Black Friday and Cyber Monday (BFCM) are the World Cup Final of ecommerce. But while brands fine-tune their marketing offers and logistics ahead of peak season, merchants may be missing an opportunity to live up to their customer’s payment expectations.

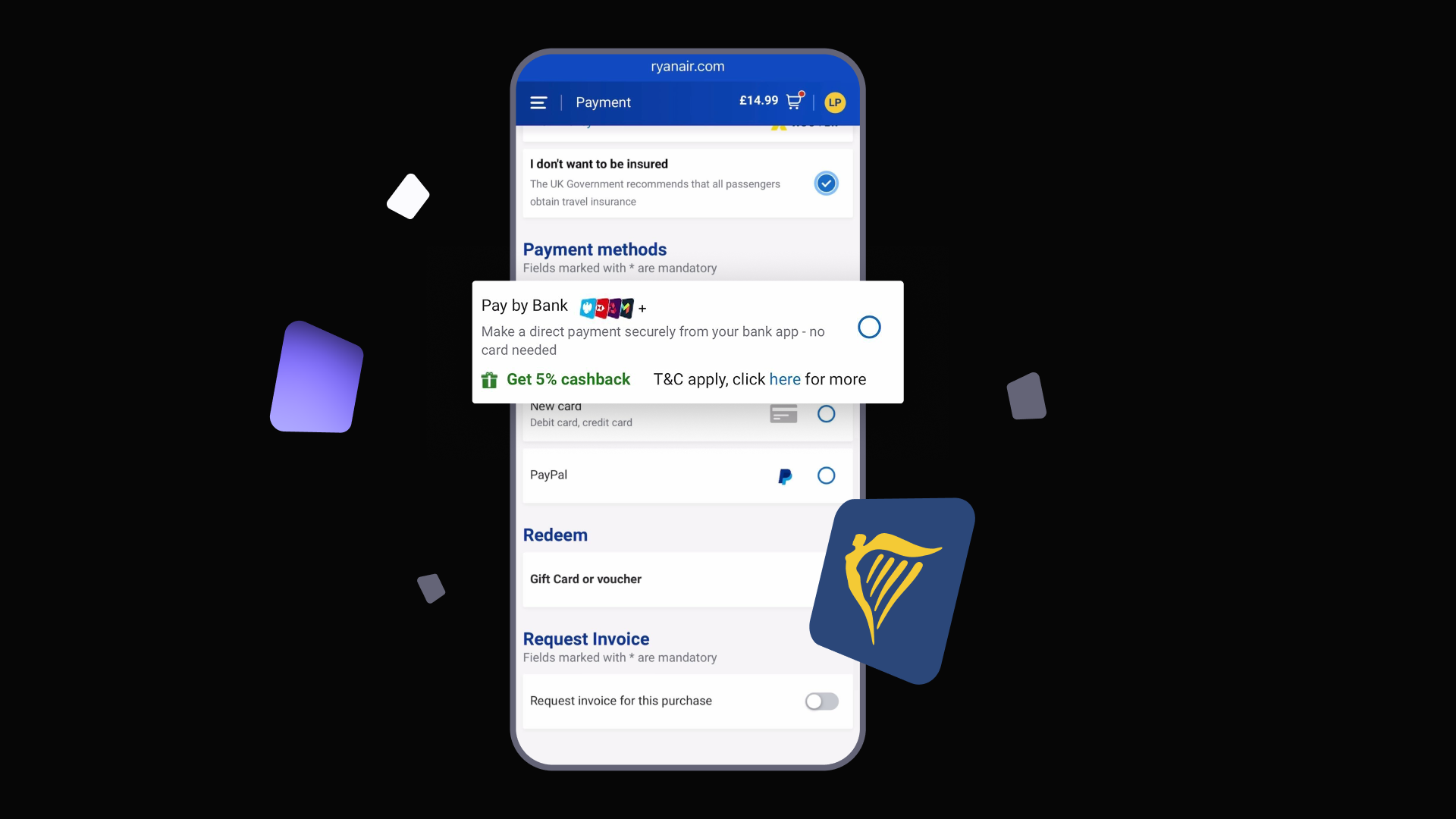

According to Yaguara, 59% of customers will abandon a transaction if their preferred payment method is unavailable at checkout. When Pay by Bank ranks as a top three payment method in the UK, Netherlands, Finland, Spain and Germany, it’s time to make sure you reign champion of the checkout this peak season.

