A key motivation behind open banking has always been to enable the growth of alternative payment methods to compete with cards. Industry development, regulation and innovation have all worked together to deliver that in the form of open banking payments.

Meanwhile, the rapid growth of online retail transactions has added strain to legacy card payment systems that merchants have relied on for years – ecommerce payments are ripe for change.

To better understand the key reasons for this potential shift, TrueLayer commissioned an independent research consultancy with extensive experience in open banking and payments.

The resulting report draws on research into open banking in the UK and the EU, plus interviews with independent experts, international banks, industry bodies, merchants and consumers.

You can download a copy of the full report, and we’ve broken down a few of the key takeaways from the report below:

1. Despite a slow start, open banking payments are growing fast

Open banking payments were initially slower to develop than other UK open banking services. But they’re now growing consistently, with payment volumes rapidly accelerating. Successful payments made using open banking providers have grown from 280,000 in July 2020, to 1.83 million in June 2021, an increase of over 550%.

This number will only continue to increase as open banking payments become more widely available. And while open banking can still feel like a brand new technology, there are already over 3 million open banking users in the UK, which equates to 5% of the population.

On its current growth trajectory, around 60% of the population will be open banking users by as soon as September 2023. The growth of successful open banking payments, including in ecommerce, will follow suit.

2. Ecommerce payments are growing consistently, boosted by a sudden spike during COVID-19

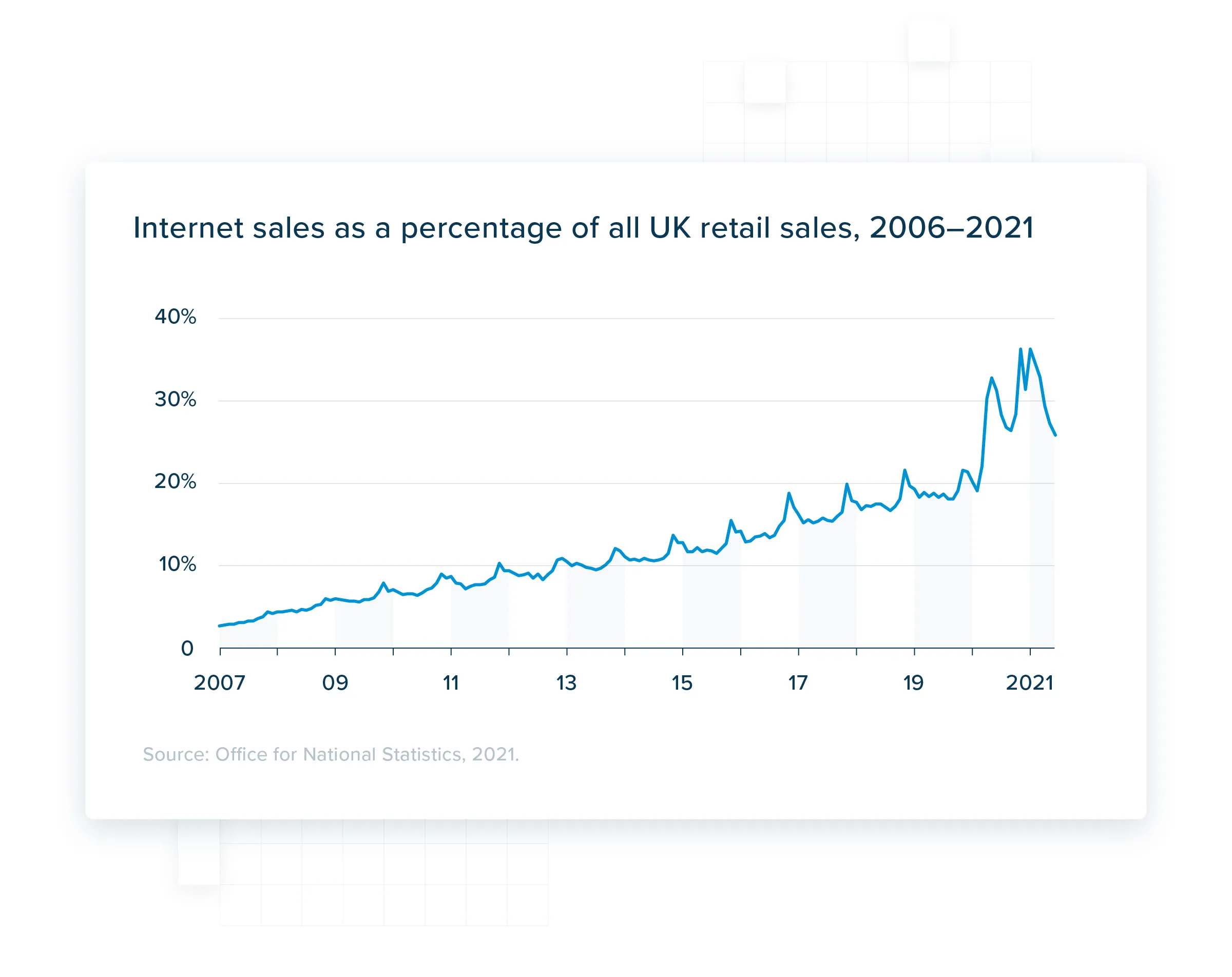

Two trends in retail payments have created an opportunity for more open banking payments in ecommerce. First, cash has declined as electronic payments have grown. Second, ecommerce sales as a share of UK retail purchases have increased.

Internet sales as a percentage of total retail sales have steadily increased since 2006, and they accelerated significantly with the onset of the COVID-19 pandemic. In 2006, internet sales as a share of total UK retail sales stood at 2.8%, rising to 36.5% at the height of the pandemic.

Ecommerce payments have lower barriers to entry than point of sale payments because they don’t require merchants to upgrade their physical infrastructure in order to accept new payment methods. This means open banking payments can be integrated into the ecommerce customer journey with relative ease. Different payment options are typically displayed transparently at the online checkout, reducing friction and expanding choice for consumers.

3. Non-card payment methods in Europe show appetite for payment alternatives

While the growth in payment volumes and ecommerce sales point to the demand and need for open banking payments, cards continue to be the status quo in ecommerce. So is it realistic to expect a new payment method to take a significant share of wallet from the likes of Visa and Mastercard?

