At peak moments like Black Friday and Cyber Monday (BFCM), your checkout is under an incredible amount of pressure. Traffic surges, payment demand spikes, and all the while customers are expecting instant and seamless experiences while weighing your brand up directly against competitors thanks to back-to-back holiday purchases. A resilient checkout is one that can handle all of that pressure without breaking, and then some. What would it cost your business if your payments went down for one hour during peak season? How many customers might you lose to a competitor?

Card rails are the common denominator and single point of failure for payment methods like Apple/Google Pay, PayPal and BNPL, even if they’re dressed up differently. When 68% of merchants have experienced one or more issues in collecting card payments due to system outages, it’s time to plan for resilience this BFCM. Find out how to build the most resilient checkout that brings your customers back for more.

1. Ease at every stage of the journey

Shoppers drop off when checking out takes too long. In the world of ‘Amazon prime expectations’, shoppers have less and less patience. Ecommerce and payment teams need to remove any risk of drop off along the way. A resilient checkout:

Minimises form-filling and redirects.

Reduces steps to payment confirmation.

Supports mobile-first experiences.

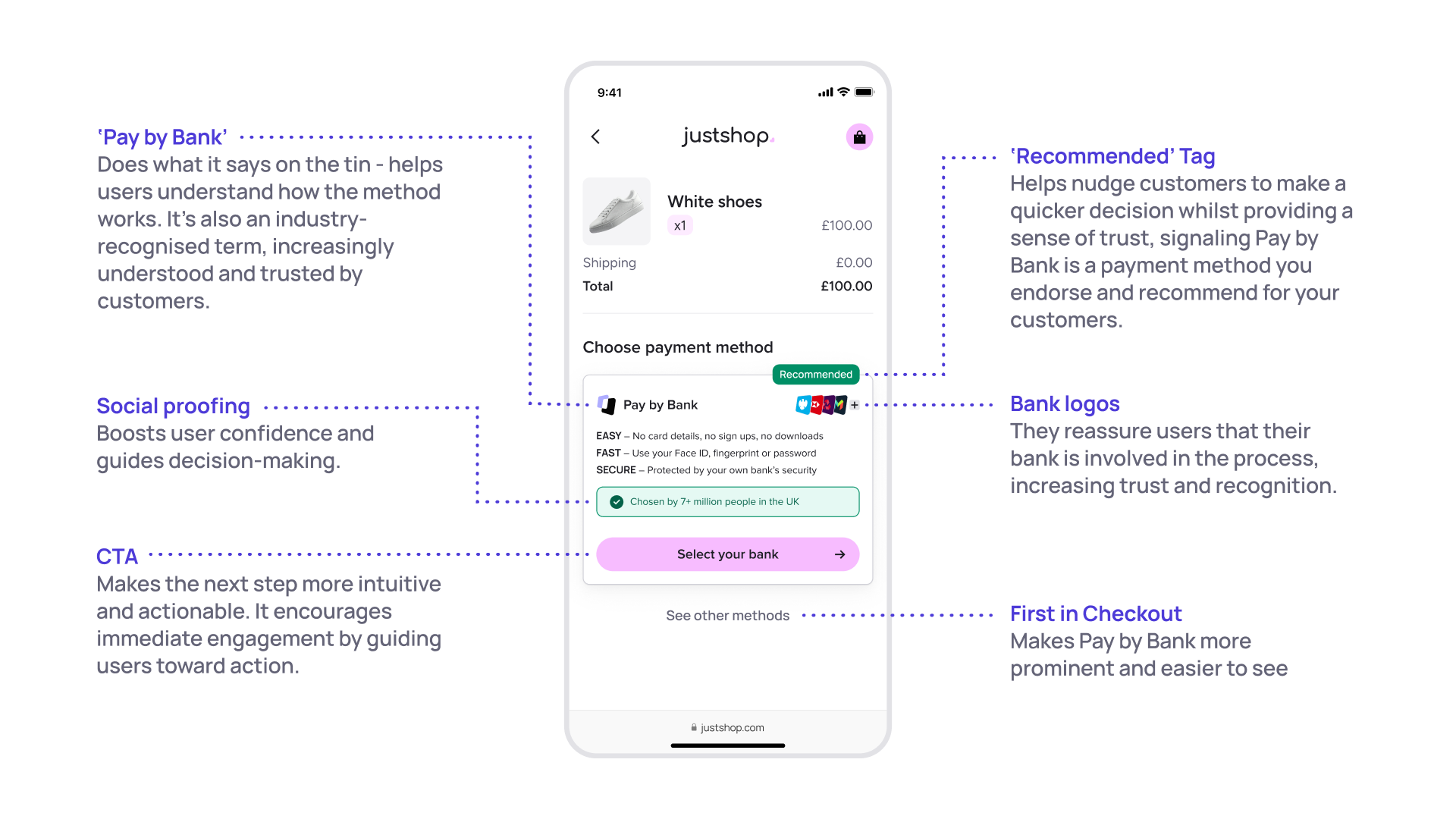

Pay by Bank makes this possible, connecting users directly to their bank, skipping the card entry, and leveraging biometrics or bank app logins they already trust. Here’s a breakdown of Pay by Bank in 90 seconds:

2. Reliable under a heavy load

Your payment system needs to scale as quickly as your demand, especially during events like BFCM as transaction volumes spike dramatically. When choosing a Pay by Bank provider, here are some factors worth checking:

Network size – A large, active user base can indicate consumer trust and familiarity, which often translates to higher checkout conversion.

Capacity for peak volumes – Ask about metrics like annualised payment volume or the provider’s record for transactions per second/minute. This helps you gauge whether they can handle thousands of simultaneous transactions without slowing down.

Enterprise-grade infrastructure – Look for evidence that the provider has been integrated successfully into large, high-traffic businesses. Partnerships with established PSPs and high uptime statistics (99.9% or better) are good indicators they can withstand peak loads.

The goal is to be confident that, even during your busiest hour of the year, your checkout can process every legitimate payment without delays or downtime.

3. Minimises failed payments

On big-sale days, failed payments literally translates to lost sales. A resilient checkout:

Reduces decline rates (especially for legitimate transactions)