Here’s your ultimate checklist to ensure your payment offerings don’t crack under the pressure.

1. Look back to go forward

This almost goes without saying. Yet often, ecommerce teams overindex on channel performance, so payment teams: this is one to get ahead of and become a key part of your BFCM retro.

Start with your own data

Where did drop-offs occur during payments? Was there a specific event that triggered this, and did a payment fail altogether? If so, it’s a good time to understand why and if expired card details played a part as they so often do.

Which payment methods performed the best?

What are payment trends and market research telling you about this year?

How did fraud or failed payments impact revenue?

Use these insights to prioritise this year’s improvements. Whether it’s payment flow optimisation, form performance or reconciliations. Align each team to make sure everyone knows the areas to watch and react to this year.

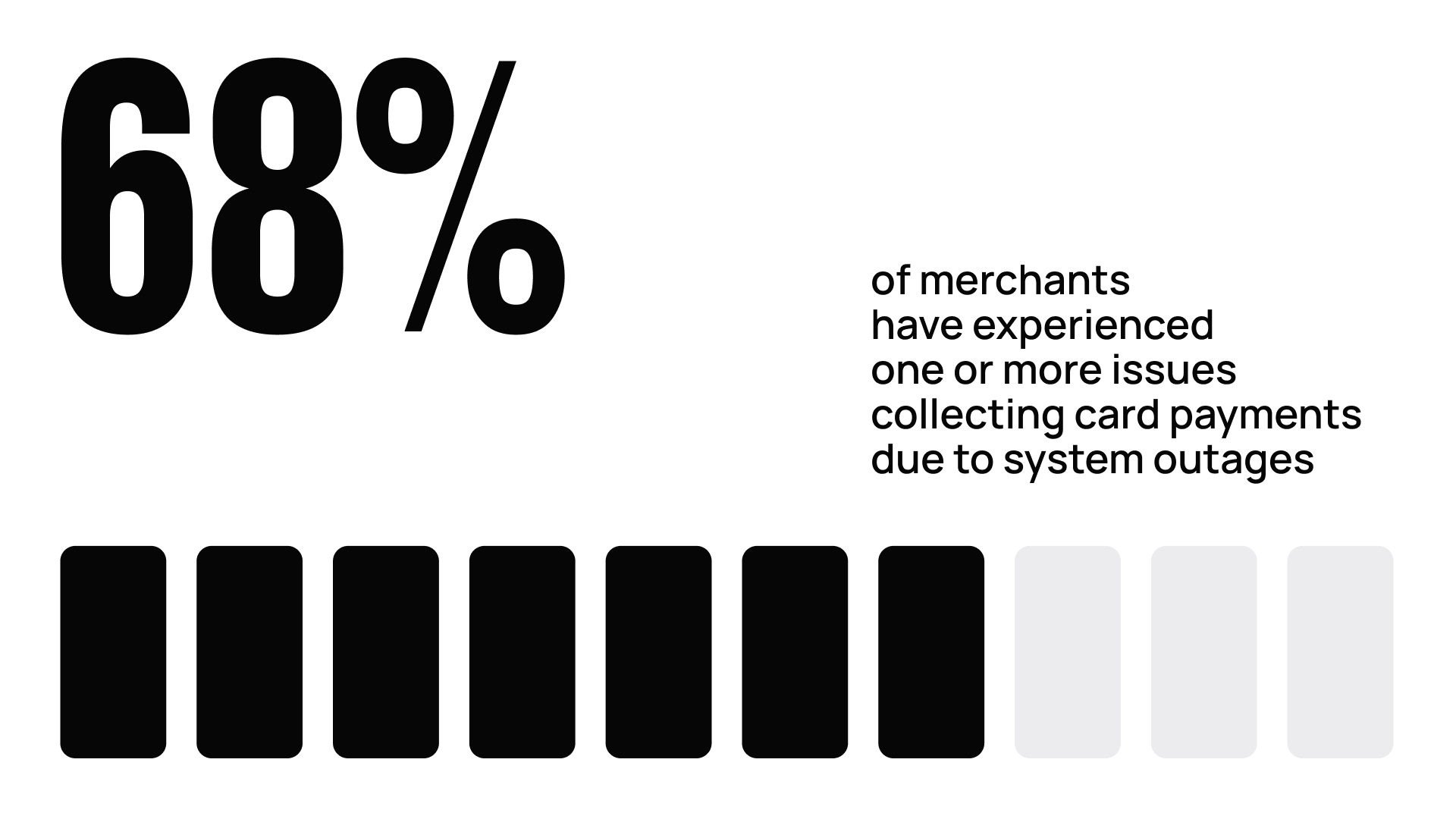

2. Stress-test your checkout under pressure

How do you know your infrastructure will be prepared for the influx of visitors you’re hoping (and praying to the ecommerce gods) for? As many things in the world of payments, the key to a sturdy payment experience starts with testing under a sandbox environment.

Where to start

Simulate high traffic across devices and regions.

Then think, can your system handle 5x the usual load?

Are payments failing during spikes?

Partner with your providers, especially your Pay by Bank provider, to test your resilience and implement any necessary measures or changes based on your tests’ results.

What does testing look like in practice for Pay by Bank?

Flow validation: end-to-end testing checks to ensure payment journeys are frictionless and will drive high conversion rates, putting user experience at the heart of every flow.

Security: account-to-account payments involve sensitive financial data. Testing must be rigorous to help identify vulnerabilities, ensure compliance and reduce the risk of fraud.

Regulatory compliance: it’s no surprise that Pay by Bank transactions must comply with financial regulations (such as PSD2). The testing phase is crucial for checking that all legal and compliance requirements are met.