The good news is, some payment methods already have. Simply look at non-card payment methods that have gained wide adoption in EU jurisdictions, including iDEAL in the Netherlands, Swish in Sweden and SOFORT in Germany (which is now owned by Klarna).

These non-card payment providers have already achieved high rates of consumer adoption in ecommerce transactions, with lower merchant fees compared to cards, as well as low rates of fraud.

But unlike these payment methods, open banking has a pan-European mandate. This gives it the coverage needed to challenge the dominance of cards.

4. Greater competition from open banking payments gives ecommerce merchants an alternative to ageing card infrastructure

Without viable alternatives to card payments, merchants face persistently high fees for accepting electronic payments, as well as high rates of card-not-present fraud and purchase abandonment. Greater competition from open banking payments can improve the situation for merchants and consumers in the following ways:

Lower fees for merchants

Open banking payments offer lower and more predictable merchant processing fees than card acquirers do. For example, TrueLayer’s average fee is less than 1% of the transaction value. Open banking payments also do not involve additional costs that card payments typically do, such as for card terminal hire, PCI compliance and chargeback processing.

Greater payments security

Consumers using open banking payments must authorise every payment with their bank using strong customer authentication (SCA). SCA has been implemented for open banking in the form of ‘redirection’, which uses secure APIs to ensure banking credentials are only shared with the bank, without the need for risky information-sharing among parties to a transaction.

Increased convenience for consumers

Some of the core features of open banking make ecommerce payments more convenient for consumers. For example, by pre-populating the merchant’s payment details, open banking providers reduce the steps of a transaction down to simply redirecting a consumer to their bank to authenticate the transaction (e.g. with a thumbprint).

In summary

Open banking has led to the emergence of new payment providers with the potential to challenge the dominance of card networks.

The growth of open banking payments has been encouraged by the decline of cash in retail transactions (which fell by 35% between 2019 and 2020); and the expansion of ecommerce.

Non-card payment providers in other countries with similarities to open banking payment providers have achieved high take-up rates, strong popularity with consumers, low fees and low fraud rates.

Greater competition between open banking payments and card payments is likely to bring significant benefits to merchants and consumers, including:

lower merchant fees for accepting electronic payments

reduced risk of unauthorised payments and fraud, thanks to embedded strong customer authentication (SCA)

increased convenience for consumers (and conversion rates for) as a result of shorter payment journeys

It’s exciting to see more and more ecommerce brands develop new payment experiences using open banking. At TrueLayer, we believe open banking payments will become the default way to collect ecommerce payments in the coming years.

Get your copy of the full future of ecommerce payments report

TrueLayer completes acquisition of Zimpler

Why your iGaming payment stack needs to work as one

)

)

)

)

)

)

)

)