Introducing TrueLayer

From time to time, technology enables new forms of interaction. As a result, industries are poised to change forever. This is now happening to financial services.

Desktop and mobile are shifting the way we consume and interact with banks, delivering contextual, just-in-time experiences at the right moment and through the best possible channel and at point-of-sale.

“Customers are shifting from banks to banking.

We want financial apps that follow our needs, habits and our daily life.

We expect total integration and synchronisation of data. We expect to access and share our bank data with other apps; to easily send payments; even to finance an online purchase or apply for travel insurance while we are booking our next vacation.

This new world, and the underlying transformation, will bring unprecedented convenience, frictionless experiences, price competition, and will put the customer at the centre of the value-chain like never before.

Financial Services will need to break their traditional boundaries and communicate and integrate with the applications that we all like to use in our daily routine. And they need to do that in a seamless, secure and reliable way. APIs will be both the backbone of this innovation and the connectivity tissue that will enable institutions to deliver their services.

At TrueLayer, we believe that this change will be driven and carried forward by developers for their users.

We believe that the future of financial services will be shaped by ambitious founders, creative product designers, and top-notch developers.

“TrueLayer is built around a single motivation: to help developers connect their applications with banking infrastructure.

To start, today we’ve launched a simple REST API that will enable developers to connect their apps with the data of customers’ accounts from all the major banks and credit cards in the UK.

We decided to take a different route from anything seen before and to focus on security, transparency, reliability and the developer experience. We want developers to recognize the big responsibility of dealing with private and sensitive customer data and we designed our API platform around the principles of explicit customer consent and security by design.

This year, the UK’s Competition and Markets Authority (CMA) and the EU’s Second Payment Services Directive (PSD2) will push the industry to embrace collaboration and establish a new level of security and transparency. For this reason, we are working closely with financial institutions and regulators in order to deliver the most secure and reliable bank API platform out there.

“We want to thank Connect Ventures, Graph Ventures, Tony Jamous, Eric Nadalin and all our angel investors for believing in us and our vision.

Today, we are opening our beta program, if you want to add bank data to your product, we welcome you to join us.

We are excited to see the amazing experiences you will build with TrueLayer!

Software engineering in the age of AI: run the mile you're in

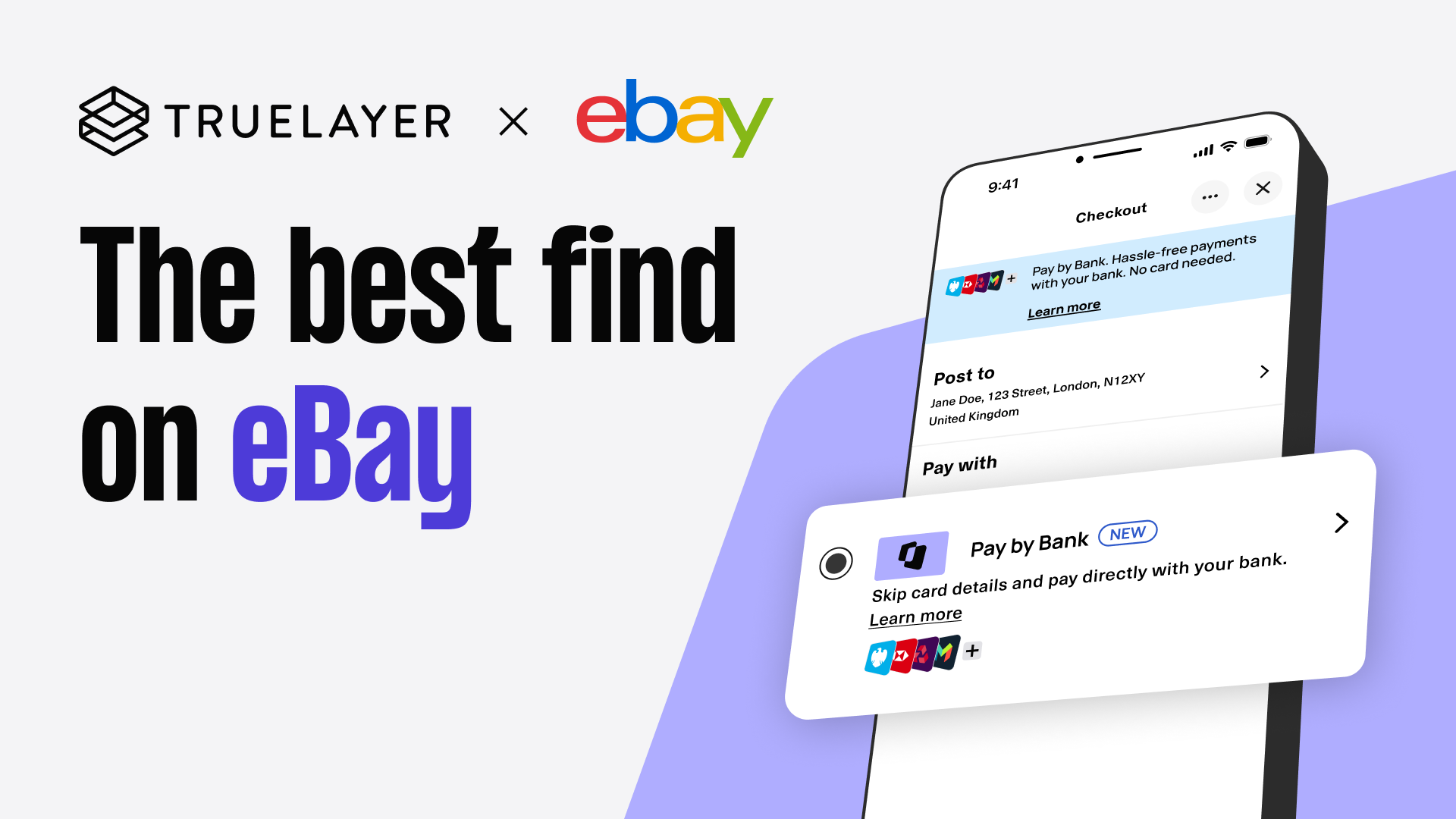

eBay partners with TrueLayer to offer Pay by Bank at checkout

)

)

)

)

)