Compatibility: businesses use different banks, devices, and platforms. There are multiple moving pieces. Testing helps verify that integrations actually work across various banking systems, APIs and user environments.

Performance and scalability: load testing ensures that the system can handle high transaction volumes without performance degradation. This is crucial for enterprise businesses with large volumes.

Ultimately, this level of testing is what maximises session conversion and customer retention and minimises downtime and errors. This includes us providing our clients with a Sandbox environment for risk-free testing, allowing developers to debug at a rapid pace.

3. Lean into AI for personalisation

Cutting through the noise during BFCM means embracing future-forward technology that allows you to provide a tailor-made experience to your customers. Serve your customers what they want, when they want it, and watch them come back to you post-holidays. This means:

Including product recommendations on the checkout based on their on-site behaviour

Dynamic web or in-app content for a modern brand experience to encourage trust from potential customers

Send-time optimisation for the best times to hit your users with discounts and messages, based on their own individual data.

Customer data is your treasure trove for this BFCM; don’t forget to use it.

4. Build momentum with the right incentives strategy

Segment your audience

Personalise your incentives based on user behaviour - whether that’s high repeat, high value or dormant customers. But to do this you need to know your customers! Use customer insights to tailor offers, like money off an item often paired with what’s already in their basket, rather than falling into a generic, one-size-fits-all approach that misses the mark.

Get clear on your metrics

Define what KPIs you want to move the needle on before launching. Know which metrics you want to shift, then design campaigns strategically. For example, rewards during historically low order periods to maximise uplift, rather than chasing revenue in less impactful moments. Instant benefits usually perform better than deferred ones during time-limited shopping events like Black Friday.