Avoids unnecessary 3DS interruptions

Bypasses expired, blocked, or insufficient funds issues that often plague cards

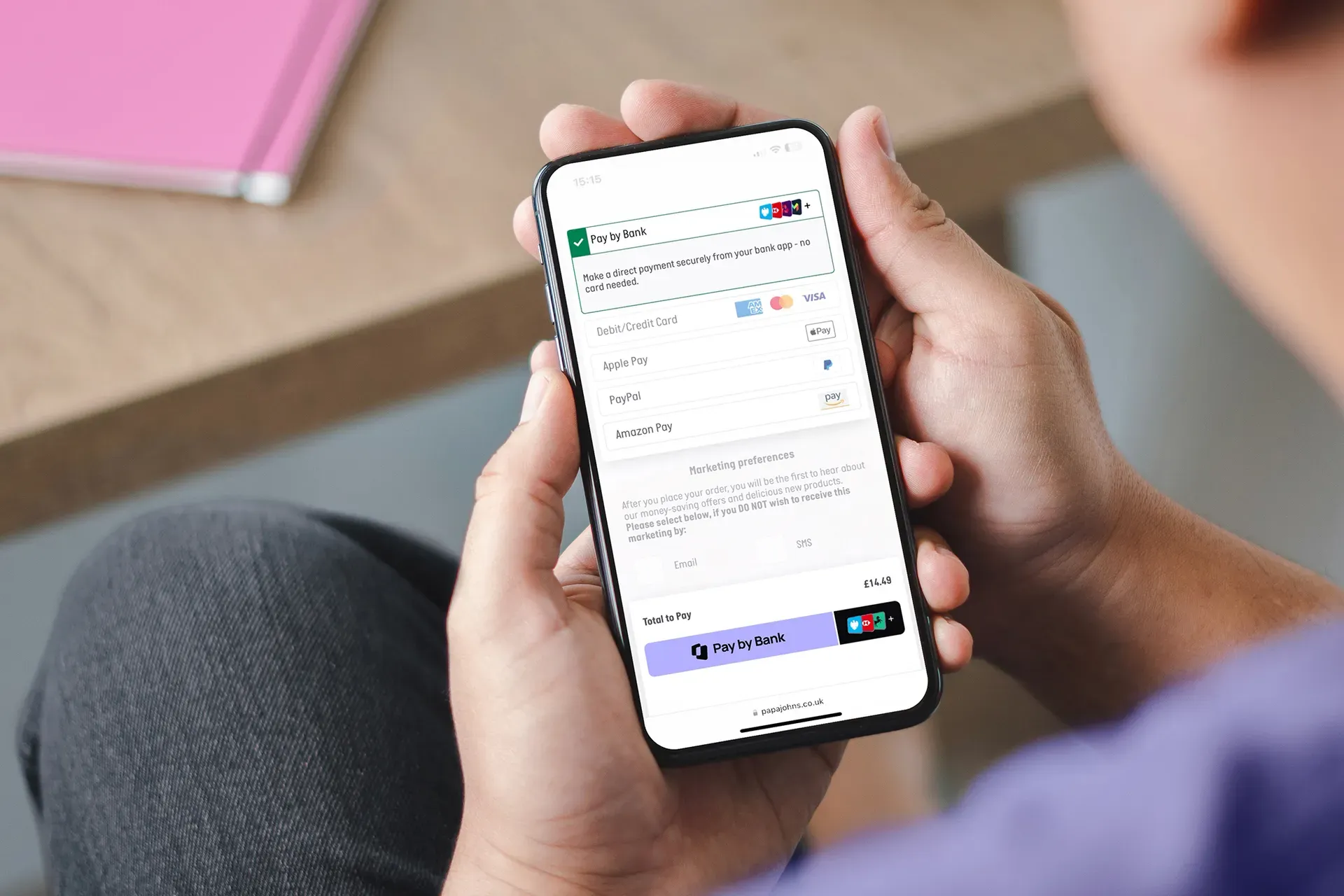

Pay by Bank payments help avoid these problems. They settle instantly, don’t expire, and don’t get blocked due to risk scoring like cards do. Senior Product Manager, Eamon Lindsell, from Papa Johns sums up the revenue opportunities:

“If you can recover 20% of failed payments by offering Pay by Bank as an alternative, we can rescue over £1 million in revenue each year… By integrating TrueLayer’s Pay by Bank solution, we’re improving our customers’ digital experience and increasing customer retention, all while reducing fraud, eliminating chargebacks and lowering our cost of payments by more than 40%.

Research from checkout.com shows that 42% of consumers say a failed payment would stop them from returning to a site altogether, while 66% say a slow or difficult payment experience would erode trust in a brand. Performance at checkout isn’t just about completing a sale, it’s about protecting the relationship between the brand and their consumers.

What about BNPL and other alternatives, though?

Checkout issues like payment failures and limited options often lead to cart abandonment—but even many "alternative" payment methods like BNPL, Apple Pay, and Google Pay still rely on card rails, which don’t eliminate friction. Customers may still need to retrieve their debit cards or update expired details mid-purchase. That’s why, during the recent Crowdstrike outage, lastminute.com saw a spike in Pay by Bank usage while others struggled. Unlike card-based methods, Pay by Bank removes these pain points.

