As the UK retail market resets after the pandemic, the recent surge in ecommerce volumes looks here to stay, with ecommerce stabilising at around 40% of all ex-grocery retail sales (Source: Benedict Evans / ONS 2021). But new research from YouGov suggests that incumbent payment methods like cards, which were built for the pre-internet economy, are increasingly holding back retailers.

TrueLayer partnered with YouGov to survey 891 online shoppers in the UK and Ireland and 350 ecommerce merchants about their attitudes to payments, security and refunds online. We asked:

Where are ecommerce retailers feeling the most pain with existing payments providers?

How are online payment preferences and expectations evolving?

What levers can merchants pull to improve payment experience and drive customer loyalty?

How will customers react to new native online payment options like instant bank payments?

Our research reveals five key insights. Download the full report here, including comments from UK online retailers like Cazoo, or get the key takeaways below.

1. The cost of payments is the top pain for merchants

With cards and digital wallets still dominating the ecommerce checkout, cost is the #1 pain point for merchants. Almost half of merchants surveyed (49%) rated the high cost of payments as one of their top two pain points with existing payment providers, and almost a third (31%) said it was their #1 pain point.

High fraud and chargebacks, and low payment conversion are also causing merchants significant pain: 36% of merchants rated high fraud and chargebacks in their top two pain points, while 1 in 5 merchants (20%) said it was their #1 pain point.

2. Merchants with high order values suffer more

Merchants with high average order value (AOV) – more than £500 – are more likely to say fraud and chargebacks are a top pain point. A quarter of these merchants said chargebacks and fraud were their top payment pain (26%) compared to 10% of merchants with low average order values.

Merchants with high AOV also reported the highest overall chargeback costs and were more likely to receive frequent complaints about refunds. These merchants were also more likely to report that instant bank payments, powered by open banking, are in their long-term strategy.

3. Shoppers are worried about payment security

Payment security is still of utmost concern to consumers, and can stop them from buying something online. The majority of shoppers (60%) admitted that they sometimes refrain from buying something online because they’re worried about payment security, while 8% said this happens all the time.

When it comes it strong customer authentication, the research revealed a generational difference: shoppers under 45 prefer to authenticate via biometrics, while shoppers over 45 prefer one-time passcodes / SMS.

4. Customers want speedy refunds, but most aren’t getting them

The majority of shoppers expect a refund from an online purchase in one week or less.

Those expectations are not always being met: one third of merchants receive frequent complaints about slow or lost refunds, and this rises to more than half for merchants with high average order value.

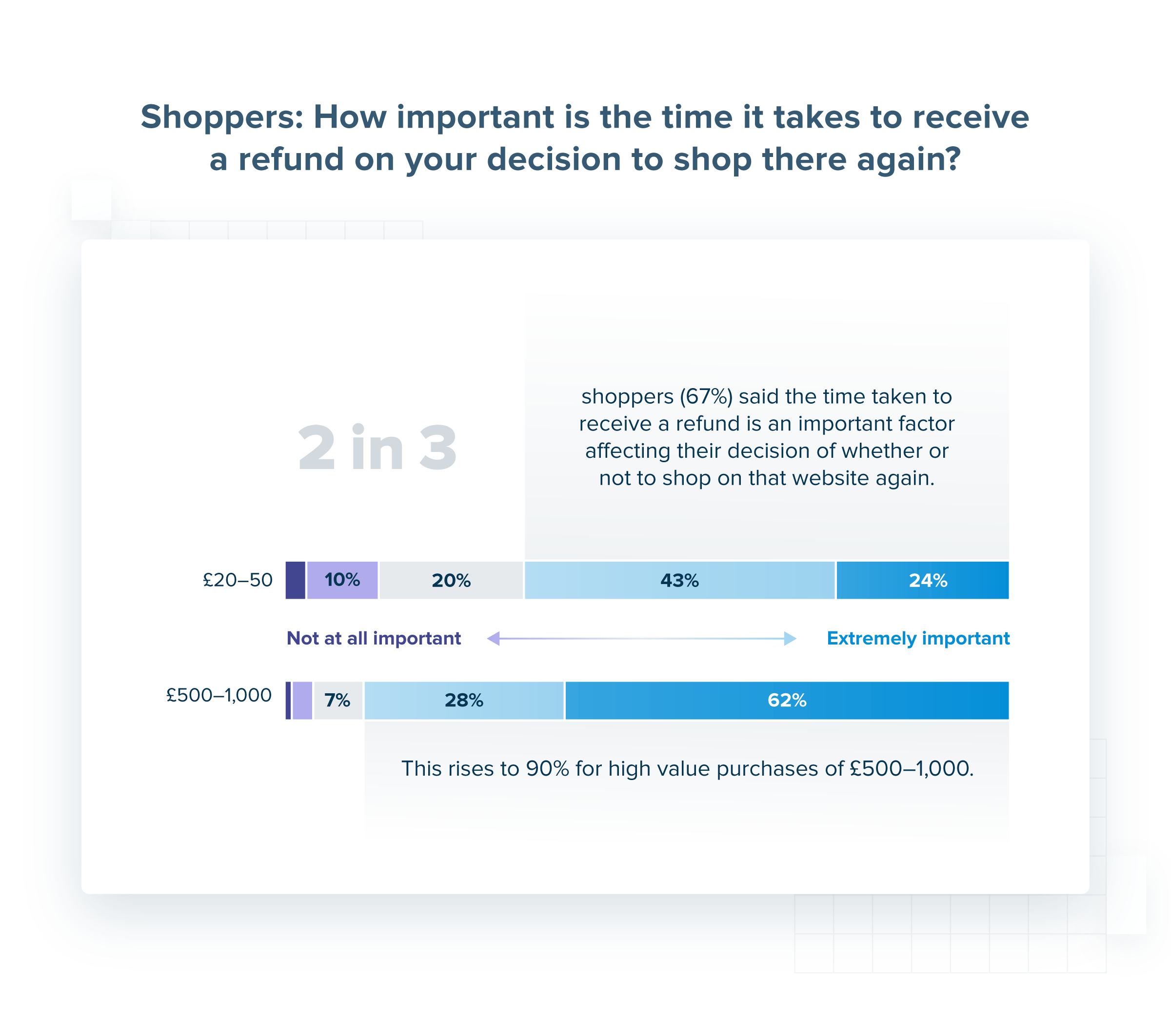

Instant refunds present an opportunity for retailers to win customer loyalty: 2 in 3 shoppers (67%) said the time taken to receive a refund is an important factor affecting their decision of whether or not to shop on that website again. Merchants agreed: 85% said that offering instant refunds would make customers more likely to shop with them again.

5. Merchants are planning for instant bank payments

Cards still dominate the online checkout with half of all UK and Ireland shoppers (50%) reporting that credit and debit cards are their primary online payment method.

Digital wallets are also popular: 37% of shoppers said this is the primary way they pay online. Shoppers are less likely however to use digital wallets for higher ticket items – only 19% choose wallets for purchases over £200.

Our research suggests that shopping behaviour is influenced by the availability of payment options. Almost half of UK and Ireland shoppers (48%) said availability of different payment options makes them more likely to buy from a retailer.

Only 11% of shoppers currently use bank transfer as their primary payment method online, but almost two thirds (63%) said they would be comfortable paying by instant bank transfer. 3 in 4 merchants (74%) said that instant bank transfers, powered by open banking, are part of their long-term strategy.

Download the full report here including comments from UK online retailers like Cazoo.

Software engineering in the age of AI: run the mile you're in

eBay partners with TrueLayer to offer Pay by Bank at checkout

)

)

)

)

)

)

)