Make it visible, maximise awareness

Don’t limit yourself to the usual suspects like email newsletters or web banners. Meet customers right at the decision point— at checkout. Early engagement is great, but if the incentive isn’t there when they’re ready to act, you risk losing the conversion.

““Black Friday and Cyber Monday success isn’t just about bigger discounts—it’s about smarter ones. Know your customers and be ready to entice them with a reward at checkout, where it will drive the most impact. The right offer turns browsers into buyers, laying the groundwork to bring customers back again and again, while boosting your business’ bottom line.”

Julia Martinez, Head of Product Marketing at TrueLayer

5. Always keep loyalty on your radar

BFCM is the perfect opportunity to garner loyalty and encourage customers to act as brand advocates. Following a positive Black Friday experience:

74% are likely to refer a friend or family member.

More than six in ten would join a loyalty program, with the same number likely to leave a review.

57% would follow a brand or join a community on social media.

(All stats from Ecommerce Age via Loyalty Lion)

When you provide the kind of experience that brings customers back again and again, you reap the rewards. As Senior Product Manager, Eamon Lindsell from Papa Johns said:

““By integrating TrueLayer’s Pay by Bank solution, we’re improving our customers’ digital experience and increasing customer retention, all while reducing fraud, eliminating chargebacks and lowering our cost of payments by more than 40%.”

6. Set up real-time reporting

When it comes to a campaign as big as BFCM, you can’t fix what you can’t see. Your teams should be able to make fixes immediately using real-time dashboards to:

Spot drop-offs or failures as they happen

Track conversion by payment method

Set up water-tight protocols to alert teams to unusual trends mid-campaign

Why not make tracking a bit of fun in the office and add to the holiday hype this year? You can take inspiration from Stripe’s custom BFCM machine which ran real-time monitoring of everything from peak transactions per minute to currency volumes. Try throwing this onto the big screen in the office for extra peak season excitement.

7. Plan your post‑BFCM debrief now

And finally, your BFCM synopsis is crucial for setting you up for success during January sales. Track these data points to stay prepared:

Payment Conversion & Drop-off Analysis

Why it matters: BFCM traffic is high, but if checkout completion rates dip, you’re looking at lost revenue.

What to measure:

Checkout initiation vs. completed transactions

Drop-off by payment method (Pay by Bank, cards, wallets, BNPL, etc.)

Failed vs. abandoned payments

Pro tip: Break down by device type (mobile vs. desktop). BFCM mobile traffic is huge, and mobile failures can be disproportionately costly for your business.

Payment Method Mix & Uptake

Why it matters: Consumer preferences continue to shift year on year, so knowing which methods surged can help to inform your strategy for 2026.

What to measure:

Share of checkout by payment type vs. average month

Average order value (AOV) by method

Settlement & Payout Timelines

Why it matters: Cash flow post-BFCM can make or break inventory restocking for the next sales period in the New Year.

What to measure:

Average settlement delay by provider/method

Any reconciliation discrepancies

Operational Performance

Why it matters: Operational bottlenecks impact payment outcomes.

What to measure:

Payment system uptime during peak hours

Average transaction processing time

Any provider outages or slowdowns

Operational costs per payment methods

For the best analysis, make sure to know your benchmarks as well as localisation nuances. Plus, segmentation is king. Split out geography, issuing bank, transaction size, time of day, and customer cohort for the most accurate results.

And that’s a wrap! TrueLayer is helping brands like Just Eat, Ryanair and many more power instant, intelligent payments for peak performance. With 80% of ecommerce merchants planning to add Pay by Bank to their roadmap in the next 12 months, speak to TrueLayer’s experts to join the revolution.

TrueLayer completes acquisition of Zimpler

Why your iGaming payment stack needs to work as one

)

)

)

)

)

)

)

)