4. Secure and trusted

Lastly, security should be felt, not forced. A resilient checkout:

Remains secure without adding unnecessary steps to the payment flow. This helps businesses like Jaja Finance see 71% of their customers choosing Pay by Bank and citing 8 out of 10 or higher customer satisfaction with Pay by Bank.

Meets regulatory standards like PSD2 and SCA, without adding friction.

Shows the kind of logos and copy that reassures shoppers of legitimacy within payment methods, and doesn’t confuse them.

Keep your focus on these things, and you’ll be winning

So if you're looking for just one piece of advice this BFCM, let it be from TrueLayer's Chief Strategy Officer, Lisa Scott:

“Black Friday and Cyber Monday are about more than just scaling infrastructure—they're about earning customer trust in the moments that matter. Merchants can get ahead by offering payment experiences that are not only reliable, but instant and intuitive. That means reducing friction, expanding choice, and making sure your payment stack can perform under pressure.

“When almost 7 in 10 ecommerce brands have had issues collecting card payments due to a system outage in the last 12 months, payment diversity is more important than ever this peak season. Diversity ensures a resilient checkout.

Lisa Scott, TrueLayer's Chief Strategy Officer

To find out how to prepare for the unforeseen and build the checkout of the future, speak to one of our Pay by Bank experts today about starting your journey with Pay by Bank.

TrueLayer completes acquisition of Zimpler

Why your iGaming payment stack needs to work as one

)

)

)

)

)

)

)