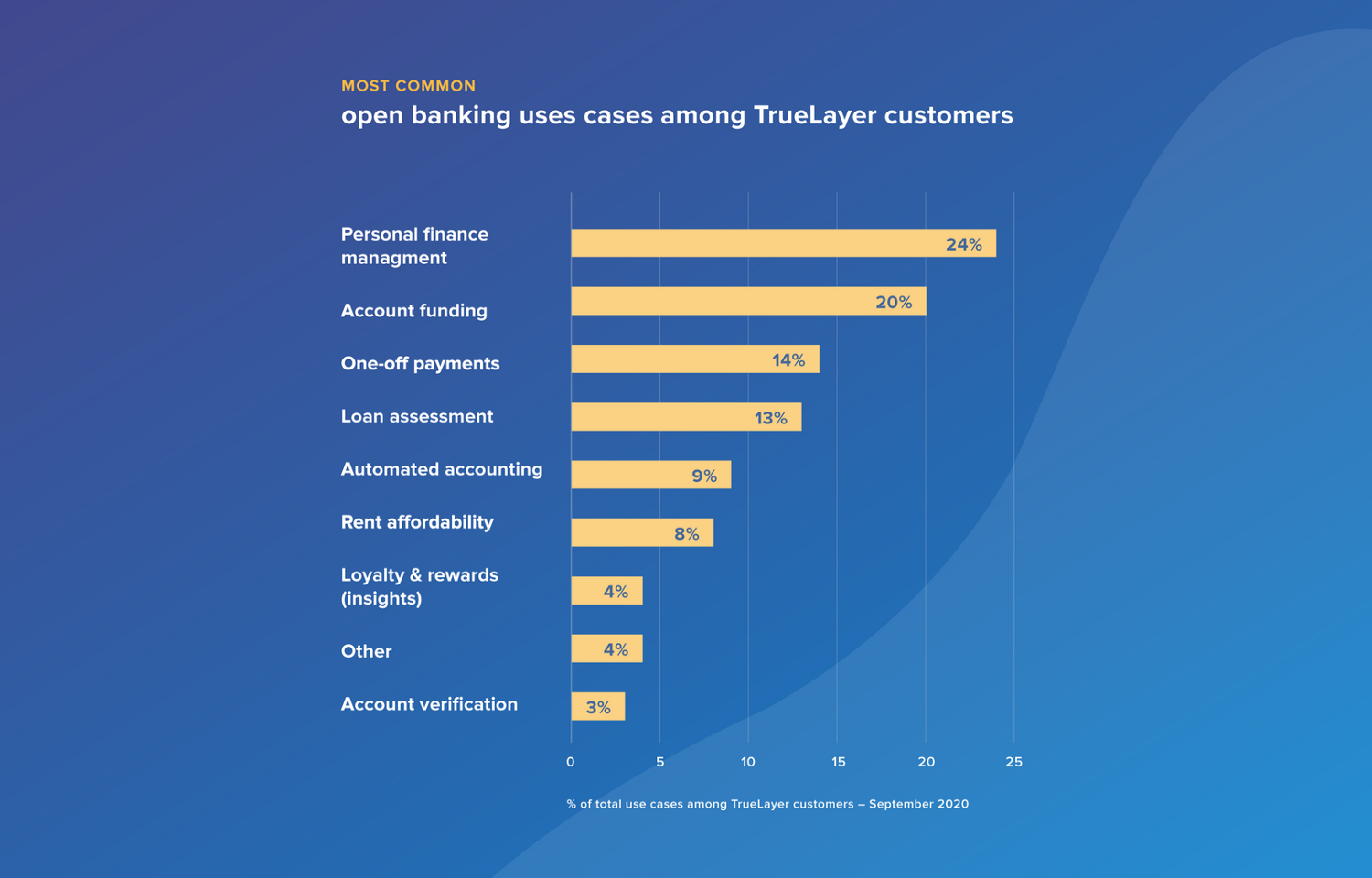

We’ve looked across our customer base and at the millions of open banking API calls going through our platform each month to identify the proven use cases already driving value for consumers in Europe, including:

Smart onboarding (account and identity verification, auto-filling forms, income verification and affordability checks)

Personal finance management (finance dashboards, auto-saving and smart budgeting)

SME finances (account aggregation, automated accounting and affordability checks).

We’ve also looked at emerging open banking examples and use cases, where open banking is expanding beyond fintech into sectors like iGaming, marketplaces and wealth management, and is primed to take over broken and fragmented processes:

Data-driven insights and personalised services

Instant bank payments (instant account funding and one-off payments).

In the report, we cover real examples of companies driving value from open banking, from Revolut, Chip, Plum and CreditLadder to Smarkets, Trading 212 and Nutmeg. We also look at how open banking examples might evolve in the future and consider the potential of combining them to transform the user experience.

Download the report today to inspire your open banking strategy

TrueLayer completes acquisition of Zimpler

Why your iGaming payment stack needs to work as one

)

)

)

)

)

)

)